Each day tons of of economic documents are created within the enterprise. To help the submitting of authentic documents, the documents should be divided into a quantity of categories.Different monetary enterprise transactions need completely different information throughout the documents. Some further knowledge may even be required for particular postings.The accounting department desires to make certain that it is unattainable to post to a earlier posting period.Head accountants need to have more posting authority than their staff.

SAP DOCUMENT PRINCIPLE

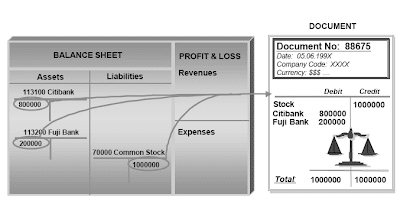

The R/3 system records at least one doc for every enterprise transaction. Every doc receives a singular document number.R/3 can assign the doc numbers (= inside task) or the person can assign the number at doc entry time (= exterior assignment). A enterprise occasion may trigger a couple of document within R/3. When goods are obtained from a vendor, a fabric doc is created to maintain monitor of details important to inventory tracking. A accounting document is created to trace financially relevant info, resembling G/L accounts and amounts.Many business occasions happen throughout R/3 for which a doc is created, however no accounting doc is produced because there is no financial impact. An example of this could be a buy order order.R/3 will link related paperwork collectively within the system, to supply a whole image of any enterprise transaction throughout the system.

SAP DOCUMENT TYPES

The document kind controls the doc header and is used to differentiate the business transactions to be posted, e.g. customer bill, vendor funds, etc. Doc sorts are outlined on the shopper stage and are therefore legitimate for all firm codes. The standard system is delivered with document sorts which can be utilized, modified, or copied.Major controls of document types are:

. the number range of document numbers, and

. the account types allowed for posting

Doc sort further controls :

. the field standing of the header fields “Textual content” and “Reference Quantity”, and

. if invoices are posted with the web method.

Within the process advisable by SAP for submitting unique paperwork , the doc sort controls doc filing. At all times retailer the original paperwork beneath the variety of the info processing document. If the unique document has an external quantity:

. enter the external variety of the unique document into the reference number discipline in the header of the info processing document, and

. record the info processing document quantity within the authentic document.

Doc sort AB permits postings to all account types.All other doc varieties restrict the varieties of accounts you'll have the opportunity to post to. Document sort DG, for instance, permits you to submit to buyer (D) and G/L accounts (S) only.To transfer billing documents from the R/3 billing system, the usual system makes use of the doc varieties:

. RV, the default doc sort for SD billing documents (customer invoices).

. RE, the default document sort for MM billing paperwork (vendor invoices).

When inside number task is used, the system assigns a new number to every doc within the Financial Accounting component. In external number assignment, the system transfers the billing doc number to the FI doc so lengthy as this quantity has not already been assigned.The fee program makes use of the document sort ZP for its automated postings.

The doc quantity vary defines the allowable vary through which a doc number should be positioned and cannot overlap.

- Internal numbering: The system shops the last used doc quantity from the quantity vary in the sector “present quantity” and takes the following quantity for the subsequent doc (examples 0 and 01 above)

- External numbering: The user enters the unique doc quantity, or the number is transferred routinely from a pre-invoicing system. The numbers often should not used in sequence and therefore the system can't store a “current number” (example 02). The numbers could also be alphanumeric.

- The doc quantity range must be outlined for the year in which it is used. Document number ranges could be outlined:

- . till a fiscal yr sooner or later: Originally of each fiscal yr the system continues to take the subsequent quantity after the “present quantity”. It does not restart on the decrease limit.

- . per fiscal yr: At first of every fiscal year the document numbering starts again on the lower limit. This helps to keep away from reaching the upper limit of a range.

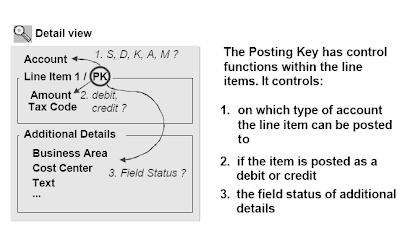

FUNCTIONS OF POSTING KEYS

Like doc types, posting keys are defined on the consumer level.Along with the above mentioned control features, the posting key signifies:

. whether or not the line item deals with a payment transaction or not. This info is required in analyzing payment history and creating cost notices.

. whether the sales figures of the account needs to be updated by the transaction, e.g. when posting a customer invoice.

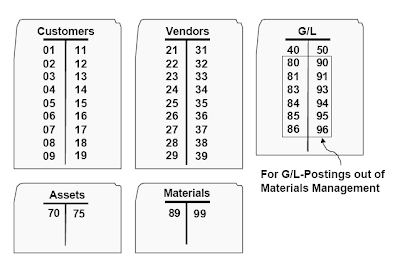

Posting keys have been enhanced with the new Enjoy SAP functionality. In the usual transactions, posting keys are labeled “debit” and “credit”. In Customizing, R/3 delivers the following default values:

- For GL Transactions: “debit” is posting key 40, “credit score” is posting key 50.

- For Buyer Invoices: “debit” is posting key 01, “credit score” is posting key 50.

- For Vendor Invoices: “credit score” is posting key 31, “debit” is posting key 40.

DOCUMENT FIELD STATUS

During document entry, different fields are displayed relying on the transaction and the accounts used. For instance, when posting bills, a cost center and tax data is usually required. Nevertheless, when posting cash, this similar info just isn't necessary. These totally different displays during document processing are controlled by area status.As a basic rule, you customize the account-dependent field standing on basic ledger accounts. For customer and vendor processing, you customize the sphere status on the posting key as necessary.Just as within the area status definition in G/L accounts, the sector standing with the higher priority applies.The priority is proven above.

Exceptions of the rule above:

- If business areas shall be used, the sphere “business space” must be prepared for input. It's switched on by enabling business area stability sheets for the corporate code. With the sector standing, you can solely decide if it shall be a required or an elective entry field.

- Tax fields are solely ready for entry if the G/L account is set up as tax-relevant.

The field standing definitions ”suppress” and ”required entry” cannot be combined. This combination causes an error.

FIELD STATUS GROUPS

For every category of basic ledger account, e.g., money accounts, expense accounts, that you must decide the status of every document entry field. Will text be required, suppressed or optionally available for doc entry when utilizing these GL accounts? Will price heart be required, suppressed or optional for document entry when utilizing these GL accounts? Etc. etc.These “rules” are grouped into discipline status teams for every category of general ledger accounts. Area standing teams are assigned on the respective basic ledger grasp records.The sphere status groups are collected underneath one discipline standing variant.The sector standing variant is assigned to your organization code(s). No posting can be made until that is complete. Usually, the identical discipline standing variant is assigned to all of your firm codes so that the same “rules” apply throughout company codes..R/3 delivers an ordinary set of area status groups. It is recommended to repeat the usual delivered subject status teams and modify as necessary.If a doc is posted to a sub ledger account, the sector status group of the reconciliation account will apply.

STANDARD POSTING KEYS

SAP recommends that you use these standard delivered posting keys . In case you change them or outline new posting keys, all tables containing a reference to these keys should even be maintained.Posting keys for belongings and supplies may only be used if the corresponding SAP components are implemented.By influencing the field standing definitions of posting keys and the sphere standing group, the sector status might be made transaction-dependent and account-dependent.Since the sub ledger accounts do not need a subject status group, differentiation in the sub ledger postings is principally made by completely different posting keys. Subsequently, there are quite a lot of posting keys for sub ledger postings.

Typically ledger postings differentiation is especially made by completely different discipline standing groups. Therefore, solely two posting keys (forty and 50) are needed for common ledger postings.

POSTING PERIODS

Posting periods are defined within the fiscal yr variant.To prevent paperwork from being posted a flawed posting period, desired durations could be closed.Often the present posting period is open and all other intervals are closed. On the finish of a period it is normally closed and the subsequent interval is opened. A period is opened by getting into a spread into the posting period variant which encompasses this period. It is doable to have as many durations open as desired.In the course of the process of financial closing, some special intervals may be open for closing postings.Through the time of the closing procedure, two interval ranges must be open at the identical time.due to this fact, two period ranges might be entered within the posting interval table.

Several firm codes can use the identical posting period variant. The closing and opening of periods is then carried out on the similar time for all assigned firm codes, thus making period upkeep easier.

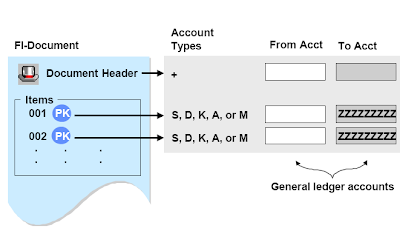

PERIOD CHECKS FOR ACCOUNT TYPES

On the doc header degree, R/3 checks the intervals that are allotted to the account type “+”. This is the primary check. Due to this fact the account sort “+” have to be open for all durations which are purported to be open for another account type. The account sort “+” is the minimum entry in the posting interval variant.Posting intervals might be handled in a unique way for various account types, i.e. for a certain period,postings on buyer accounts could additionally be potential while postings on vendor accounts may not.On the line item stage, R/3 checks the account type of the posting key to verify that the interval is open for the assigned account type. The account vary always comprises G/L accounts. By coming into certain reconciliation accounts behind sub ledger account types, these sub ledger accounts can be treated in another way than accounts which have a unique reconciliation account.

Related Posts

SAP Network Level Security

Mysap web application server

SAP web application and business server pages

SAP project introduction in the best ERP

SAP project migration

SAP Project blueprint

No comments :

Post a Comment