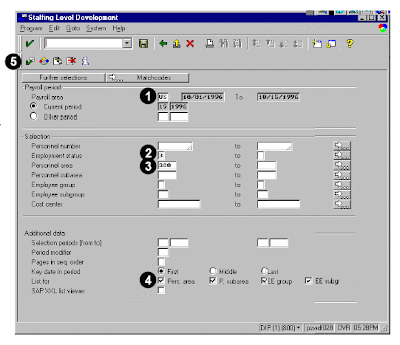

The flexibility of this SAP ABAP HR report allows you to create earnings registers, deduction registers, or other miscellaneous payroll registers for a given payroll period.This report only runs for employees with valid payroll results. You must answer the following three questions on the selection screen before running the report.

1. For which special run or period must the evaluation be started?

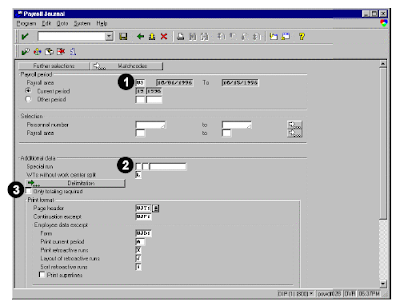

Pay period selection criteria are used for gathering data in this report. You must specify a payroll area and a specific pay period in which to select employees. You may also indicate if a special payroll run should be considered.

2. For which employees must the evaluation be started?

Specific employee numbers may be entered to further limit the data selected. Additional selection fields may be made available using the Further Selections button.

3. Which layout is required for the result of the evaluation?

The payroll journal consists of four individual forms which must be configured by the user:

1. Page header: The page header appears at the beginning of each printed page.

2. Employee data excerpt: Employee data excerpts appear on detail pages as a means of displaying individual employee’s payroll results.

3. Continuation excerpt: If the system begins a new page when printing the employee data excerpt, it prints this form (a mini-header for the employee) on the new page before printing the remainder of the employee data excerpt. Additional control functions appear on the selection screen to provide special handling for retroactive payroll runs (for example, printing on separate versus the same page).

4. Totals block: A totals block appears on the totals page below the page header. This form has the same function on the totals pages as the employee data excerpts on the detail pages.

You may select an alternate currency on the selection screen. You may alter the output of the data by configuring the system’s standard forms to produce a payroll register, earnings register, and deduction register.

This SAP ABAP report includes :

1. Variants

2. Execution (and print) in background

3. Standard selection fields

4. Additional selections fields (use the Further Selections or Matchcodes buttons)

5. Data output settings (provides a summary or detailed information using configurable forms)

To access the first screen for this report, choose Human resources → Payroll → Subs. activities → Per payroll period → Lists/statistics → Payroll journal.

1. Enter US in Payroll area. When you choose Enter, the current pay period from the control record automatically appears.

1. Enter US in Payroll area. When you choose Enter, the current pay period from the control record automatically appears.2. Leave the Special run payroll type blank to indicate a regular payroll run.

3. Leave the Only totaling required field blank (as shown in this example) if you need employee

detail.

4. Under Print format, enter UJT1 in Page Header.

5. Enter UJF1 in Continuation excerpt.

6. Under Employee data excerpt, enter UJD1 in Form.

7. Under Totals display, enter UJS1 in Form.

8. Under Output currency, select Inperiod.

9. Choose Execute.

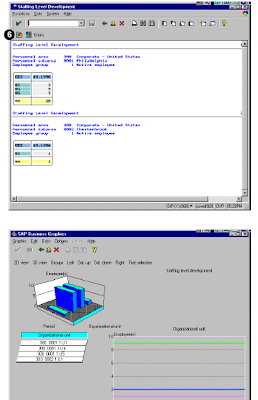

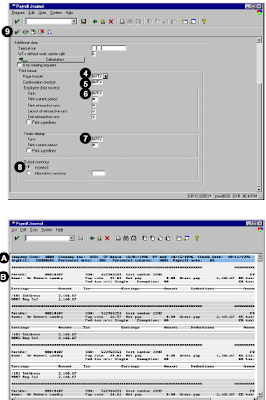

A The data output header (shown on each page)

B Employee data (as defined in the detail form)

The corresponding screen shot is as shown.

C All key fields of the header and data totals

D Summary level (indicated by an asterisk (*). In this example, all personnel subareas are totalled for personnel area 3300.

E All key fields of the header replace with an asterisk (*) to indicate final totalling.

F The count of the employees selected and processed.

Related Posts:

ABAP HR head count report for sap

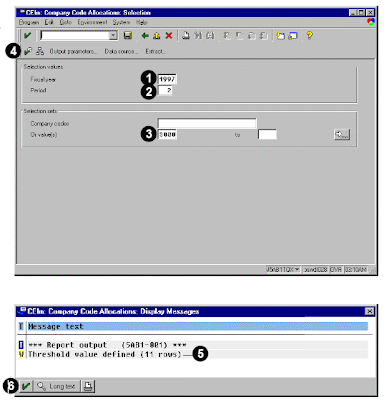

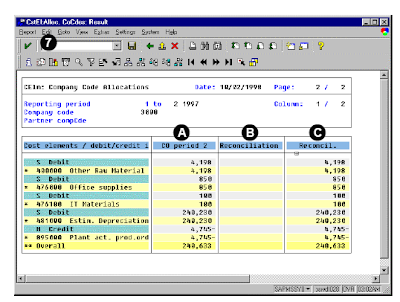

SAP ABAP FICO REPORT FOR GROUP CURRENCY RECONCILIATION

Organizational challenges in crm and mysap solutions

Business View and Mysap.com

What is SAP R/3 introduction to mysap.com