SAP Finance and control(sap fico) report lists balances by customer account number and reconciliation account.

It provides a high-level review of carry-forward balances, current debit, and credit balances for each customer in the local currency for the period selected.

The previous sap fico report deals with customer open items of SAP Finance and control.

The following data is issued at the end of the list for each local currency:

Totals per company code

Final total across all company codes

To run this SAP ABAP finance report, we have two options:

1.Information systems → Accounting → Financial accounting

Accounts receivable → Select report

Customers → Information system → Account information → Balances in local currency

2.Choose System → Services → Reporting and enter RFDSLD00 in the Program field.

Then, choose Execute to run the this finance report.

You must select a fiscal year and reporting period before running this report.

The selection screen of this ABAP report includes:

Generate a listing of all customer balances for company 3000 in the year 1996.

To access the first screen for this report, choose

Information systems → Accounting → Financial accounting

Accounts receivable → Select report

Customers → Information system → Account information → Balances in local currency.

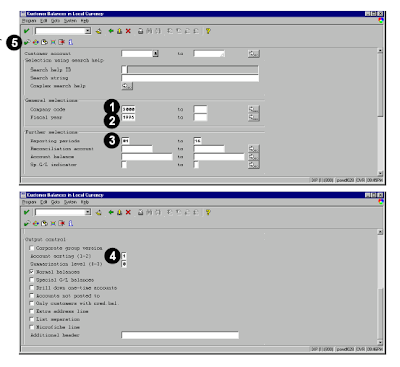

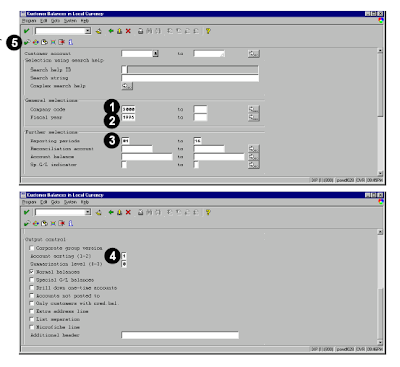

The selection screen of this sap fico report is as shown below.

Each number of the screen shot gives the following description.

1. Enter 3000 in Company code.

2. Enter the year for which customer balances are to be reviewed (for example, 1996).

3. Enter a reporting period (for example, 01 to 16)in Reporting periods.

The period determines the reporting debit and credit balances. Any period that is excluded in this selection will be captured in the opening balance or the balance for the entire period.

4. Enter the standard setting of 1 in Account sorting to sort the report by company code, reconciliation account, and customer account.

5. Choose Execute.

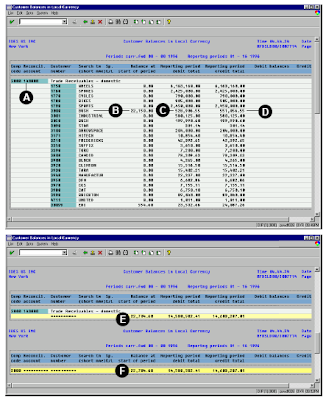

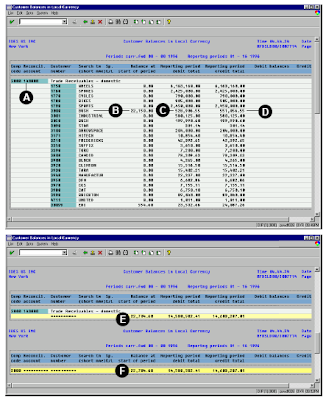

The output screen is as shown below.

This screen shows the list of customer balances for the selected carry forward period (1-16 1996).

A Company code (3000) and reconciliation account (140000), followed by the customer accounts .

B Balances at the period start are listed for each customer (for example, customer 3000 BUSH has an opening balance of 22,150.00)

C Debit balance (528,906.55) for the period

D Credit balance (551,056.55) for the period

E Totals (provided by reconciliation account)

In this example, the carry-forward balance for the reconciliation account 140000 is 22,704.60. The reporting debit and credit balances are listed as 14,580,582.41 and 14,603,287.01.

F Total (for all reconciliation accounts in company code 3000)

You may be also interested in the following SAP Finance reports.

SAP Finance General Ledger report account balance

Finance general ledger line items SAP ABAP report

General ledger report SAP FINACNE

OOPS ABAPALE

IDOC'S

It provides a high-level review of carry-forward balances, current debit, and credit balances for each customer in the local currency for the period selected.

The previous sap fico report deals with customer open items of SAP Finance and control.

The following data is issued at the end of the list for each local currency:

Totals per company code

Final total across all company codes

To run this SAP ABAP finance report, we have two options:

1.Information systems → Accounting → Financial accounting

Accounts receivable → Select report

Customers → Information system → Account information → Balances in local currency

2.Choose System → Services → Reporting and enter RFDSLD00 in the Program field.

Then, choose Execute to run the this finance report.

You must select a fiscal year and reporting period before running this report.

The selection screen of this ABAP report includes:

- Variants

- Dynamic selection options

- User variables

- Execution (and print) in background

- The output of this report includes a listing of the customer open items, sorted by various criteria.

Generate a listing of all customer balances for company 3000 in the year 1996.

To access the first screen for this report, choose

Information systems → Accounting → Financial accounting

Accounts receivable → Select report

Customers → Information system → Account information → Balances in local currency.

The selection screen of this sap fico report is as shown below.

Each number of the screen shot gives the following description.

1. Enter 3000 in Company code.

2. Enter the year for which customer balances are to be reviewed (for example, 1996).

3. Enter a reporting period (for example, 01 to 16)in Reporting periods.

The period determines the reporting debit and credit balances. Any period that is excluded in this selection will be captured in the opening balance or the balance for the entire period.

4. Enter the standard setting of 1 in Account sorting to sort the report by company code, reconciliation account, and customer account.

5. Choose Execute.

The output screen is as shown below.

This screen shows the list of customer balances for the selected carry forward period (1-16 1996).

A Company code (3000) and reconciliation account (140000), followed by the customer accounts .

B Balances at the period start are listed for each customer (for example, customer 3000 BUSH has an opening balance of 22,150.00)

C Debit balance (528,906.55) for the period

D Credit balance (551,056.55) for the period

E Totals (provided by reconciliation account)

In this example, the carry-forward balance for the reconciliation account 140000 is 22,704.60. The reporting debit and credit balances are listed as 14,580,582.41 and 14,603,287.01.

F Total (for all reconciliation accounts in company code 3000)

You may be also interested in the following SAP Finance reports.

SAP Finance General Ledger report account balance

Finance general ledger line items SAP ABAP report

General ledger report SAP FINACNE

ABAP TOPIC WISE COMPLETE COURSES

BDCOOPS ABAPALE

IDOC'S

You could be left with a credit balance in accounts receivable for many different reasons. For example, it could be because the customer has overpaid due to an error in your original invoice or because they’ve accidentally duplicated payment.

ReplyDelete