The purpose of this sap abap finance and control report is to provides an overview of the reconciliation postings necessary to ensure that FI and CO postings made across company codes, business areas, and functional areas within the selected company code have been recorded to theGeneral Ledger (G/L), both on a period and a fiscal year-to-date basis. This report is specifically coded to pick up only cross-company code postings, not cross business area or cross-functional area postings.

The accounting department uses this report to ensure that financial and controlling transactions reconcile for CO postings that occur across company codes. Since cross-company code postings affect financial statements, this report monitors the expected reconciliation postings based on CO data, and the reconciliation postings made to FI.

You must enter a value in the selection fields before running this report. You may leave the company code selection blank, and obtain a list that contains values for all company codes for which reconciliation postings have been made. If you choose to use a group of company codes, you must first create a set that contains them in order to access Report Painter/Report Writer reports.

You can run a context-sensitive actual line item report from this reconciliation ledger report. For example, when positioning the cursor on a cell, only the line items that make up the cell total will appear. The actual line items for a reconciliation ledger report can be executed for either one cell, or a range of cells.

The system displays four columns for all sections of the report, including:

CO postings already made to the reconciliation ledger

FI postings already made to the reconciliation ledger

Variance between CO and FI postings

Reconciliation values still to be posted

By double-clicking on any subtotals in the report, the amount of detail that makes up the subtotal can either be hidden or displayed. For example, double-clicking on a cost element summary line will hide the debit/credit detail. To display this detail again, double-click on this line again.

This report contains data obtained from postings to the reconciliation ledger. This is a fixed special ledger to which postings are made when CO transactions span company codes, business areas, and functional areas. As such, the data cannot be changed or manipulated from the report.

The report contains two different blocks of data, as shown below. By navigating around these blocks, different types of reconciliation ledger data can be viewed.

To access the first screen for this report, choose Information systems → Accounting → Overhead costs and then, Cost elements → Report selection. From the reporting tree, choose the following report: Cost flow → Cross-company code → CElm: Company Code Allocations.

The displayed output consists of the following numbered data .

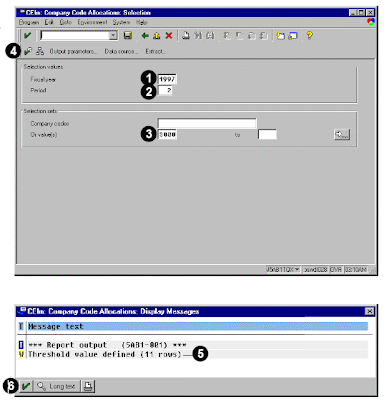

1. Enter 1997 in Fiscal year. This report runs for only one fiscal year at a time.

2. Enter 002 in Period. The report will show the reconciliation postings for the company code for

the selected period. In addition, the report will show a cumulative value of period 1 through the selected period.

3. Enter 3000 in Or value(s). You can also enter a range of company codes, or a company code group.

4. Choose Execute.

5. This display message indicates that 11 rows will be shown based on the threshold value defined within the report.Additional data may exist, but it will not be shown.

6. Choose Enter.

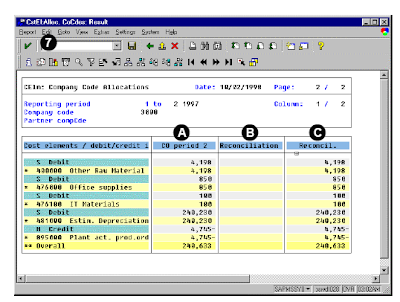

These rows show the cost elements and the debit/credit indicators of all postings to the reconciliation ledger.

A The CO period 2 column contains all CO postings made to the reconciliation ledger in period 002, in which allocations were made into and out of company code 3000.

B The Reconciliation column contains all postings to the reconciliation ledger made from FI.

C The Reconcil. column calculates the difference between the two columns. Non-zero values indicate values to be posted.

7. Choose Edit → Threshold value.

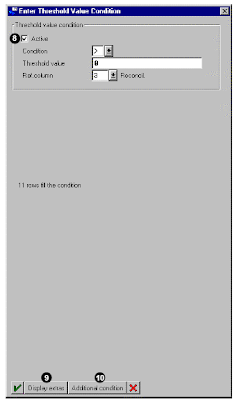

8. Make certain the threshold default Active is selected. This default specifies a row to appear only if the value in the variance column is greater than zero. If no row appears, there is no variance.

8. Make certain the threshold default Active is selected. This default specifies a row to appear only if the value in the variance column is greater than zero. If no row appears, there is no variance.The lines that are suppressed are those in which there is no outstanding reconciliation posting to be made (a value of 0 in the Reconcil. column).

9. Choose Display extras.

10. Choose Additional condition.

Related Posts:

Related Posts:Business View and Mysap.com

What is SAP R/3 introduction to mysap.com

FICO sap abap reporting

abap fico profitability analysis and customer analysis

No comments :

Post a Comment