SAP Financial Cost Management is widely used by most businesses have too many bank accounts, held at too many various banks. This makes it tough to keep an outline of the related account balances.As banks send statements each day, exact, worth-date accounting doesn't happen often. Businesses miss out on the complete advantages of funding devices as a end result of worth date info is lacking.Payments are sometimes made from one account solely, no matter whether it incorporates enough funds.The duties of a cash administration system are to:

- Analyze monetary transactions in completed accounting periods

- Determine and reproduce future movements in financial budgeting as exactly as potential

- The money position, which illustrates short term actions within the financial institution accounts

- The liquidity forecast, which illustrates medium-term movements in sub-ledger accounts too

SAP Cash Management has the identical objectives as typical money administration methods, particularly to:

- Safeguard firm liquidity so that fee obligations may be met

- Monitor payment flows

The format of the money position and the liquidity forecast is set by two options:

- Each reviews contain levels. These provide high-quality data on the industrial causes for a movement in an account - that's, they clarify how the account opening and closing balances came about. For example, ranges give info on whether or not a steadiness in a bank account is the end result of a financial institution posting or of a memo report entered manually.They can additionally be categorized in response to how secure the receipt is - for instance, by confirmed or unconfirmed memo record.

- Within the cash position, accounts (bank and bank clearing accounts) provide information on the present balance.

- The liquidity forecast comprises groups as an alternative of accounts. Vendors and customers are assigned to a planning group by way of an entry in the grasp records. Each group displays certain options, procedures, or risks.

First, you want to create an instrument which provides you with helpful information about your bank accounts.You employ the money position for this,considering first its particular attributes and aspects of integration.To have the opportunity to use the cash position successfully,you must first arrange your FI bank accounts in a particular construction, and configure them accordingly.After the bank statements are posted in FI, the account transactions will be displayed in the money position.The balances within the financial institution accounts, which you'll show using the money place, type the idea for planning decisions.Treasury transactions may additionally be displayed in the cash place, below certain conditions.

Bank accounting is to provide a financial institution (present) account for every foreign money and, in each case, a clearing account, on a lower level and per processing type.You may tailor the clearing accounts to the needs of your business.Goals:

- Accounts could be reconciled at any time

- Foreign forex and local foreign money are managed in parallel

- Might be managed by worth date

- Interest can be calculated

- Line item analysis attainable

- Contingent liabilities can be monitored

- Items posted automatically utilizing computerized payment transactions

- Automated breakdown utilizing digital banking transactions

- 113102 Financial institution 1 (outgoing bank switch, home): B2 degree

- 113109 Bank 1 (buyer cash receipts): a B9 level

You now want to reproduce a home bank - that's,a financial institution the place you hold buyer/vendor accounts and from which you want to name up financial institution assertion info - in your SAP Cash Management installation. You could already have created the bank once you applied SAP FI Monetary Accounting.You must additionally create the related G/L accounts in the system and configure them in line with outlined criteria.To reproduce these accounts within the cash position, give them an acceptable description and assign them to a grouping time period which is responsible for setting up the cash position.

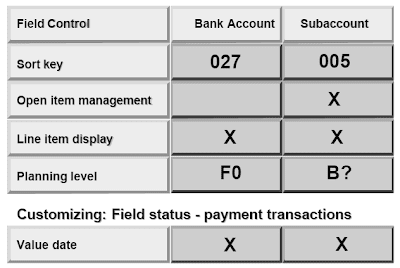

Each G/L account is assigned to an account group. This determines the setup for the second master report screen. You format it using the sphere status. Every account group inside a chart of accounts can have a unique discipline status.

Field Status

The sector standing group is chargeable for the doc format if you're posting to a specific account. For that reason, you have to define the suitable area status group for the bank account.To manage financial institution postings by value date, you have to enter the worth date in all postings to the financial institution account. To this end, you can configure the related discipline status group in such a manner that the "Value date" field is a required entry.You possibly can have the system automatically suggest the present date as the worth date. This makes things easier in coaching courses and system demonstrations, however not in business use as a outcome of errors occur frequently.

Bank Accounts

The company code bank accounts are saved under an account ID for the house banks that you just define. You enter the external account number and its forex with the bank, along with the related G/L account quantity, thereby guaranteeing that postings go to the precise accounts. A G/L grasp document is created for every bank account.In the G/L account master file, you probably can enter the home bank key and the account ID, so as to have entry from the general ledger to the address knowledge retailer for the house bank. That is necessary for bank correspondence, for example throughout cash concentration: the system uses the financial institution ID and account ID to obtain the handle information from the bank directory.If you occur to preserve overseas trade accounts, the foreign money key in the G/L grasp report should be the similar as the currency in the foreign foreign money account.

Planning Levels

You outline a planning degree within the G/L account master file, in order that postings to this account may be seen in the cash position.Planning ranges present data on the sort of account transaction and the reason for the transaction. They are freely definable.The Supply indicator checks verifies that the info for the specified level is permitted in the money position. The BNK source symbol is so outline that every one planning levels assigned to it are displayed in the cash position and never the liquidity forecast.You'll give you the chance to define new planning ranges by selecting and copying the standard entries or by coming into a utterly new level.

Groupings are used to mix accounts and assign summarization terms to them. Their balances might be displayed per account or as an aggregate. You'll have the option to prohibit the show to particular firm codes and charts of accounts.Grouping phrases are freely definable. This means you may tailor the cash position display to your own individual requirements. The degrees selected appear in the display.The type shows whether levels (L) or groups (G) are displayed. In every grouping, you could configure at the very least one line of type L and one among sort G. The choice determines which ranges (2 digits) or groups (10 digits) are combined. You probably can configure maskings or partial maskings for particular person values. Teams must be ten characters lengthy and, if necessary, entered with leading zeros.The summarization term determines whether the individual worth or the cumulative value is displayed.If you create new grouping entries, it's important to outline headings for them.

Liquidity Forecast

The money position exhibits how your financial institution accounts will transfer within the subsequent few days. In the meantime, the liquidity forecast illustrates liquidity changes within the subledger accounts. Functions are additionally supported which you can use to obtain related info on forecast payment flows. This info seems as planned objects within the liquidity forecast. The data is based on funds in and out from/to prospects and vendors, per the open items.As planning for incoming and outgoing payments covers a larger timeframe, the probability of the funds occurring on the day given is lower than in the cash position.The next are examples of sources of planning data for the liquidity forecast:

- Receivables and commitments as anticipated incoming funds

- Planned wage and wage payments

Percentage Distribution

When you choose the cumulative and distributed show in addition to the display distributed by inflows and outflows, the system will distribute memo records and abstract information for every level according to the specifications you can define.Gadgets are distributed earlier than or after the decided value date using the +/- indicators, days, and percentages that you simply specify.Planning teams differentiate prospects and distributors according to explicit characteristics (customer in France), conduct (takes cash low cost) or risks (credit rating). They're consumer-definable and are entered in the "Planning group" field within the buyer or vendor grasp record.If you select the "Display screen management" option (SCn), the "Planning date" and "Planning degree" fields are prepared for input when documents are entered or changed. You can overwrite the values the system routinely defaults for these fields.

The replace to Cash Management distinguishes between two circumstances:

- Different 1 (liquidity forecast):If no fee particulars have been maintained within the transactions - that's, the bank accounts usually are not identified -, the cash movement for a bank account or financial institution clearing account cannot be displayed. However, the amount should seem in Money Administration in some way, so the quantity is displayed re sub ledger accounts. The system then attracts on the planning group specified in the grasp report for the business partner.

- Alternative 2 (cash place):If payment details are specified within the transaction - that's, the financial institution accounts are recognized -, the cash flow appears in TR-CM on the level assigned to the related checking account/bank clearing account.

There are two locations the place you can define a model new money journal accounting transactions: within the money journal itself or within the implementation guide. Relying on the kind of transaction you may be posting,you can identify it accordingly, e.g. for cash sales postings, you'll be able to identify the accounting transaction “Cash Sale”.To create accounting transaction, choose the next:

- the corporate code in which the accounting transaction must be created

- the accounting transaction sort, (Word: you can not make an entry within the discipline G/L account for accounting transaction types D and K)

- select a tax code for E (Expense) and R (Revenue), transactions which determines the accounting transaction control.

Cash General Transaction

The money journal has the form of a new ENJOY transaction. The screen is divided into three sections:

- Knowledge choice: Right here, the time period of the info may be selected.

- Balance show: Displays the totals of incoming and outgoing cash and the start and ending balance.

- Accounting transactions Here, the cash journal transactions will be entered.

The money journal is a Bank Accounting sub ledger for the management of cash in a business. It might well be used independently of different posting transactions.Cash journal entries are saved locally within the money journal sub ledger. All balances are mechanically calculated and displayed.The money journal entries saved are posted to the normal ledger. The comply with-on documents from money journal entries posted are displayed.

Related Posts

Related PostsMysap web application server

SAP web application and business server pages

My SAP Project safety and security

No comments :

Post a Comment