Transfer Data from SAP Controlling is a way of getting data extraction for the required business.All primary postings to account assignment objects in Controlling are posted to profit centers using the same cost element.For allocations in cost accounting (distribution, assessment, cost allocation, transfers, order settlement, calculation of imputed costs and overhead), the following records are updated in Profit Center Accounting:

ŸThe profit center of the crediting account assignment object is “credited” using the same cost element, and the profit center of the object to be debited is used as the partner profit center.Ÿ In addition, the profit center of the “receiver” is debited using the same cost element, and the profit center of the sender is used as the partner profit center.

Elimination of internal business volume : you can have the system ignore transaction data between account assignment objects of the same type which are assigned to the same profit center. If you want to use elimination of internal business, you need to select a flag in Customizing under “PCA Controlling area settings”.

Statistical Key Figures : In addition to the monetary data in accounting, you also can transfer Statistical Key Figures from the account assignment objects in CO to PCA. In addition to transferring statistical key figures, you also can create them manually in PCA.

All the secondary transfers between CO objects are selected and represented in the assigned profit centers.You can represent the data in Profit Center Accounting by reflecting the original document directly.The exchange of services between profit centers is represented as internal cost allocations in CO. If elimination of internal business volume is active, Profit Center Accounting only reflects those services which are provided by one profit center for another one or between different controlling object type (e.g. cost center and internal order).

The primary costs of an auxiliary cost center are passed on to Profit Center Accounting. If it is not possible to assign this auxiliary cost center to a profit center, you should work with a service center here. The assessment or distribution to CO objects which are assigned to "real" profit centers can thus be reflected as an assessment or distribution from the service center to a "real" profit center.If any over- or under absorption occurs for the service center, you need to allocate this in Profit Center Accounting. If you cannot assign the final cost centers to one profit center, you can collect the data in an allocation center and then assess or distribute it in Profit Center Accounting.

You can calculate work in process to determine the cost of goods manufactured for materials which have not yet been delivered. You can calculate work in process periodically for each run-schedule header, production order or process order based on the quantities confirmed thus far. The work in process calculated is transferred periodically to Financial Accounting, where the following accounts are assigned:

ŸValue of unfinished products (balance sheet account)

ŸChange to work in process (profit and loss account)

Ÿ

This data is reflected in Profit Center Accounting. The assignment to a profit center is stored in the corresponding production order.The account “Change to work in process” is not defined as a cost element, since the production order is not supposed to be credited. The data is still displayed in Profit Center Accounting for this account, however, because the data is needed in order to display profits using the period accounting method.

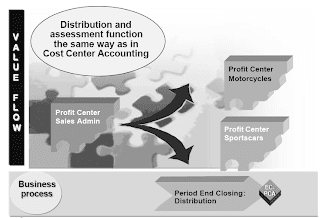

Distribution/Assessment

Allocation (assessment and distribution) of overhead costs is usually performed at period closing. This is usually done directly in CO and reflected in the data in Profit Center Accounting. If you have a service profit center or allocation center in your profit center hierarchy, you may need to assess or distribute costs again in Profit Center Accounting.Under certain circumstances it may also be necessary to allocate revenues and sales deductions. You can do this as well in Profit Center Accounting.

One important use for this function is to distribute balance sheet items (raw materials, land, and so on) that you initially post to one profit center and need to spread across several receiving profit centers.Assessing or distributing data in Profit Center Accounting only makes sense after you have completed all the period closing activities in the applications which supply EC-PCA with data (FI, CO, SD, MM, etc.). You should also post any additional profit center data manually, such as PCA Statistical Key Figures, before allocating.Distribution and assessment work the same way as in Overhead Management, but affect PCA data only.

Transfer of Statistical Key Figures

In addition to the monetary data in accounting, you can also transfer Statistical Key Figures from the account assignment objects in Controlling to Profit Center Accounting. Statistical key figures can be transferred from the following:

Ÿcost centers

Ÿcost center/activity types

Ÿorders

Ÿcost objects

Ÿnetworks/network activities

ŸWBS elements

Ÿsales documents

A control table determines which key figures can be transferred from which objects to Profit Center Accounting. (See Customizing for Profit Center Accounting.) This means that you can choose not to transfer certain key figures which are unnecessary in EC-PCA, such as those used solely in Cost Center Accounting as tracing factors for periodic allocations.

Creating Profit Center Documents

You can use this function to import external data to Profit Center Accounting via batch input.You can also use it to create the opening balance for transferring Additional Balance Sheet Items to Profit Center Accounting.You can create your own document entry layout in customizing or take one of the standard layouts. Enter the company code, the document type, and the posting date. If you desire, you can also enter a different date to be used for currency translation. The system assigns a document number internally.If you wish, you can also enter a transaction currency and a basic unit of measure. Enter the currencies and quantities as well as an account assignment for each document line. For credit postings, you must enter a minus sign ("-") after the amount.The documents you create here are only updated in Profit Center Accounting. No postings are made in FI or in the Special Purpose Ledgers.

Related Posts

No comments :

Post a Comment