SAP Financial Automatic Payments and payment process is involved in every firm needs some solution to pay their vendors. The automatic cost program is a software that will help customers handle parables.R/3 provides customers the options to automatically as choose open invoices to be paid or collected and submit fee documents print payment media, use knowledge medium trade (DME), or generate electronic knowledge interchange (EDI).The fee program has been developed for each national and worldwide payment transactions with vendors and prospects, and handles each outgoing and incoming payments.It's flexible sufficient to allow users to outline those payment features that vary from nation to nation such as fee strategies, cost types or information carrier specifications.

Payment Process Overview

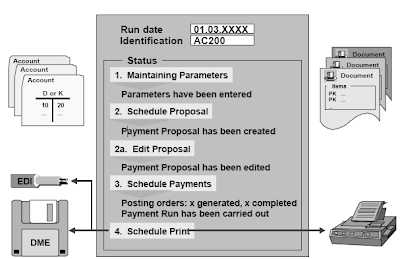

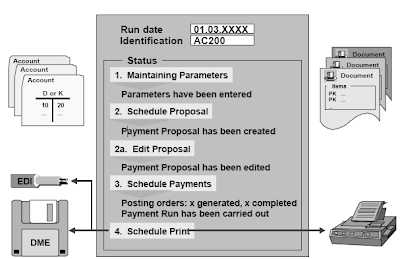

There are 4 steps to the cost process:

The main payment program configuration menu has push buttons for each area. To be sure that the configuration is complete, work from left to proper by every push button.The primary three areas would require minimal configuration changes. The standard system incorporates the frequent payment strategies and their corresponding varieties, which have been defined separately for each country.

All company Codes

If firm code A is making payments on behalf of another company code, B, then B can be the sending company code. If an organization code will not be specified, the system robotically regards the sending firm code as the paying firm code.The paying firm code is the corporate code that will probably be responsible for processing the outgoing payments. This is the company code that will document the bank postings (A). The sending firm code will file the subledger postings (B). Each firms will steadiness by routinely generated cross company postings.If you already know that your distributors often grant a sure variety of grace days you may enter tolerance days for payables for each company code. With these tolerance days you postpone the fee of some due items till the following fee run, whereas nonetheless receiving appropriate discounts.Vendor/Customer Sp. G/L Transactions to be paid specifies which particular basic ledger transactions will be processed with the fee program.

If activated, Cost Method Dietary supplements provide the ability to print and sort payments. You create a 2 character cost methodology supplement that might be assigned to business accomplice grasp information which default to the road merchandise during doc entry. In addition they might be manually keyed or overwritten into the road item throughout document entry. Payments are sorted and might be printed by the supplement.

Paying Company Codes

Customers outline the minimum quantities for payment and the kinds that will in all probability be used for every paying company code.Customers define how many payments of exchange are created for each account in the course of the fee run for the invoice of exchange fee method.Users control which open gadgets for the bill of change fee method are to be thought of during the cost run utilizing the due date specifications.In the “sender” display, users can outline any company code dependent-commonplace texts to the payment forms.

Payment Methods

Payment methods have 2 parts: country specific settings and firm code specific settings.This section particulars the essential requirements and specs for payment strategies for each country.

n If a selected fee methodology has required grasp file necessities , i.e. address is required, invoices won't be paid with this payment method except the requirements are met.On this area, specify the document varieties that shall be used for posting and clearing documents.The identify of the print program and the print data set for this cost method is also defined.You probably can limit payment strategies to particular currencies. On the permitted currencies display screen, enter any forex that the payment methodology is limited to. If there are not any entries on this display, the fee technique is legitimate for all currencies.

Payment Method

This space defines the eligible payment methods for the corporate code. It defines the following specs for every cost method which may differ throughout company codes:

Bank Selection

On the main configuration screen the pushbuttons are located for every of these sections: rating order, amounts, accounts, prices, value date and postal code.As users step by manner of each of the pushbuttons, the payment program configuration must be completed.By this point, the configuration for home banks and associated accounts at those banks must be configured.On the rating order display screen, enter the home banks within the order the cost program should contemplate them for fee per the cost method.If the bank/cost method mixture doesn't exist, create a new one by defining…

The quantities display screen lists the house banks and the quantity of funds obtainable at every bank.To add a brand new home bank define the following…

Bank Selection Charges

The functions for incoming and outgoing funds provide a field, financial institution costs, through which users can enter any financial institution charges which may be a part of the fee being made or received. For incoming payments the system subtracts the bank charges from the clearing quantity, while for outgoing payments it provides the charges to the clearing amount.The system additionally posts the costs to an expense account. To do this, it requires a posting key and an account task, each of that are already outlined in the usual system. If users usually are not using the charts of accounts delivered with the usual system, users need to enter their very own account specification to post financial institution charges. The Related to cash circulation indicator have to be set in the grasp information of accounts that file financial institution charges.

If users have selected, “Optimize by postal code ” for a fee method, the fee program will have a glance at the enterprise associate’s postal code to determine from which financial institution to make the payment.The worth date is used along side money administration to track the outflow of funds. For example, payments that are made by transfer are deducted from the bank the following day no matter the amount. This means that the money should be available the following day for funds with this method. For this payment methodology, enter 1 into the field, “Days until value date”.

Value date = cost run posting date + days till value date. The days entered right here correspond

with the day specification for the “available quantities”.

Bank Selection Parameters

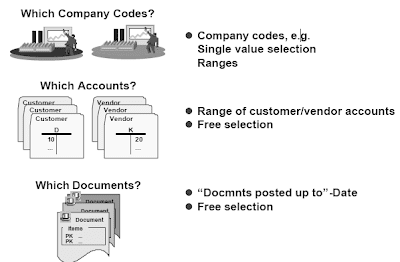

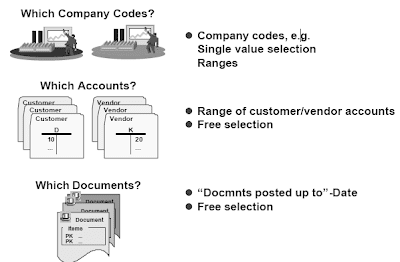

Once the essential configuration is complete, the fee course of can begin. In step one of the fee process define the next

Open Item Selection

Paperwork which had been entered up till the Docs entered as much as-date are considered within the payment run.The posting date is the date that the general ledger will possible be up to date with the postings. This date defaults from the run date on the previous screen.If a quantity of company codes are listed, they need to be separated by commas. For a variety of company codes, the first and the final firm code within the range should be entered in brackets. Observe: Don't enter a space after the comma.

With the parameters, you inform the dunning program which documents and accounts wherein company codes it ought to look at for overdue items.You too can activate an extra log which after the dunning run - gives you details about the profitable or unsuccessful completion of the dunning run processing steps. Use this log for testing and coaching purposes only sinceit requires a lot of system resources.

Proposal Run

Proposal Run

On the main fee program display screen, after the parameters are entered, schedule the fee proposal to be created.The proposal run searches for documents and accounts attributable to be paid based on the factors set in the upkeep of parameters. The system then teams these items to payments and ascertains the cost methods and bank connections to be used. If no valid payment methodology or financial institution knowledge can be found, or if an item is blocked for payment, then those objects are positioned on the exception list.As quickly as the proposal run is complete, the system generates 2 stories: the proposal checklist and the exception record which will be considered on-line or printed.

The proposal record details the business partners and the amounts to be paid or received. Relying on the road structure users choose for the display screen, the associated document numbers and money reductions can be displayed.Any exceptions will probably be listed right here as well. Customers can drill down a number of instances to view and alter the details of the person payment items.

Payment Blocks

There are a quantity of ways that a payment block will be configured:

To additional analyze the proposal checklist, customers can edit the list to view the details of a selected payment,change the fee phrases, or add a payment block.After the cost run has been created, it could be edited by accounting clerks. Users can assign an accounting clerk to a buyer/vendor by coming into the clerk’s key into the shopper/vendor grasp data. For enhancing the fee proposal, the vital thing will be typed in to show only the funds of the accounts, that are assigned to the clerk.On the first display in the modifying transaction, the clerk receives an summary of all the payments the program proposes.By drilling down on a fee, a list of all open objects that are on account of be paid with the payment is generated. In these line objects customers can change the fee block and the discount. Furthermore, it is possible to reallocate the item to another existing fee or to create a brand new fee by deciding on a fee methodology and a home bank.

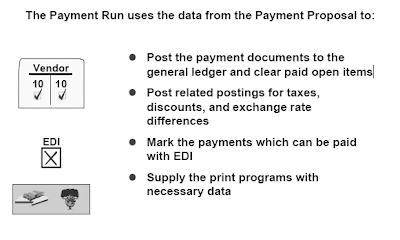

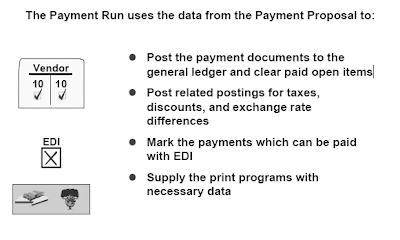

Payment Run

As quickly as the fee proposal has been edited and saved, the cost run uses the changes as a basis for the precise payments.Up so far, no postings have occurred. The paperwork included in this payment run have been “locked” in opposition to any other postings, i.e. an invoice eligible to be paid in the present automatic payment run is blocked against being paid manually or in another fee run.In this step, cost documents are created, open items are cleared and the overall and sub-ledgers are posted to.The fee program posts funds and related postings comparable to those for tax, tax changes,change price variations or money discount automatically.Some countries require that the payment paperwork are normally not posted before the actual settlement, i.e. earlier than the payment appears on the financial institution statement. Within the cost technique definitions of those international locations, the flag ”Generate cost order solely” can be set. Then, the fee program does not publish a payment document. As an alternative, a cost order is generated which contains info on the items. When the payment seems on the bank statement, the fee document is generated by getting into the cost order. Till then, the paid objects are blocked for other clearing transactions.

Bank Sub Accounts

It is advisable to make use of bank sub-accounts for posting incoming and outgoing funds, e.g. accounts for outgoing cheques, outgoing transfers, incoming cheques and financial institution collection.Utilizing sub-accounts gives some advantages: It is doable to reconcile,at any time, the steadiness of the checking account, with the balance of the corresponding G/L account. The sub-accounts comprise all incoming and outgoing payments until the cash is definitely debited from/credited to the financial institution account (worth date). Then the posting is transferred from the sub-account to the bank account. To mirror the postings at the financial institution in the normal ledger, usually the performance of the guide or the digital financial institution assertion is used.The financial institution sub-accounts have to be assigned to the cost strategies within the financial institution choice part in configuration. The financial institution sub-accounts could additionally be differentiated by house financial institution and currency. Sub accounts are usually managed on an open item basis and with line item display.

The Payment Document

The doc type for the payment paperwork is specified in the country-specific specs of the cost method. For cross-company-code funds, one other doc kind could be entered which is used for the clearing postings. Both doc sorts should be defined using inside numbering assignment.Documents from the fee run contain in the doc header text-subject the date and identification number (e.g. 19940301-ID) of the run.The value date of the clearing doc is calculated by including the times to value date to the posting date. The days to worth date depends on the cost methodology, the financial institution, the account, the currency and the account limit. If no entry is made, the system takes the posting date as the value date. For calculating the worth date of cheque funds, a cheque cashing time can be entered in the grasp record. This has precedence over the times to worth date for cheques.If payments are made per business area, the financial institution posting is made to the enterprise area of the paid items. If funds are normally not made per business space, the business area for the bank postings might be specified. In all other circumstances, the postings to the bank sub-accounts are carried out without reference to business areas.

Payment Medium Forms

Within the payment program configuration, several payment medium types should be assigned either to the paying firm code or the cost method / firm code.R/3 gives customary types which might be altered for customers requirements. Details on the fee types and file codecs within the user’s country could be discovered within the nation-specific program documentation.For in-depth info on form structure, seek advice from the SAPscript documentation, the SAPscript course, and the documentation of the print program.

EDI and Payment Process

EDI and Payment Process

The primary print program which is run by the fee program is the print program RFFOEDI1. This report selects all funds that are marked for EDI, transforms them into SAP-intermediate paperwork and forwards them to the EDI-subsystem. The EDI-subsystem then transforms the intermediate doc into EDI-data which is distributed to the bank.Payment advices can either be sent by mail or by EDI depending on whether or not the client/vendor has the capability to receive EDI-messages.

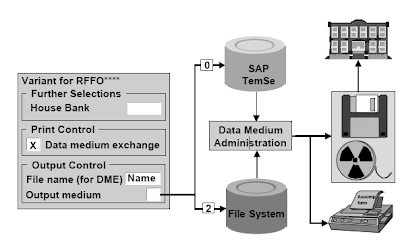

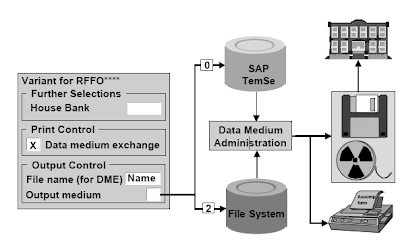

Data Media Exchange

By using Knowledge Medium Trade,a file is created which accommodates all fee data similar to the banking guidelines of the country in question. The DME file is saved in the information medium administration, it might be downloaded on an information provider and the DME accompanying note can be printed. The info carrier and the DME accompanying note is then handed to the bank.DME can often be used with all fee strategies during which the cost medium is handed to the financial institution for further processing, e.g. financial institution switch, direct debit, etc. It can't be used with fee methods the place the fee medium is sent to the customer/vendor, e.g. cheque.To use DME for a special fee methodology, it is just essential to mark the sphere Data medium change in the variant. To generate separate DME files for every house bank, one variant per house bank has to be entered.

The DME file can be both stored within the SAP-TemSe (TEMporary SEquential file) throughout the R/3-system or in the file system. Within the SAP-TemSe, the file can't be accessed by unauthorized external users. The name of the file to be created during the obtain can be decided when working the fee medium program: the contents of the file name parameter are saved within the administration knowledge and are proposed when operating the download. Cheque Management

Cheque Management

With the intention to print a cheque in SAP, a liability, e.g. an invoice, has to reside on the system.The fee course of creates a cost doc which data the payment of the legal responsibility and clears the open invoice.Creating the cheque is a separate step from creating the payment document. When the cheque is created, each the cost document and the open invoice are up to date with the cheque number, financial institution info as properly as the cheque recipient.When errors are made, users have to determine if the cheque must be re-printed or voided or each the cheque and the payment document must be voided and reversed, respectively.

Payment Documents

There are three ways to pay an bill in R/3;

SAP Financial Customer Vendor Accounts

EnjoySAP Financial Invoice Entry

Payment Process Overview

There are 4 steps to the cost process:

- Parameters : In this step, the next questions are requested and answered:

- Who is going to be paid?

- What fee methods will seemingly be used?

- When will they be paid?

- Which company codes will be thought-about?

- How are they going to be paid?

- Proposal: Once the parameters have been specified, the proposal run is scheduled and it produces a listing of business companions and open invoic es which would possibly be due for payment. Invoices might be blocked or unblocked for payment.

- Program: As quickly as the payment list has been verified, the cost run is scheduled. A cost doc is created and the overall ledger and sub-ledger accounts are updated.

- Print: The accounting capabilities are accomplished and a separate print program is scheduled to generate the payment media.

The main payment program configuration menu has push buttons for each area. To be sure that the configuration is complete, work from left to proper by every push button.The primary three areas would require minimal configuration changes. The standard system incorporates the frequent payment strategies and their corresponding varieties, which have been defined separately for each country.

All company Codes

If firm code A is making payments on behalf of another company code, B, then B can be the sending company code. If an organization code will not be specified, the system robotically regards the sending firm code as the paying firm code.The paying firm code is the corporate code that will probably be responsible for processing the outgoing payments. This is the company code that will document the bank postings (A). The sending firm code will file the subledger postings (B). Each firms will steadiness by routinely generated cross company postings.If you already know that your distributors often grant a sure variety of grace days you may enter tolerance days for payables for each company code. With these tolerance days you postpone the fee of some due items till the following fee run, whereas nonetheless receiving appropriate discounts.Vendor/Customer Sp. G/L Transactions to be paid specifies which particular basic ledger transactions will be processed with the fee program.

If activated, Cost Method Dietary supplements provide the ability to print and sort payments. You create a 2 character cost methodology supplement that might be assigned to business accomplice grasp information which default to the road merchandise during doc entry. In addition they might be manually keyed or overwritten into the road item throughout document entry. Payments are sorted and might be printed by the supplement.

Paying Company Codes

Customers outline the minimum quantities for payment and the kinds that will in all probability be used for every paying company code.Customers define how many payments of exchange are created for each account in the course of the fee run for the invoice of exchange fee method.Users control which open gadgets for the bill of change fee method are to be thought of during the cost run utilizing the due date specifications.In the “sender” display, users can outline any company code dependent-commonplace texts to the payment forms.

Payment Methods

Payment methods have 2 parts: country specific settings and firm code specific settings.This section particulars the essential requirements and specs for payment strategies for each country.

n If a selected fee methodology has required grasp file necessities , i.e. address is required, invoices won't be paid with this payment method except the requirements are met.On this area, specify the document varieties that shall be used for posting and clearing documents.The identify of the print program and the print data set for this cost method is also defined.You probably can limit payment strategies to particular currencies. On the permitted currencies display screen, enter any forex that the payment methodology is limited to. If there are not any entries on this display, the fee technique is legitimate for all currencies.

Payment Method

This space defines the eligible payment methods for the corporate code. It defines the following specs for every cost method which may differ throughout company codes:

- the minimal and maximum cheque quantities to be processed. Any quantities decrease/higher than this amount might be excluded from the payment run.

- if payment to prospects/vendors overseas is allowed. When chosen, this indicator permits overseas clients and distributors to be processed utilizing this cost method.

- if payments by manner of buyer/vendor’s bank overseas is allowed. When chosen, this indicators allows funds from buyer and vendor banks abroad.

- if foreign foreign money is allowed. When chosen, this indicator lets you use foreign Forex with this payment method.

- if bank optimization is used. When chosen, the cost program will attempt to pay from a bank throughout the similar clearing house system (ACH).

- if postal code optimization is used. In configuration, banks could be designated to particular postal areas. When chosen, the payment program looks to make fee from the financial institution based mostly on the customer/vendor’s metropolis of residence.

Bank Selection

On the main configuration screen the pushbuttons are located for every of these sections: rating order, amounts, accounts, prices, value date and postal code.As users step by manner of each of the pushbuttons, the payment program configuration must be completed.By this point, the configuration for home banks and associated accounts at those banks must be configured.On the rating order display screen, enter the home banks within the order the cost program should contemplate them for fee per the cost method.If the bank/cost method mixture doesn't exist, create a new one by defining…

- the payment methodology

- the currency: depart this field blank if the payment method for this financial institution is legitimate for all currencies otherwise it will be limited to the forex specified

- the ranked order; the fee program will take this into consideration when determining which financial institution to pay from . the home bank identifier to be used with this cost methodology

The quantities display screen lists the house banks and the quantity of funds obtainable at every bank.To add a brand new home bank define the following…

- the bank and the bank account

- the days until the worth date when utilizing payments of exchange. This is used so funds will be posted before their due date. In all different cases, enter 999 and then the worth dates is not going to be taken into consideration.

- Forex: leave this subject clean if the cost technique for this bank is valid for all currencies in any other case it will likely be restricted to the foreign money specified.

- amount accessible for outgoing payment: enter the amount of the funds obtainable on the house bank.Please notice that the quantity area doesn't update after each cost run.

Bank Selection Charges

The functions for incoming and outgoing funds provide a field, financial institution costs, through which users can enter any financial institution charges which may be a part of the fee being made or received. For incoming payments the system subtracts the bank charges from the clearing quantity, while for outgoing payments it provides the charges to the clearing amount.The system additionally posts the costs to an expense account. To do this, it requires a posting key and an account task, each of that are already outlined in the usual system. If users usually are not using the charts of accounts delivered with the usual system, users need to enter their very own account specification to post financial institution charges. The Related to cash circulation indicator have to be set in the grasp information of accounts that file financial institution charges.

If users have selected, “Optimize by postal code ” for a fee method, the fee program will have a glance at the enterprise associate’s postal code to determine from which financial institution to make the payment.The worth date is used along side money administration to track the outflow of funds. For example, payments that are made by transfer are deducted from the bank the following day no matter the amount. This means that the money should be available the following day for funds with this method. For this payment methodology, enter 1 into the field, “Days until value date”.

Value date = cost run posting date + days till value date. The days entered right here correspond

with the day specification for the “available quantities”.

Bank Selection Parameters

Once the essential configuration is complete, the fee course of can begin. In step one of the fee process define the next

- Who is going to be paid?

- What fee strategies might be used?

- When will they be paid?

- Which firm codes might be considered?

- How are they going to be paid?

- run date

- identification

Open Item Selection

Paperwork which had been entered up till the Docs entered as much as-date are considered within the payment run.The posting date is the date that the general ledger will possible be up to date with the postings. This date defaults from the run date on the previous screen.If a quantity of company codes are listed, they need to be separated by commas. For a variety of company codes, the first and the final firm code within the range should be entered in brackets. Observe: Don't enter a space after the comma.

- The corporate codes in a cost run have to be in the same country.

- For every nation, we outlined payment methods that can be used inside that individual country. Out of those payment methods, select those which are going for use in the present cost run.

- When using a couple of cost methodology in the cost run, the order during which they are entered has significance. The first technique listed has the primary precedence, the next has second precedence, and so on… The system makes the fee using the best priority.

With the parameters, you inform the dunning program which documents and accounts wherein company codes it ought to look at for overdue items.You too can activate an extra log which after the dunning run - gives you details about the profitable or unsuccessful completion of the dunning run processing steps. Use this log for testing and coaching purposes only sinceit requires a lot of system resources.

Proposal Run

Proposal RunOn the main fee program display screen, after the parameters are entered, schedule the fee proposal to be created.The proposal run searches for documents and accounts attributable to be paid based on the factors set in the upkeep of parameters. The system then teams these items to payments and ascertains the cost methods and bank connections to be used. If no valid payment methodology or financial institution knowledge can be found, or if an item is blocked for payment, then those objects are positioned on the exception list.As quickly as the proposal run is complete, the system generates 2 stories: the proposal checklist and the exception record which will be considered on-line or printed.

The proposal record details the business partners and the amounts to be paid or received. Relying on the road structure users choose for the display screen, the associated document numbers and money reductions can be displayed.Any exceptions will probably be listed right here as well. Customers can drill down a number of instances to view and alter the details of the person payment items.

Payment Blocks

There are a quantity of ways that a payment block will be configured:

- If there is a problem in the course of the invoice verification course of, sometimes the invoice is blocked for payment. This kind of block might be configured so that the block is eliminated only inside the bill verification process.

- If there's a cause for a vendor to not be paid, a master file fee block will be created. This block can be entered on the grasp file and would prevent any invoices from being paid. It might be configured such that the block should be manually removed from the grasp record in order to course of any payments.

- During AP invoice entry, an bill may be blocked for payment. Relying on they sort of payment block, it may be removed throughout the fee proposal.

- Additional fee blocks could be outlined within the system and users can further outline whether or not the cost block might be eliminated throughout cost processing.

To additional analyze the proposal checklist, customers can edit the list to view the details of a selected payment,change the fee phrases, or add a payment block.After the cost run has been created, it could be edited by accounting clerks. Users can assign an accounting clerk to a buyer/vendor by coming into the clerk’s key into the shopper/vendor grasp data. For enhancing the fee proposal, the vital thing will be typed in to show only the funds of the accounts, that are assigned to the clerk.On the first display in the modifying transaction, the clerk receives an summary of all the payments the program proposes.By drilling down on a fee, a list of all open objects that are on account of be paid with the payment is generated. In these line objects customers can change the fee block and the discount. Furthermore, it is possible to reallocate the item to another existing fee or to create a brand new fee by deciding on a fee methodology and a home bank.

Payment Run

As quickly as the fee proposal has been edited and saved, the cost run uses the changes as a basis for the precise payments.Up so far, no postings have occurred. The paperwork included in this payment run have been “locked” in opposition to any other postings, i.e. an invoice eligible to be paid in the present automatic payment run is blocked against being paid manually or in another fee run.In this step, cost documents are created, open items are cleared and the overall and sub-ledgers are posted to.The fee program posts funds and related postings comparable to those for tax, tax changes,change price variations or money discount automatically.Some countries require that the payment paperwork are normally not posted before the actual settlement, i.e. earlier than the payment appears on the financial institution statement. Within the cost technique definitions of those international locations, the flag ”Generate cost order solely” can be set. Then, the fee program does not publish a payment document. As an alternative, a cost order is generated which contains info on the items. When the payment seems on the bank statement, the fee document is generated by getting into the cost order. Till then, the paid objects are blocked for other clearing transactions.

Bank Sub Accounts

It is advisable to make use of bank sub-accounts for posting incoming and outgoing funds, e.g. accounts for outgoing cheques, outgoing transfers, incoming cheques and financial institution collection.Utilizing sub-accounts gives some advantages: It is doable to reconcile,at any time, the steadiness of the checking account, with the balance of the corresponding G/L account. The sub-accounts comprise all incoming and outgoing payments until the cash is definitely debited from/credited to the financial institution account (worth date). Then the posting is transferred from the sub-account to the bank account. To mirror the postings at the financial institution in the normal ledger, usually the performance of the guide or the digital financial institution assertion is used.The financial institution sub-accounts have to be assigned to the cost strategies within the financial institution choice part in configuration. The financial institution sub-accounts could additionally be differentiated by house financial institution and currency. Sub accounts are usually managed on an open item basis and with line item display.

The Payment Document

The doc type for the payment paperwork is specified in the country-specific specs of the cost method. For cross-company-code funds, one other doc kind could be entered which is used for the clearing postings. Both doc sorts should be defined using inside numbering assignment.Documents from the fee run contain in the doc header text-subject the date and identification number (e.g. 19940301-ID) of the run.The value date of the clearing doc is calculated by including the times to value date to the posting date. The days to worth date depends on the cost methodology, the financial institution, the account, the currency and the account limit. If no entry is made, the system takes the posting date as the value date. For calculating the worth date of cheque funds, a cheque cashing time can be entered in the grasp record. This has precedence over the times to worth date for cheques.If payments are made per business area, the financial institution posting is made to the enterprise area of the paid items. If funds are normally not made per business space, the business area for the bank postings might be specified. In all other circumstances, the postings to the bank sub-accounts are carried out without reference to business areas.

Payment Medium Forms

Within the payment program configuration, several payment medium types should be assigned either to the paying firm code or the cost method / firm code.R/3 gives customary types which might be altered for customers requirements. Details on the fee types and file codecs within the user’s country could be discovered within the nation-specific program documentation.For in-depth info on form structure, seek advice from the SAPscript documentation, the SAPscript course, and the documentation of the print program.

EDI and Payment Process

EDI and Payment ProcessThe primary print program which is run by the fee program is the print program RFFOEDI1. This report selects all funds that are marked for EDI, transforms them into SAP-intermediate paperwork and forwards them to the EDI-subsystem. The EDI-subsystem then transforms the intermediate doc into EDI-data which is distributed to the bank.Payment advices can either be sent by mail or by EDI depending on whether or not the client/vendor has the capability to receive EDI-messages.

Data Media Exchange

By using Knowledge Medium Trade,a file is created which accommodates all fee data similar to the banking guidelines of the country in question. The DME file is saved in the information medium administration, it might be downloaded on an information provider and the DME accompanying note can be printed. The info carrier and the DME accompanying note is then handed to the bank.DME can often be used with all fee strategies during which the cost medium is handed to the financial institution for further processing, e.g. financial institution switch, direct debit, etc. It can't be used with fee methods the place the fee medium is sent to the customer/vendor, e.g. cheque.To use DME for a special fee methodology, it is just essential to mark the sphere Data medium change in the variant. To generate separate DME files for every house bank, one variant per house bank has to be entered.

The DME file can be both stored within the SAP-TemSe (TEMporary SEquential file) throughout the R/3-system or in the file system. Within the SAP-TemSe, the file can't be accessed by unauthorized external users. The name of the file to be created during the obtain can be decided when working the fee medium program: the contents of the file name parameter are saved within the administration knowledge and are proposed when operating the download.

Cheque Management

Cheque ManagementWith the intention to print a cheque in SAP, a liability, e.g. an invoice, has to reside on the system.The fee course of creates a cost doc which data the payment of the legal responsibility and clears the open invoice.Creating the cheque is a separate step from creating the payment document. When the cheque is created, each the cost document and the open invoice are up to date with the cheque number, financial institution info as properly as the cheque recipient.When errors are made, users have to determine if the cheque must be re-printed or voided or each the cheque and the payment document must be voided and reversed, respectively.

Payment Documents

There are three ways to pay an bill in R/3;

- the automated payment program: creates fee paperwork and cheques robotically en masse. That is used to pay a quantity of vendors at one time.

- “put up and print varieties”: creates particular person fee paperwork and cheques. The user manually selects invoices for payment. That is used to pay one vendor or one specific bill, e.g. the

- vendor arrived in individual demanding a cheque.

- “post”: creates individual fee documents after the consumer manually selects invoices for payment. As before, this is used to pay one vendor or one explicit bill utilizing pre-printed cheques crammed out manually or typed on a typewriter, e.g. the cheque printer is down and the boss needs a cheque. On this case, type the cheque on the typewriter. Later, return into R/3 to create the cost doc after which assign it a cheque number since a cheque will not be produced from R/3.

SAP Financial Customer Vendor Accounts

EnjoySAP Financial Invoice Entry

No comments :

Post a Comment