SAP Financial Accounting Organizational Elements has purchasers are used to divide data in a SAP System into numerous knowledge areas for various purposes. If a company, for example, needs to use its SAP System for both check and training functions, a shopper is created for every purpose.A client is recognized via a three character code. Information will be moved by approach of transports and corrections from one consumer to another. When logging on to the system, the person has to pick a consumer during which he/she needs to work. The user can then solely access knowledge on this client.

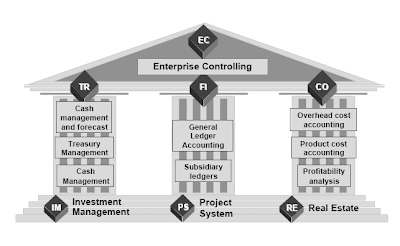

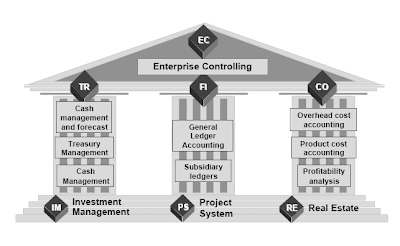

Numerous monetary applications offer totally different views of the financial place and performance of a firm and permit varied management levels.

Predominant FI-models:

Firm code (exterior functions): A Company Code represents an independent balancing/authorized accounting entity. An example would be a company inside a corporate group. Steadiness sheets and revenue/loss statements required by legislation, might be created at the company code level. Subsequently, an organization code is the minimum structure crucial in R/3 FI.In a world business, operations are often scattered throughout numerous countries. Since most government and tax authorities require the registration of a authorized entity for every company, a separate company code is often established per country.

Business area (inner functions) : Enterprise areas symbolize separate areas of operation within a company and can be utilized across company codes. They're balancing entities which are capable of create their own set of economic statements for inside purposes. Using business areas is optional.

A company code is an unbiased accounting entity (the smallest organizational element for which a complete self-contained set of accounts can be drawn up). An instance is an organization inside a corporate group. It has a unique, four character key.The overall ledger is kept on the company code stage and is used to create the legally required stability sheets and revenue and loss statements.A company code designation is required for each financially based mostly transaction entered into R/3.That is completed both manually or automatically by deriving the company code from other data elements.

The affiliates of IDES are arrange as company codes within the R/3 system and are uniquely recognized by 4 character codes. Every company code has a neighborhood currency. Amounts posted in foreign currency are robotically transformed to the native currency.The worldwide implementation of R/3 Financial Accounting was fairly problem-free since the commonplace system got here full with country-particular templates for the nations wherein IDES operates.

Creating Company Code

Copy the company code from an existing company code. This has the advantage that you just also copy the prevailing company code-specific parameters. After copying, you probably can edit data in your new company code.It's necessary to choose a four-character alpha-numeric key as the company code key. This key identifies the corporate code and should be entered later when posting enterprise transactions or creating firm code-particular data.The utilization of the organization copy perform is just not required. It is also potential to define the firm code and fill the customizing tables from scratch.

Within the R/3-commonplace system firm code 0001 is a template for a basic company code with chart of accounts INT and no particular country-specifications.In case you want an organization code in a rustic for which a country template exists, you should use the nation model program which copies the nation-specific customiz ing tables from the precise country template into company code 0001. Upon completion, firm code 0001 might be personalized for the selected country. You should then copy this company code into your new desired company code. You could then start the nation version program again to create a template for another country and so on.The country version program not only creates a rustic-particular company code template but also a rustic-particular template for controlling areas, crops, purchasing organizatio ns, gross sales organizations, credit score control areas, monetary administration areas,etc.

Don't forget to repeat the template before you proceed further. Do not use company code 0001 as your productive company code because the nation version program all the time makes use of this company code as the target firm code. Furthermore, you must run the country model program solely in a new installation of R/3 and never in an upgrade set up because the structure of the country-particular customizing may have modified from one R/3 release to another.

Company Code Components

The editing of the company code knowledge includes:

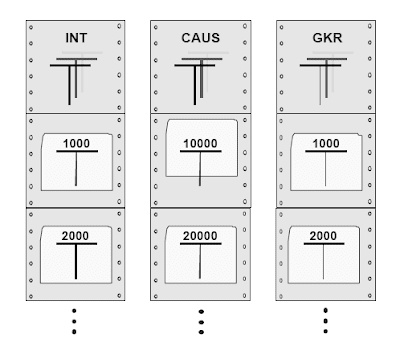

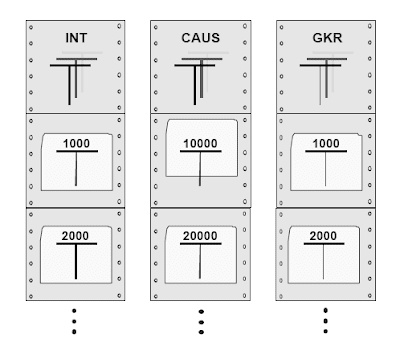

Business areas are typically firm-code impartial, that's, you can make postings to them from any firm code.On the slide, you can see three business areas of the IDES group. If sure firm codes usually are not energetic in specific enterprise areas, you can use a validation to prevent postings to this enterprise space from the corporate codes specified.Every general ledger is set up in response to a chart of accounts. The chart of accounts accommodates the definitions of all G/L accounts in an ordered form. The definitions consist mainly of the account quantity, account title, and the type of G/L account, that is, whether the account is a P&L sort account or a steadiness sheet sort account.

You possibly can define a limit less number of charts of accounts in the R/3 System. Many country-specific charts of accounts are included in the standard system. For every company code, it's a must to specify one chart of accounts for the general ledger. This chart of accounts is assigned to the corporate code. A chart of accounts can be used by multiple company codes.Which means that the final ledgers of these firm codes have the equivalent structure.The variant principle is a extensively used technique in R/3 to assign special properties to one or more R/3objects.

For every company code, it's a must to specify one chart of accounts for the general ledger. This chart of accounts is assigned to the corporate code. A chart of accounts can be used by multiple company codes.Which means that the final ledgers of these firm codes have the equivalent structure.The variant principle is a extensively used technique in R/3 to assign special properties to one or more R/3objects.

For instance utilizing creating a company code as an example;

The Fiscal Year

To separate enterprise transactions into totally different intervals, a fiscal yr with posting periods has to be defined. The fiscal year is defined as a variant which is assigned to the corporate code.The fiscal 12 months variant accommodates the definition of posting periods and special intervals . Particular intervals are used for postings which are not assigned to time periods, but to the method of year-finish closing. In whole,sixteen intervals may be used.The system derives the posting period from the posting date. When the posting date falls throughout the final normal posting interval, the transaction could additionally be posted into one of the special periods.

Example: Above you see a fiscal 12 months with 12 posting durations and 4 particular periods. If the posting date falls within the 12th period, the transaction can instead be posted in one of the four particular periods.Commonplace fiscal year variants are already outlined within the system and can be utilized as templates.The fiscal 12 months variant doesn't embrace the data as as to whether a period is open or closed; that is maintained in another table. The fiscal year variant only defines the amount of durations and their start and end dates.

If every fiscal year of a fiscal 12 months variant makes use of the same number of periods, and the posting periods always begin and finish on the similar day of the year, the variant known as 12 months-independent. A year independent fiscal 12 months variant will be outlined as . the calendar 12 months

. a non-calendar 12 months

n If the fiscal year is outlined as the calendar 12 months, the posting durations are equal to the months of the year. Due to this fact a calendar yr variant must have 12 posting periods.If the fiscal 12 months is outlined as a non-calendar yr, the posting periods have to be outlined by assigning ending dates to each period. A non-calendar yr can have between 1 and 16 posting periods. If the non-calendar 12 months doesn't begin at January 1st the intervals of the yr which belong to the previous or the coming fiscal year should get an annual displacement indicator (-1, +1).

The example above on the correct exhibits a non-calendar yr with 6 posting durations which goes from April to March. The months January to March therefore still belong to the previous fiscal yr and have to have the annual displacement indicator ”-1”.If the fiscal 12 months differs from the calendar 12 months, but the posting intervals correspond to calendar months, the day limit for February ought to be 29 to be prepared for leap years.Fiscal years are normally yr-independent.

A fiscal year variant needs to be defined as ”year-dependent” if the beginning and the end date of the posting intervals of some fiscal years will be completely different from the dates of different fiscal years, and/or if some fiscal years shall use a distinct variety of posting periods.If the entire years of a yr-dependent fiscal 12 months variant have the same number of periods, solely the completely different period dates for the different years must be defined (see example to the left).If one 12 months of a fiscal yr variant has less posting periods than the others, it is referred to as a ”shortened fiscal year” (see instance on the appropriate). This might be required if closing has to be made earlier than the end of the normal fiscal yr; (e. g. if the beginning of the fiscal 12 months must be modified or if the company was offered). The shortened fiscal 12 months and its variety of posting periods must be specified before definition of the period dates. For this yr solely a lesser number of posting durations can be assigned.

Related Posts

SAP CRM Technology Overview

CRM Data Exchange with SAP R/3 CRM Data Exchange via Adapter

CRM E commerce Introduction

CRM Interaction Center System ArchitectureCRM Field Sales

People Centric SAP CRM

System Functions and user Profiles in SAP Financials

Numerous monetary applications offer totally different views of the financial place and performance of a firm and permit varied management levels.

- FI Financial Accounting

- CO Controlling (Managerial accounting)

- TR Treasury

- IM Investment Management

- EC Enterprise Controlling

- RE Real Estate

- PS Challenge System

Predominant FI-models:

Firm code (exterior functions): A Company Code represents an independent balancing/authorized accounting entity. An example would be a company inside a corporate group. Steadiness sheets and revenue/loss statements required by legislation, might be created at the company code level. Subsequently, an organization code is the minimum structure crucial in R/3 FI.In a world business, operations are often scattered throughout numerous countries. Since most government and tax authorities require the registration of a authorized entity for every company, a separate company code is often established per country.

Business area (inner functions) : Enterprise areas symbolize separate areas of operation within a company and can be utilized across company codes. They're balancing entities which are capable of create their own set of economic statements for inside purposes. Using business areas is optional.

A company code is an unbiased accounting entity (the smallest organizational element for which a complete self-contained set of accounts can be drawn up). An instance is an organization inside a corporate group. It has a unique, four character key.The overall ledger is kept on the company code stage and is used to create the legally required stability sheets and revenue and loss statements.A company code designation is required for each financially based mostly transaction entered into R/3.That is completed both manually or automatically by deriving the company code from other data elements.

The affiliates of IDES are arrange as company codes within the R/3 system and are uniquely recognized by 4 character codes. Every company code has a neighborhood currency. Amounts posted in foreign currency are robotically transformed to the native currency.The worldwide implementation of R/3 Financial Accounting was fairly problem-free since the commonplace system got here full with country-particular templates for the nations wherein IDES operates.

Creating Company Code

Copy the company code from an existing company code. This has the advantage that you just also copy the prevailing company code-specific parameters. After copying, you probably can edit data in your new company code.It's necessary to choose a four-character alpha-numeric key as the company code key. This key identifies the corporate code and should be entered later when posting enterprise transactions or creating firm code-particular data.The utilization of the organization copy perform is just not required. It is also potential to define the firm code and fill the customizing tables from scratch.

Within the R/3-commonplace system firm code 0001 is a template for a basic company code with chart of accounts INT and no particular country-specifications.In case you want an organization code in a rustic for which a country template exists, you should use the nation model program which copies the nation-specific customiz ing tables from the precise country template into company code 0001. Upon completion, firm code 0001 might be personalized for the selected country. You should then copy this company code into your new desired company code. You could then start the nation version program again to create a template for another country and so on.The country version program not only creates a rustic-particular company code template but also a rustic-particular template for controlling areas, crops, purchasing organizatio ns, gross sales organizations, credit score control areas, monetary administration areas,etc.

Don't forget to repeat the template before you proceed further. Do not use company code 0001 as your productive company code because the nation version program all the time makes use of this company code as the target firm code. Furthermore, you must run the country model program solely in a new installation of R/3 and never in an upgrade set up because the structure of the country-particular customizing may have modified from one R/3 release to another.

Company Code Components

The editing of the company code knowledge includes:

- The handle knowledge is required for correspondence and is recorded on analysis reports.

- .For every company code a currency should be specified. Accounts are managed within the firm code currency. All other currencies are indicated as foreign. The system converts the amounts posted in a international forex into this currency. The currency outlined within the firm code is often known as the native forex inside R/3.

- The nation key specifies which country is to be thought to be the house country. The system interprets all other nations as foreign. That is necessary with enterprise or payment transactions, since totally different forms are needed for foreign fee transactions, and the system supports completely different codecs for addresses for overseas correspondence.

- A language key should be entered in order that the system can create texts robotically within the right language; for instance, when issuing checks.

Business areas are typically firm-code impartial, that's, you can make postings to them from any firm code.On the slide, you can see three business areas of the IDES group. If sure firm codes usually are not energetic in specific enterprise areas, you can use a validation to prevent postings to this enterprise space from the corporate codes specified.Every general ledger is set up in response to a chart of accounts. The chart of accounts accommodates the definitions of all G/L accounts in an ordered form. The definitions consist mainly of the account quantity, account title, and the type of G/L account, that is, whether the account is a P&L sort account or a steadiness sheet sort account.

You possibly can define a limit less number of charts of accounts in the R/3 System. Many country-specific charts of accounts are included in the standard system.

For every company code, it's a must to specify one chart of accounts for the general ledger. This chart of accounts is assigned to the corporate code. A chart of accounts can be used by multiple company codes.Which means that the final ledgers of these firm codes have the equivalent structure.The variant principle is a extensively used technique in R/3 to assign special properties to one or more R/3objects.

For every company code, it's a must to specify one chart of accounts for the general ledger. This chart of accounts is assigned to the corporate code. A chart of accounts can be used by multiple company codes.Which means that the final ledgers of these firm codes have the equivalent structure.The variant principle is a extensively used technique in R/3 to assign special properties to one or more R/3objects.For instance utilizing creating a company code as an example;

- Outline the variant: K4 is our fiscal 12 months variant

- Populate the variant with values: we define the properties of K4 to be “calendar year”

- Assign the variant to R/3 objects: we assign K4 to multiple company codes that use that calendar n The principle benefit for using variants is that it is simpler to maintain properties which are common amongst a number of enterprise objects.

The Fiscal Year

To separate enterprise transactions into totally different intervals, a fiscal yr with posting periods has to be defined. The fiscal year is defined as a variant which is assigned to the corporate code.The fiscal 12 months variant accommodates the definition of posting periods and special intervals . Particular intervals are used for postings which are not assigned to time periods, but to the method of year-finish closing. In whole,sixteen intervals may be used.The system derives the posting period from the posting date. When the posting date falls throughout the final normal posting interval, the transaction could additionally be posted into one of the special periods.

Example: Above you see a fiscal 12 months with 12 posting durations and 4 particular periods. If the posting date falls within the 12th period, the transaction can instead be posted in one of the four particular periods.Commonplace fiscal year variants are already outlined within the system and can be utilized as templates.The fiscal 12 months variant doesn't embrace the data as as to whether a period is open or closed; that is maintained in another table. The fiscal year variant only defines the amount of durations and their start and end dates.

If every fiscal year of a fiscal 12 months variant makes use of the same number of periods, and the posting periods always begin and finish on the similar day of the year, the variant known as 12 months-independent. A year independent fiscal 12 months variant will be outlined as . the calendar 12 months

. a non-calendar 12 months

n If the fiscal year is outlined as the calendar 12 months, the posting durations are equal to the months of the year. Due to this fact a calendar yr variant must have 12 posting periods.If the fiscal 12 months is outlined as a non-calendar yr, the posting periods have to be outlined by assigning ending dates to each period. A non-calendar yr can have between 1 and 16 posting periods. If the non-calendar 12 months doesn't begin at January 1st the intervals of the yr which belong to the previous or the coming fiscal year should get an annual displacement indicator (-1, +1).

The example above on the correct exhibits a non-calendar yr with 6 posting durations which goes from April to March. The months January to March therefore still belong to the previous fiscal yr and have to have the annual displacement indicator ”-1”.If the fiscal 12 months differs from the calendar 12 months, but the posting intervals correspond to calendar months, the day limit for February ought to be 29 to be prepared for leap years.Fiscal years are normally yr-independent.

A fiscal year variant needs to be defined as ”year-dependent” if the beginning and the end date of the posting intervals of some fiscal years will be completely different from the dates of different fiscal years, and/or if some fiscal years shall use a distinct variety of posting periods.If the entire years of a yr-dependent fiscal 12 months variant have the same number of periods, solely the completely different period dates for the different years must be defined (see example to the left).If one 12 months of a fiscal yr variant has less posting periods than the others, it is referred to as a ”shortened fiscal year” (see instance on the appropriate). This might be required if closing has to be made earlier than the end of the normal fiscal yr; (e. g. if the beginning of the fiscal 12 months must be modified or if the company was offered). The shortened fiscal 12 months and its variety of posting periods must be specified before definition of the period dates. For this yr solely a lesser number of posting durations can be assigned.

Related Posts

SAP CRM Technology Overview

CRM Data Exchange with SAP R/3 CRM Data Exchange via Adapter

CRM E commerce Introduction

CRM Interaction Center System ArchitectureCRM Field Sales

People Centric SAP CRM

System Functions and user Profiles in SAP Financials

No comments :

Post a Comment