Overall Value Flow in PCA

Before you can analyze your profits by profit center, the system needs to summarize all the profit related postings in profit centers.

Which data is transferred to Profit Center Accounting?

ŸAll postings affecting revenue and cost elements

ŸP&L postings directly coded to a profit center

ŸP&L accounts maintained with automatic account assignment in PCA customizing

Ÿ

Balance Sheet accounts maintained with automatic account assignment in PCA customizing Ÿ P&L accounts related to transactions in Logistics.The data is posted to other objects and passed on from there to a profit center in Profit Center Accounting. This makes it possible to display your company’s results by profit center based on the original postings and with no additional work.

Profit Center Derivation P & L

When you post data directly in Financial Accounting , all primary cost elements require an additional assignment to a CO object. The assignment of this CO object (cost center, order, and so on) to a profit center ensures that the data is passed on to Profit Center Accounting.It is necessary to assign SD sales orders to profit centers in order to reflect sales revenues and sales deductions. The profit center assignment is also passed on from the sales order through the logical chain sales order > delivery note > goods issue > billing document. Sales orders are divided into header data and item data. Each order item is assigned separately to a profit center, since this is the finer level of detail.

All the goods movements between profit centers are created in Materials Management and, where necessary, reflected from a profit center point of view via a special account determination.When you post a purchase order, the system posts the goods usage immediately upon goods receipt if the purchase order has an account assignment.

At invoice receipt, if the amount on the invoice is different from the standard price of the material purchased, price differences arise when you post the invoice receipt. This difference is also reflected in Profit Center Accounting.When you deliver a production order to warehouse, the change in stock is created in the profit center of the production order.

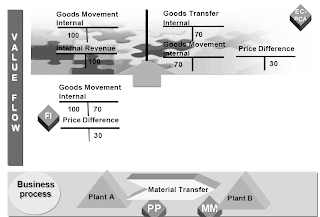

Value Flow from Material Management

Internal goods movements in Logistics (stock transfers, materials usage for production orders, and so on) can lead to an exchange of goods between profit centers. To be able to show the material flow correctly in Profit Center Accounting, you need to look at the profit center as an independent company. This means that a sale is made by the sending profit center, while the receiving profit center posts a goods receipt.

This way of looking at postings in Profit Center Accounting cannot be achieved based solely on the original posting. You therefore need to make an additional account assignment. A separate account determination generates additional posting lines on the basis of the original document, and then posts these in Profit Center Accounting. The source document is not changed. Therefore this has no effect on Financial Accounting (FI). However, note that these lines are also updated in FI if your organization is using transfer prices and storing the profit center valuation method in FI .

For some goods movements, it does not make sense to make an additional posting. These goods movements are given a special handling. The table that contains these exceptions is fully maintained and delivered by SAP in the standard R/3 System. You only need to define special handling if you require this for movement types that you defined yourself.You enter the accounts that you need in order to represent internal goods movements in Profit Center Accounting for each controlling area. These accounts must be defined already in Financial Accounting (FI).

Transfer from Sales and Distribution

The assignment of a sales order to a profit center is passed from the sales order to the delivery note and then on to the billing document. The change in stock is posted to the profit center upon goods issue.If account-based Profitability Analysis (CO-PA) is active in your system, the G/L account for changes in stock must be defined as a cost element. If account-based CO-PA is not active, you must define this account as a profit and loss account. The system still ensures that the goods issue posting is passed on to the profit center. The following data is transferred from bills and debit and credit memos to Profit Center Accounting.

Revenues

ŸSales deductions (shipping, discounts, and so on)

ŸAccruals (e.g. from rebate agreements)

The profit center is assigned at the item level of the sales order.The Financial Accounting document and the profit center document are supplied from the original document in SD via the same interface.

In Financial Accounting, you can also assign revenues “directly” to a profit center. For example, you might use this function if you are not using the SD module of the R/3 system. You must define the corresponding G/L account as a revenue element. If you are using account-based Profitability Analysis, you must choose a profitability segment as the “real” account assignment object. Enter the corresponding profit center for the characteristic “Profit center” in the profitability segment.

If you are not using account-based Profitability Analysis, you need to enter the profit center in the corresponding field in the G/L account posting. In this case you must have defined the FI field status definition so that the field “Profit center” is displayed.In the latter case, in CO the system updates a so-called ‘reconciliation object’ in the background for reconciliation with FI. From the CO point of view, the posting to this object is regarded as the real posting.

Related Posts

No comments :

Post a Comment