SAP Financial Receivables needs Foreign Currency Valuation.You can run a program SAPF100 so that you just first run the program in TEST mode and study the ensuing output for accuracy (i.e. currency charges and account dedication). If mandatory, adjust customizing.The Foreign money codes you employ have to be defined underneath global settings in customizing for your entire system. In addition, you must specify the variety of decimal places which may be managed for particular person currencies.You outline translation rates within the desk for trade rates. The system determines the charges throughout doc entry and for key date valuations through the use of numerous currency rate varieties which can be outlined under world settings in customizing. Translation charges obtain a validity date.

Exchange Rage Types

Valuation Methods

You presumably can outline different valuation strategies for valuing international currency.For every valuation technique, you specify as Parameters for the valuation procedure and Parameters for exchange fee determination.You need to use different charge varieties for figuring out the trade rate.See switch: Stability evaluation.Solely relevant when using strictest or lowest evaluation principle. Instance: evaluation of the open objects of customer accounts.So as to have credit objects evaluated, the change must be ”on”. In every other case, solely debit objects will be evaluated.

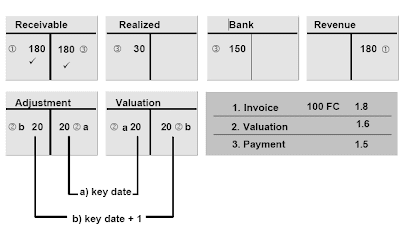

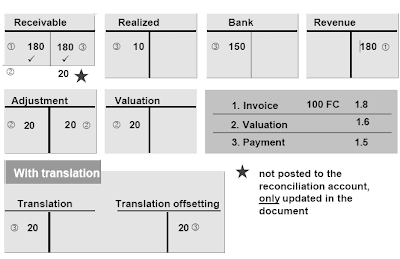

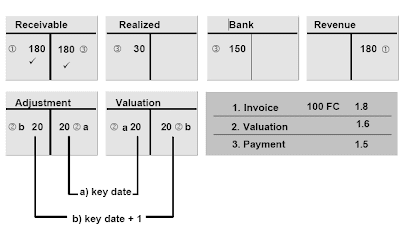

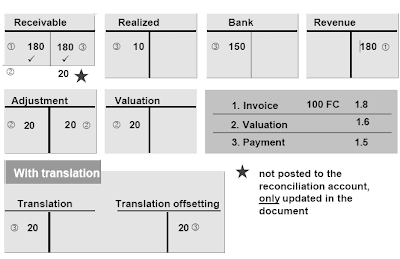

The above accounts show the posting transactions when valuing objects in international foreign money with out an update of the valuation distinction in the doc line item.In the interval that the valuation is carried out (as defined by the essential thing date), a posting is made to regulate the general receivables balance for the change in alternate rates. This posting is reversed in the subsequent period, to convey the balances back to the original position. A subsequent valuation or the payment clearing is then based mostly on the unique posting.The adjustment posting is normally made on the essential thing date and reversed on the key date + 1, nonetheless,the person can specify completely different posting dates if required.

Valuation

With Launch 4.5, you now have the ability to perform an automated flat-fee individual worth adjustment for overdue receivables.In Accounts Receivable configuration, you outline the debit fee proportion (bad debt expense share) for a valuation adjustment key and an overdue time interval in days. You could also arrange the appropriate A/R adjustment and bad debt expense accounts on the account dedication table.You assign the valuation adjustment key to the grasp record for any customer accounts that you simply wish to embrace within the flat-rate particular person valuation adjustment posting.Periodically, you course of a valuation run to calculate the bad debt expense posting for overdue items.The valuation run produces a valuation proposal, which you can manually change, if desired. When you're happy with the proposal, you perform a valuation switch to generate your postings in G/L. The system will create each the adjustment posting and a reversal posting for the subsequent period.

With Launch 4.5, you now have the ability to perform an automated flat-fee individual worth adjustment for overdue receivables.In Accounts Receivable configuration, you outline the debit fee proportion (bad debt expense share) for a valuation adjustment key and an overdue time interval in days. You could also arrange the appropriate A/R adjustment and bad debt expense accounts on the account dedication table.You assign the valuation adjustment key to the grasp record for any customer accounts that you simply wish to embrace within the flat-rate particular person valuation adjustment posting.Periodically, you course of a valuation run to calculate the bad debt expense posting for overdue items.The valuation run produces a valuation proposal, which you can manually change, if desired. When you're happy with the proposal, you perform a valuation switch to generate your postings in G/L. The system will create each the adjustment posting and a reversal posting for the subsequent period.

Related Posts

SAP Financial General Ledger Accounts

SAP Financial Customer and Vendor Accounts

SAP Financial Open Item Clearing

SAP Financial Correspondence

Exchange Rage Types

- Change fee sort: If no trade charge is entered on the doc, the system uses an alternate fee sort to learn the trade fee table. The system makes use of alternate rate kind "M" for currency translation throughout posting transactions if no trade rate has been specified in the doc type configuration. This exchange price kind must be contained within the system. Different sorts could additionally be used during valuation procedures of overseas forex transactions.

- Base Currency: If you need to perform international forex translations for loads of different currencies,specifying a base forex for an exchange price sort can simplify the upkeep of international forex translations. Instead of entering translation rates between every single foreign money, you solely need specify the translation price between every currency and the base currency. All forex translations then take place in two steps - into the base currency and from the bottom foreign money into the goal currency. For alternate price relations inside the EU, it is a legal requirement that the base forex (EUR) is the From-currency.

- Buying rate at/ Promoting price at: You could have the choice of letting financial institution shopping for and promoting rates to be calculated from common rate and spread. The unfold is the difference between common fee and financial institution shopping for charge or between average charge and bank promoting rate. For bank buying or selling fee, you enter the alternate charge type of the average charge to which the financial institution buying or promoting price corresponds.

- Inversion: If an entry is lacking for the translation of a foreign foreign money into local currency in the system, then the translation takes place by means of the entry for the interpretation of local currency into overseas forex, providing the indicator is set.

- Dring valuation, translation to financial institution selling and buying fee is finished when the typical charge is decided (during the analysis run) and the spread is added to or subtracted from this rate.

- On this table you enter spreads for every foreign currency - native foreign money relationship you must value in your system.

Valuation Methods

You presumably can outline different valuation strategies for valuing international currency.For every valuation technique, you specify as Parameters for the valuation procedure and Parameters for exchange fee determination.You need to use different charge varieties for figuring out the trade rate.See switch: Stability evaluation.Solely relevant when using strictest or lowest evaluation principle. Instance: evaluation of the open objects of customer accounts.So as to have credit objects evaluated, the change must be ”on”. In every other case, solely debit objects will be evaluated.

The above accounts show the posting transactions when valuing objects in international foreign money with out an update of the valuation distinction in the doc line item.In the interval that the valuation is carried out (as defined by the essential thing date), a posting is made to regulate the general receivables balance for the change in alternate rates. This posting is reversed in the subsequent period, to convey the balances back to the original position. A subsequent valuation or the payment clearing is then based mostly on the unique posting.The adjustment posting is normally made on the essential thing date and reversed on the key date + 1, nonetheless,the person can specify completely different posting dates if required.

Valuation

- The check box ”Balance sheet preparation valuation” of the SAPF100 program determines whether or not or not open items will be updated.

- When following the strict lowest value principle , you have to use valuation with an update.SAP recommends this only for the year-end valuation.

- For those who value a document line merchandise, the R/3 System shops the valuation distinction within the document line item. The system then uses this valuation when clearing the item during payment or for subsequent valuations.

- Change rate differences that are not realized as valuation differences in the cost settlement, are posted as an alternate rate translation (see instance above). You specify how the exchange price translation is posted for each firm code. This is related solely in sure countries.

With Launch 4.5, you now have the ability to perform an automated flat-fee individual worth adjustment for overdue receivables.In Accounts Receivable configuration, you outline the debit fee proportion (bad debt expense share) for a valuation adjustment key and an overdue time interval in days. You could also arrange the appropriate A/R adjustment and bad debt expense accounts on the account dedication table.You assign the valuation adjustment key to the grasp record for any customer accounts that you simply wish to embrace within the flat-rate particular person valuation adjustment posting.Periodically, you course of a valuation run to calculate the bad debt expense posting for overdue items.The valuation run produces a valuation proposal, which you can manually change, if desired. When you're happy with the proposal, you perform a valuation switch to generate your postings in G/L. The system will create each the adjustment posting and a reversal posting for the subsequent period.

With Launch 4.5, you now have the ability to perform an automated flat-fee individual worth adjustment for overdue receivables.In Accounts Receivable configuration, you outline the debit fee proportion (bad debt expense share) for a valuation adjustment key and an overdue time interval in days. You could also arrange the appropriate A/R adjustment and bad debt expense accounts on the account dedication table.You assign the valuation adjustment key to the grasp record for any customer accounts that you simply wish to embrace within the flat-rate particular person valuation adjustment posting.Periodically, you course of a valuation run to calculate the bad debt expense posting for overdue items.The valuation run produces a valuation proposal, which you can manually change, if desired. When you're happy with the proposal, you perform a valuation switch to generate your postings in G/L. The system will create each the adjustment posting and a reversal posting for the subsequent period.Related Posts

SAP Financial General Ledger Accounts

SAP Financial Customer and Vendor Accounts

SAP Financial Open Item Clearing

SAP Financial Correspondence

No comments :

Post a Comment