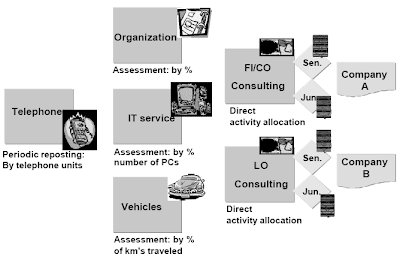

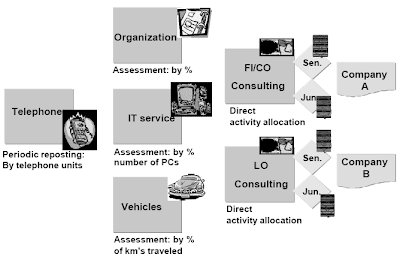

SAP Financial Master Data has some important data under the back ground to cover all the need of a effective business.The supervisor of the Controlling department outlines the fee center construction of the organization, together with the respective administration areas. You are to painting this structure in the system as a regular hierarchy. You have to assign every cost middle to this structure to painting all of your enterprise.Monetary Accounting informs you that the corporate codes are set up. In Controlling you can now start creating corresponding price elements.The consultants that work to your firm need to give you the option to settle the services that they provide to prospects directly to a price object (inner order). You need to allocate the services of junior and senior consultants separately.You need to use statistical key figures as the tracing issue for repostings and allocations at interval end.Though master knowledge stays relatively fixed for lengthy durations of time, some maintenance can be required as the enterprise grows and changes.

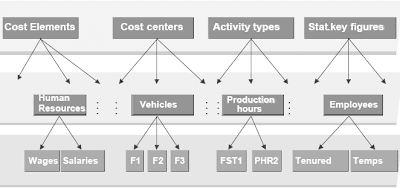

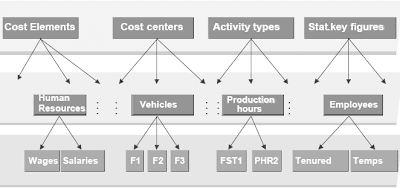

In Overhead Cost Controlling, there is a difference between master information and transaction data.Grasp knowledge is information that continues to be unchanged over a long period of time. Transaction information are used in the quick-time period and are assigned to master data. Value elements describe the origin of costs. Price parts are defined as either major or secondary. Pimary cost parts arise via the consumption of production factors which might be sourced externally. Secondary price elements come up by approach of the consumption of manufacturing factors that are offered internally (that is, by the enterprise itself).Value facilities characterize areas of duty/administration areas that generate and influence costs.Exercise sorts categorize production and repair activities supplied by a value center to the organization and used for allocating costs of inside actions to the originators of the costs.Statistical key figures (values that describe a price center) are used as the premise (tracing factor) on which to make allocations (assessments, distributions) and to analyze statistical key figures.

The Chart of Accounts

The chart of accounts accommodates all the general ledger (G/L) accounts belonging to Monetary Accounting.From the associated fee controlling viewpoint, a circular system exists as a result of the expense and income accounts in Monetary Accounting correspond to major value and income components in Controlling,and since postings in FI are handed on in realtime to Cost and Revenue Factor Accounting (COOM-CEL).In addition, it is only in Controlling that you can create secondary value elements. These are used to document inside worth flows like activity allocations, assessments and settlements.

Cost Element

The built-in nature of the R/3 System signifies that you'll want to create expense accounts in Financial Accounting with corresponding major prices parts in Controlling. This ensures which you could reconcile bills in FI with primary costs in CO. Before you may create major price elements in CO, you first must create them as G/L acccounts in FI.To be able to publish to a main value component, you require a value-carrying object (corresponding to a price heart) to identiry the origin of the costs. Examples of major price parts are material prices and salary costs.Secondary prices parts are used completely in CO to determine inner cost flows akin to assessments or settlements. They don't have corresponding common ledger accounts in FI and are outlined in CO only.Whenever you analyze revenues in cost controlling, the R/3 System information them as revenue elements.Income elements are primary value elements.When you create a price aspect, it's important to assign a cost aspect category. This assignment determines the transactions for which you can use the fee element. For example, class 01 (genearal main cost parts) is used for the standard major postings from Monetary Accounting or Supplies Management.

Automatic Creation of Cost Element

You possibly can create value parts automatically by making default settings which can be used to specify the price component, or cost element interval that you just wish to create. You also specify categories for the fee elements.You only create main cost elements if the chart of accounts comprises the corresponding G/L account. The R/3 system makes use of the title from the master knowledge for G/L accounts in FI for the fee element. Nonetheless, you can change this name in CO.Secondary price parts are created for all specified price elements, and the name is taken from the value element category.Upon getting entered the default settings, you create the fee element within the background.

Price centers are the places at which costs are incurred. You can arrange value facilities based on

functional necessities, distribution standards, activities offered, geographic al elements, and/or areas of responsibility.For overhead cost controlling, you combine price facilities of similar varieties, in response to whether they carry out decision-making, supervisory (checking), or managerial functions. You create a cost heart normal hie rarchy to signify these different sorts of cost heart in a structured form.Each level or node of this standard hierarchy represents a value center group.You may create or change cost facilities both by utilizing the appropriate operate from the menu, or when sustaining the usual hierarchy.If you need to assign a cost center to another a part of the hiearchy, you can do so when maintaining the usual hierarchy area by merely reassigning the price center. In other phrases, you do not need to make adjustments to your value heart master data.

You'll have the ability to change the assignments of the organizational items firm code, business area, or profit middle throughout the course of a fiscal year under provided that the following conditions hold:

The SAP R/3 System supplies you with collective processing capabilities for value middle master data.You presumably can choose price centers by entering intervals, teams or choice variants, keep all fields (besides customer-specific extra fields), create teams using chosen cost centers, or swap from collective to individual processing of grasp knowledge lists.You can too use collective processing to alter or delete statistical key figures.Price elements and exercise varieties can solely be displayed or deleted beneath collective processing.You'll have the opportunity to create your personal listing variants for collective processing. The listing variant determines the master data fields that could be processed. You possibly can change the listing variant during processing.

n The record display features for cost elements, value facilities, exercise types, and business processes have been improved. Within the checklist display of master knowledge you presumably can kind and filter information in the same means as is doable when using the ABAP list viewer.To make it easier to make choices at a later date, you can mix the objects displayed into groups .

Activity Types

The exercise type classifies the precise actions which can be offered by a number of value facilities within a company.If a value center gives activities for other value centers, orders, processes, and so on, then this implies that its sources are being used. The costs of these assets should be allotted to the receivers of the activity. Exercise sorts serve as tracing components for this price allocation.In an inside exercise allocation, the quantity of the activitiy, such because the variety of restore hours, is entered into the R/3 System. The system calculates the associated cost primarily based on the exercise price and generates a debit to the receiver and a credit to the sender for both the amount and costs.Internal exercise is allocated using secondary price elements , which are stored within the master knowledge of the exercise varieties as default values.You may prohibit using the exercise kind to cretain forms of price centers by entering the allowed value middle categories within the activity kind grasp record. You presumably can enter up to eight allowed cost middle classes, or go away the assignments "unrestricted" by coming into an asterisk (*).The activity kind category is used to discover out whether, and the way and activity kind is entered and allocated. For instance, you can permit some actions to be allotted directly, however specify for others that they're either not allotted, or allotted not directly only.

To allow internal activity allocation, it's worthwhile to specify which value facilities present which activity varieties at what price. You do this in the R/3 System by planning the exercise output/prices for a price center. Value center/exercise output planning features right here in the same method as an extra master record.For direct activity allocation, you enter the amount of the exercise to be allocated manually. To enable each prices and activity to be allocated, the R/3 System has to valuate the activity quantity allocated on the price specified by the sender for this activity type. For a direct exercise allocation, the plan price for the combination "cost heart/activity type" is used for this calculation.You possibly can enter the planned price both manually, or have it calculated by the system robotic ally inside planning. If you want to set the value manually, you must set the value indicator to 3 (manual). You can use this procedure if your value calculation is not complicated, for instance the place the prices required in your rates are decided within your organization and don't depend on internally produced activities, or where the rate depends upon the costs of external suppliers and never on the prices of the price center.

Statical Key Figures

Statistical key figures such as number of employees or length of cellphone calls, are statistical values that describe value centers, revenue facilities, and overhead orders. They can additionally describe a worth for a particular activity supplied by a value middle, such as the number of employees who make repairs at the transport value heart (an exercise-dependent statistical key figure).You can post both plan and actual statisical key figures.You have to use statistical key figures as the tracing factor for periodic transactions comparable to distribution or evaluation, and for key determine analysis.You define statistical key figures as a fixed worth or as a totals worth:

You presumably can retailer master data fields for price centers, cost parts, and activity sorts as time -based.In case you change one among these fields for a selected timeframe, the system creates a brand new grasp report containing the new grasp record for this period. Because of this several database records are maintained for every individual grasp record. Within the above instance, the "Responsible person" area is time-dependent, meaning that you'll have the ability to enter the totally different value center managers as they change over time.You specify whether individual fields are time-based mostly in Customizing. Certain fields, such as the assignment of a price middle to a company code, a enterprise area, or to a revenue middle, are outlined by SAP as time-dependent and this time cannot be reduced if in case you have made actual postings to this price middle within the current fiscal year. Since time-dependent data storage may end up in massive volumes of data, it's finest to define solely essential fields as time-dependent.

The Value center project to the usual hierarchy area is a non-time-dependent field. This means that once you change the task due to the current project, the system prepares historic and present value middle information.If you want to extend the validity period of a master knowledge file, entry master knowledge upkeep and create a master report for the extended period in question. To keep away from filling out the same grasp data fields, you possibly can copy from the present master record.

Master Data Groups

You use grasp information groups to summarize the assorted varieties of master knowledge in Price Middle Accounting for analysis, planning, and allocation purposes.You ought to use these teams to process multiple grasp knowledge record in one transaction, for example when planning or in reporting. For instance, you can plan all the cost components utilized by your price heart by specifying the corresponding value element group. You would additionally specify your cost center group when you wished to create a report containing the results of all the fee facilities for your area.The master knowledge group perform lets you create a hierarchical structure . Master knowledge is then assigned to the groups on the lowest stage, after which summarized in groups belonging to the upper levels. You'll have the ability to create as many hierarchical groups as your small business requires.The cost heart standard hierarchy is a special sort of cost heart group. All value facilities in a controlling area should be assigned to the standard hierarchy. Alongside the standard hierarchy, you can use the features in group maintenance to create any number of various price middle hierarchies.You probably can create new master data groups through the use of present teams as a template from which to copy.

Related Posts

Account receivable information system sap abap report

Customer open item analysis report in erp sap

General ledger balance report in mysap.com

General ledger account balance report for fico of sap abap

fico general ledger line items for mysap erp

General ledger account balance report of ABAP

In Overhead Cost Controlling, there is a difference between master information and transaction data.Grasp knowledge is information that continues to be unchanged over a long period of time. Transaction information are used in the quick-time period and are assigned to master data. Value elements describe the origin of costs. Price parts are defined as either major or secondary. Pimary cost parts arise via the consumption of production factors which might be sourced externally. Secondary price elements come up by approach of the consumption of manufacturing factors that are offered internally (that is, by the enterprise itself).Value facilities characterize areas of duty/administration areas that generate and influence costs.Exercise sorts categorize production and repair activities supplied by a value center to the organization and used for allocating costs of inside actions to the originators of the costs.Statistical key figures (values that describe a price center) are used as the premise (tracing factor) on which to make allocations (assessments, distributions) and to analyze statistical key figures.

The Chart of Accounts

The chart of accounts accommodates all the general ledger (G/L) accounts belonging to Monetary Accounting.From the associated fee controlling viewpoint, a circular system exists as a result of the expense and income accounts in Monetary Accounting correspond to major value and income components in Controlling,and since postings in FI are handed on in realtime to Cost and Revenue Factor Accounting (COOM-CEL).In addition, it is only in Controlling that you can create secondary value elements. These are used to document inside worth flows like activity allocations, assessments and settlements.

Cost Element

The built-in nature of the R/3 System signifies that you'll want to create expense accounts in Financial Accounting with corresponding major prices parts in Controlling. This ensures which you could reconcile bills in FI with primary costs in CO. Before you may create major price elements in CO, you first must create them as G/L acccounts in FI.To be able to publish to a main value component, you require a value-carrying object (corresponding to a price heart) to identiry the origin of the costs. Examples of major price parts are material prices and salary costs.Secondary prices parts are used completely in CO to determine inner cost flows akin to assessments or settlements. They don't have corresponding common ledger accounts in FI and are outlined in CO only.Whenever you analyze revenues in cost controlling, the R/3 System information them as revenue elements.Income elements are primary value elements.When you create a price aspect, it's important to assign a cost aspect category. This assignment determines the transactions for which you can use the fee element. For example, class 01 (genearal main cost parts) is used for the standard major postings from Monetary Accounting or Supplies Management.

Automatic Creation of Cost Element

You possibly can create value parts automatically by making default settings which can be used to specify the price component, or cost element interval that you just wish to create. You also specify categories for the fee elements.You only create main cost elements if the chart of accounts comprises the corresponding G/L account. The R/3 system makes use of the title from the master knowledge for G/L accounts in FI for the fee element. Nonetheless, you can change this name in CO.Secondary price parts are created for all specified price elements, and the name is taken from the value element category.Upon getting entered the default settings, you create the fee element within the background.

Price centers are the places at which costs are incurred. You can arrange value facilities based on

functional necessities, distribution standards, activities offered, geographic al elements, and/or areas of responsibility.For overhead cost controlling, you combine price facilities of similar varieties, in response to whether they carry out decision-making, supervisory (checking), or managerial functions. You create a cost heart normal hie rarchy to signify these different sorts of cost heart in a structured form.Each level or node of this standard hierarchy represents a value center group.You may create or change cost facilities both by utilizing the appropriate operate from the menu, or when sustaining the usual hierarchy.If you need to assign a cost center to another a part of the hiearchy, you can do so when maintaining the usual hierarchy area by merely reassigning the price center. In other phrases, you do not need to make adjustments to your value heart master data.

You'll have the ability to change the assignments of the organizational items firm code, business area, or profit middle throughout the course of a fiscal year under provided that the following conditions hold:

- The forex of the model new firm code is identical as that of the old company code.

- You post plan knowledge only in the given fiscal year.

- The fee center isn't assigned to a fixed asset, a work center or a HR master record.

The SAP R/3 System supplies you with collective processing capabilities for value middle master data.You presumably can choose price centers by entering intervals, teams or choice variants, keep all fields (besides customer-specific extra fields), create teams using chosen cost centers, or swap from collective to individual processing of grasp knowledge lists.You can too use collective processing to alter or delete statistical key figures.Price elements and exercise varieties can solely be displayed or deleted beneath collective processing.You'll have the opportunity to create your personal listing variants for collective processing. The listing variant determines the master data fields that could be processed. You possibly can change the listing variant during processing.

n The record display features for cost elements, value facilities, exercise types, and business processes have been improved. Within the checklist display of master knowledge you presumably can kind and filter information in the same means as is doable when using the ABAP list viewer.To make it easier to make choices at a later date, you can mix the objects displayed into groups .

Activity Types

The exercise type classifies the precise actions which can be offered by a number of value facilities within a company.If a value center gives activities for other value centers, orders, processes, and so on, then this implies that its sources are being used. The costs of these assets should be allotted to the receivers of the activity. Exercise sorts serve as tracing components for this price allocation.In an inside exercise allocation, the quantity of the activitiy, such because the variety of restore hours, is entered into the R/3 System. The system calculates the associated cost primarily based on the exercise price and generates a debit to the receiver and a credit to the sender for both the amount and costs.Internal exercise is allocated using secondary price elements , which are stored within the master knowledge of the exercise varieties as default values.You may prohibit using the exercise kind to cretain forms of price centers by entering the allowed value middle categories within the activity kind grasp record. You presumably can enter up to eight allowed cost middle classes, or go away the assignments "unrestricted" by coming into an asterisk (*).The activity kind category is used to discover out whether, and the way and activity kind is entered and allocated. For instance, you can permit some actions to be allotted directly, however specify for others that they're either not allotted, or allotted not directly only.

To allow internal activity allocation, it's worthwhile to specify which value facilities present which activity varieties at what price. You do this in the R/3 System by planning the exercise output/prices for a price center. Value center/exercise output planning features right here in the same method as an extra master record.For direct activity allocation, you enter the amount of the exercise to be allocated manually. To enable each prices and activity to be allocated, the R/3 System has to valuate the activity quantity allocated on the price specified by the sender for this activity type. For a direct exercise allocation, the plan price for the combination "cost heart/activity type" is used for this calculation.You possibly can enter the planned price both manually, or have it calculated by the system robotic ally inside planning. If you want to set the value manually, you must set the value indicator to 3 (manual). You can use this procedure if your value calculation is not complicated, for instance the place the prices required in your rates are decided within your organization and don't depend on internally produced activities, or where the rate depends upon the costs of external suppliers and never on the prices of the price center.

Statical Key Figures

Statistical key figures such as number of employees or length of cellphone calls, are statistical values that describe value centers, revenue facilities, and overhead orders. They can additionally describe a worth for a particular activity supplied by a value middle, such as the number of employees who make repairs at the transport value heart (an exercise-dependent statistical key figure).You can post both plan and actual statisical key figures.You have to use statistical key figures as the tracing factor for periodic transactions comparable to distribution or evaluation, and for key determine analysis.You define statistical key figures as a fixed worth or as a totals worth:

- The mounted value (reminiscent of "staff") is carried over from the interval in which it's entered to all subsequent periods of the identical fiscal year. You need enter a brand new posting only if the value changes.The fiscal 12 months total is the average of the interval totals.

- You submit the totals worth (for example "telephone calls") solely to the interval through which it was entered.For totals values, the fiscal 12 months total is the overall of all interval values.

- You may transfer statistical key figures from the Logistical Info System (LIS) by assigning a key figure from the LIS to a statistical key figure in Value Heart Accounting.

You presumably can retailer master data fields for price centers, cost parts, and activity sorts as time -based.In case you change one among these fields for a selected timeframe, the system creates a brand new grasp report containing the new grasp record for this period. Because of this several database records are maintained for every individual grasp record. Within the above instance, the "Responsible person" area is time-dependent, meaning that you'll have the ability to enter the totally different value center managers as they change over time.You specify whether individual fields are time-based mostly in Customizing. Certain fields, such as the assignment of a price middle to a company code, a enterprise area, or to a revenue middle, are outlined by SAP as time-dependent and this time cannot be reduced if in case you have made actual postings to this price middle within the current fiscal year. Since time-dependent data storage may end up in massive volumes of data, it's finest to define solely essential fields as time-dependent.

The Value center project to the usual hierarchy area is a non-time-dependent field. This means that once you change the task due to the current project, the system prepares historic and present value middle information.If you want to extend the validity period of a master knowledge file, entry master knowledge upkeep and create a master report for the extended period in question. To keep away from filling out the same grasp data fields, you possibly can copy from the present master record.

Master Data Groups

You use grasp information groups to summarize the assorted varieties of master knowledge in Price Middle Accounting for analysis, planning, and allocation purposes.You ought to use these teams to process multiple grasp knowledge record in one transaction, for example when planning or in reporting. For instance, you can plan all the cost components utilized by your price heart by specifying the corresponding value element group. You would additionally specify your cost center group when you wished to create a report containing the results of all the fee facilities for your area.The master knowledge group perform lets you create a hierarchical structure . Master knowledge is then assigned to the groups on the lowest stage, after which summarized in groups belonging to the upper levels. You'll have the ability to create as many hierarchical groups as your small business requires.The cost heart standard hierarchy is a special sort of cost heart group. All value facilities in a controlling area should be assigned to the standard hierarchy. Alongside the standard hierarchy, you can use the features in group maintenance to create any number of various price middle hierarchies.You probably can create new master data groups through the use of present teams as a template from which to copy.

Related Posts

Account receivable information system sap abap report

Customer open item analysis report in erp sap

General ledger balance report in mysap.com

General ledger account balance report for fico of sap abap

fico general ledger line items for mysap erp

General ledger account balance report of ABAP

No comments :

Post a Comment