This ABAP report for SAP given output of finance module general ledger balance report with P and L. This is a inbuilt SAP report which can be used by ABAPer with required modifications.

This ABAP report code creates the balance sheet and profit and loss statement for a user defined reporting period and fiscal year. This balance sheet also uses Financial Statement Versions (FSV), which are defined during configuration. These FSVs reflect different views of the balance sheet, for example, the U.S. GAAP format, the British GAAP format, etc. The balance sheet and profit and loss statements can be viewed in comparison to prior periods or planned values.

To run this report, use one of the following access options:

1. Information systems → Accounting → Financial accounting General ledger → Balance sheet

2.Choose System → Services → Reporting and enter RFBILA00 in the Program field.

Then, click Execute to run the report.

3.In the Command field, enter F.01 and choose Enter.

Sample ABAP Code :

Generate a balance sheet for company 3000 using the financial statement version BAUS (the U.S. commercial balance sheet). The comparison years are 1996 and 1997.

To access the first screen for this report, choose Information Systems → Accounting → Financial accounting General ledger → Balance sheet.

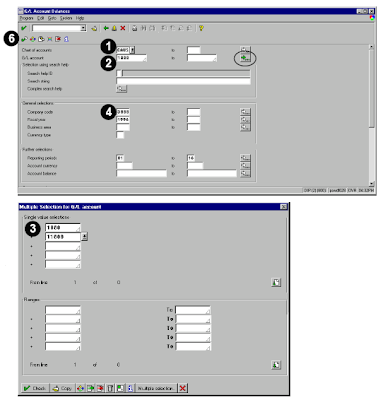

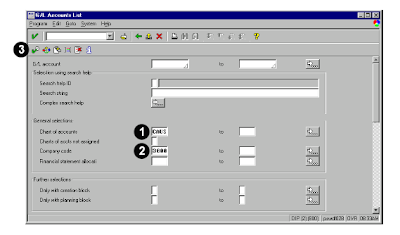

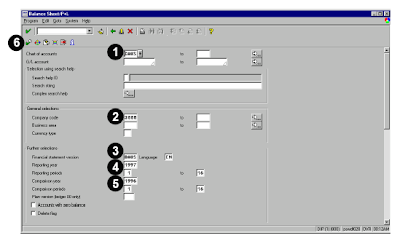

The SAP screen looks like this and each part explain the following terms.

1. Enter CAUS in Chart of accounts.

1. Enter CAUS in Chart of accounts.

2. Enter 3000 in Company code.

3. Select BAUS from a pull down list for Financial statement version.

4. For the Reporting year, enter 1997. Enter 1 to 16 as the comparison periods for both 1996 and 1997. Output control and parameters for special evaluations have been left with the default settings .

5. Enter 1996 in Fiscal year.

6. Choose Execute.

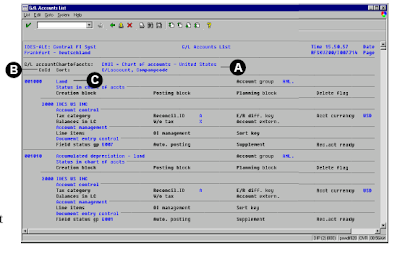

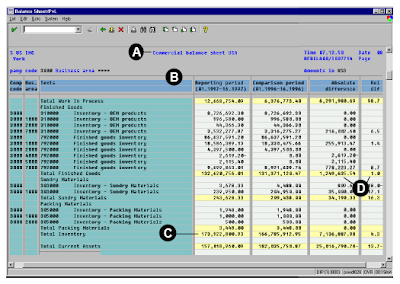

The output ABAP screen is as shown below.

Each part of this SAP report gives the following explanation.

Each part of this SAP report gives the following explanation.

A The display shows the commercial balance sheet for the USA with the current asset section shown in detail.

B The column headings list the financial statement version , the company code, and the reporting periods under evaluation.

C Each section has a subtotal and foots down to a summation for each balance sheet category.

D Both absolute and relative differences between periods are calculated. In this example finished goods changed by USD 1,249,635.54 or 1.0%.

The previous report deals with SAP Finance General Ledger balance report for ABAP with out code as it is also a default report.

This ABAP report code creates the balance sheet and profit and loss statement for a user defined reporting period and fiscal year. This balance sheet also uses Financial Statement Versions (FSV), which are defined during configuration. These FSVs reflect different views of the balance sheet, for example, the U.S. GAAP format, the British GAAP format, etc. The balance sheet and profit and loss statements can be viewed in comparison to prior periods or planned values.

To run this report, use one of the following access options:

1. Information systems → Accounting → Financial accounting General ledger → Balance sheet

2.Choose System → Services → Reporting and enter RFBILA00 in the Program field.

Then, click Execute to run the report.

3.In the Command field, enter F.01 and choose Enter.

Sample ABAP Code :

Generate a balance sheet for company 3000 using the financial statement version BAUS (the U.S. commercial balance sheet). The comparison years are 1996 and 1997.

To access the first screen for this report, choose Information Systems → Accounting → Financial accounting General ledger → Balance sheet.

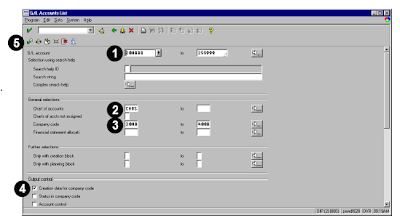

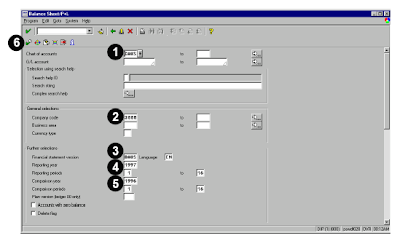

The SAP screen looks like this and each part explain the following terms.

1. Enter CAUS in Chart of accounts.

1. Enter CAUS in Chart of accounts.2. Enter 3000 in Company code.

3. Select BAUS from a pull down list for Financial statement version.

4. For the Reporting year, enter 1997. Enter 1 to 16 as the comparison periods for both 1996 and 1997. Output control and parameters for special evaluations have been left with the default settings .

5. Enter 1996 in Fiscal year.

6. Choose Execute.

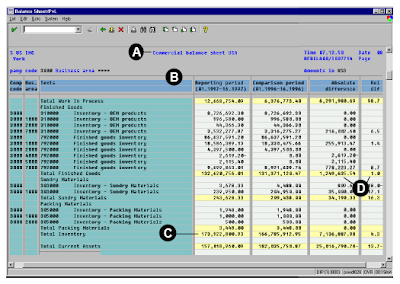

The output ABAP screen is as shown below.

Each part of this SAP report gives the following explanation.

Each part of this SAP report gives the following explanation.A The display shows the commercial balance sheet for the USA with the current asset section shown in detail.

B The column headings list the financial statement version , the company code, and the reporting periods under evaluation.

C Each section has a subtotal and foots down to a summation for each balance sheet category.

D Both absolute and relative differences between periods are calculated. In this example finished goods changed by USD 1,249,635.54 or 1.0%.

The previous report deals with SAP Finance General Ledger balance report for ABAP with out code as it is also a default report.