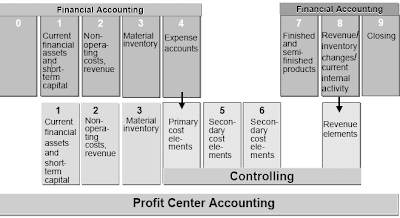

SAP Financial Profit Center Analysis has Revenue Center Accounting (EC-PCA) is a statistical accounting component. This means that it takes transaction information posted in different components and represents it from a revenue-center-oriented level of view. The postings in EC-PCA are statistical postings , for the reason that revenue heart just isn't itself an account assignment object in Controlling.The mixing of the R/3 system makes it doable to post profit-relevant knowledge to Profit Center Accounting routinely as soon because the transaction is posted. The system either transfers the related gadgets from the unique postings or creates further postings.

Profitability Management

Profitability segments are the market channels or strategic business models which are to be analyzed in CO-PA. They might be mixtures of product, customer, and sales construction information, and/or might encompass company code, business area, and revenue heart information.Since reporting margins and different profitability figures along advertising strains (as outlined by these profitability segments) is the primary purpose of CO-PA, its design has been optimized for producing profit and loss statements below the fee-of-sales accounting format and philosophy.Profit facilities are areas of accountability within an organization for revenues and expenses, as nicely as sure assets and liabilities in some cases. All revenue centers are arranged into a regular hierarchy representing your complete organization.Since reporting efficiency information alongside responsibility-oriented organizational traces (as outlined by this profit middle hierarchy) is the first goal of EC-PCA, its design has been optimized for producing profit and loss statements below the period accounting format and philosophy. Nonetheless, price-of-gross sales accounting in EC-PCA can be now doable with the help of practical areas.

Profit Center Accounting

Revenue Center Accounting takes its knowledge primarily from the Controlling utility Components. Certain parameters of the controlling space have to be in place with the intention to use the functions within Controlling and Enterprise Controlling. You'll usually set up these parameters whenever you customize one of many other applications, resembling Cost Center Accounting or Inner Orders.In EC-PCA, we customise some further parameters which apply particularly to Revenue center Accounting. These settings can't be changed as quickly as information has been posted to EC-PCA within the controlling area.Step one is to enter the name of the standard hierarchy for revenue heart grasp data. The system creates the highest node or group of the standard hierarchy routinely if you save your settings. You'll find a way to then preserve it to create the decrease level nodes required to complete your hierarchy.The dummy revenue heart, which receives all of the postings that had been made to things not assigned to a selected profit heart, is displayed here for info purposes. Both the usual hierarchy and dummy revenue middle are lined in more element within the master information discussion.When you examine the elim. of internal enterprise change, the system won't update objects of the same kind that are assigned to the identical revenue center. For instance, in the event you repost costs from one value heart to another and both are assigned to the identical revenue middle, no posting will in all probability be made in EC-PCA for this transaction, if this change is “on”.

Revenue Center Accounting supports a division of the enterprise into areas of duty for profits. You'll have the ability to divide your enterprise in response to the next features:

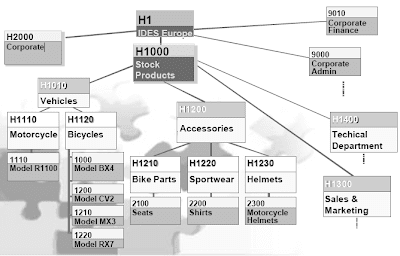

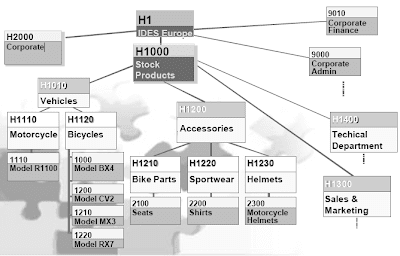

You could define a hierarchical profit middle structure earlier than you create revenue centers. This structure known as the usual hierarchy. The standard hierarchy is a tree structure for grouping all revenue facilities which belong to a controlling area. You will want to assign every profit center to a gaggle (node) of the standard hierarchy whenever you create it. This ensures that each one the profit centers of the controlling area are contained in this structure.You may preserve the usual hierarchy in Customizing or from the application menu. Customizing also offers a perform to create profit center groups by copying value middle groups. If your value center structure is much like your profit heart construction, you ought to use this function to copy the price center standard hierarchy to create your revenue heart customary hierarchy. Along with the standard hierarchy, you can define various hierarchies to be used in the information system and other functions. Various hierarchies are addressed within the revenue middle group dialogue .

Profit Center Master Data

A profit heart is assigned to a controlling area. When making a revenue middle, you enter the name of the profit heart and the period of validity. Profit heart master information is time-primarily based; therefore, you can create totally different knowledge for different durations of time.You'll give you the option to copy the master data information from an present profit center.You preserve the necessary grasp data on the basic screen, such because the revenue middle name and description, the person in charge, and the department.The Revenue heart group subject defines the task to the usual hierarchy.By selecting the lock indicator, you'll have the opportunity to lock the revenue heart in opposition to any postings, for the required time interval. If an object is assigned to a locked revenue center and you try to submit to it, the system will show an error message and doesn't put up the data.You may enter more info for the profit center on additional screens, comparable to deal with and communication data and long text about your profit center.By default, a profit heart is assigned to all firm codes assigned to the controlling area. You can deselect certain company codes for a revenue middle by choosing Firm codes. This setting can additionally be used by features in Consolidation (EC-CS) in order to create consolidation units.If your revenue middle and price middle buildings are the same, you may copy price heart master records to create new revenue facilities after which modify them as required. To accomplish this, it's important to have created nodes on the revenue center commonplace hierarchy that are identical to the nodes on the associated fee heart normal hierarchy. You can't use this function to overwrite current profit centers.

Dummy Profit Center

In apply you might inadvertently forget to assign a specific object to a revenue center. If prices or gross sales are posted to this object, the corresponding knowledge is posted to the dummy profit center in Revenue Middle Accounting. This ensures that reconciliation between EC-PCA and Financial Accounting is nonetheless potential in such instances. You can even uncover lacking assignments by analyzing the postings to the dummy profit center.Revenue Center Accounting lets you allocate the info from the dummy profit center to common profit centers. Nevertheless, the dummy profit heart shouldn't be meant to be used as an “allocation revenue middle”.It is best to define separate allocation revenue facilities for this. A special transaction is offered in Customizing for creating the dummy revenue center. Creating the dummy revenue center has only a few differences from normal profit heart creation:

By assigning all the objects which incur prices or revenues in your system to revenue facilities, you determine how your organization is to be divided into profit centers. These assignments additionally make it attainable to show selected stability sheet items. All related account project objects are assigned to the respective profit facilities utilizing Customizing functions.These assignments mean that it is not necessary to put up information explicitly to profit centers every time.Instead, it's posted robotically in Revenue Center Accounting when it's posted to the unique object.Typically, revenue and items input are transferred to Profit Center Accounting primarily based on the project of sales order items, direct costs based mostly on the task of production orders and value objects, and overhead costs based mostly on the task of the account project objects in Overhead Administration (value centers, inner orders, and so on).

Assignment of Control Objects

You assign Overhead Value Controlling objects (value centers, internal orders, initiatives, enterprise processes) to revenue centers with a function to observe the move of overhead costs from Financial Accounting and their allocation by means of inner accounting from a revenue middle level of view.While you assign a controlling object to a profit middle, the system makes certain that the controlling area is the same for the item and the profit center.Cost centers and Exercise-Based mostly Costing (ABC) enterprise processes are assigned to a revenue middle within the grasp record Fundamental Data.The validity interval of the revenue center must utterly contain that of the price middle or enterprise process.Additionally, the assignment of a price middle or inside order to a profit middle implicitly additionally assigns all property assigned to this price heart or internal order to the profit middle as well.You hyperlink internal orders to a profit center in the order grasp information Assignments. Upkeep orders of the module Plant Upkeep are assigned to a profit heart the same method as inner orders.Cost objects are used in Product Value Accounting to collect and retailer prices which can't be assigned to objects on a decrease degree (orders, tasks or cost centers). Nevertheless, in sure circumstances, chances are you'll have to assign a price object to a revenue center. This assignment is identical as the profit center to cost heart assignment.

In distinction to other project objects, profitability segments wouldn't have master records. A profitability phase is a mixture of characteristics, equivalent to a buyer, product, plant, distribution channel, and so on. One among these characteristics is always the revenue center.

Assignment Through Substitution

Defaulting the revenue heart in a sales order item from the fabric master plant information assumes a product-oriented division of profit centers (primarily based on the fabric), a geographical division (primarily based on the plant), or a mixture of both.Should you wish to construction your organization from a gross sales-oriented relatively than a manufacturing-oriented view,it's additionally attainable to determine a profit center from the accessible fields within the sales order header or item with the assistance of substitution rules.The following is a partial listing of the fields from the sales order and associated info which might be used to derive the profit middle project:

Monitoring Assignment

The task monitor provides you with an summary of all of the assignments you've gotten made to

revenue facilities and helps you whenever you make or change assignments. For example, you'll have the option to call up a listing of cost centers which have not been assigned to a revenue middle or those value facilities that are assigned to a specific profit heart or profit middle group. Once you show the listing online, you'll have the opportunity to leap from there on to the transaction for changing the object. That way you can even make any missing assignments or correct any incorrect ones.The menu Material additionally accommodates the option Quick project, which helps you to assign numerous materials to a revenue middle quickly.The menu Orders permits you to analyze the next sorts of order: inside orders (CO), imputed cost orders (CO), CO manufacturing orders, PPS manufacturing orders, process orders, community headers and upkeep orders.The menu Price objects accommodates the final cost objects as nicely as the cost objects for course of manufacturing.Incorrect assignments lead to incorrect transaction data in Revenue Heart Accounting, which often can only be corrected with great difficulty. You must therefore test your assignments very carefully.

Balance Sheet Items

The following stability sheet gadgets may be transferred online in real time:

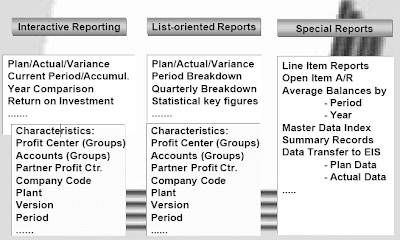

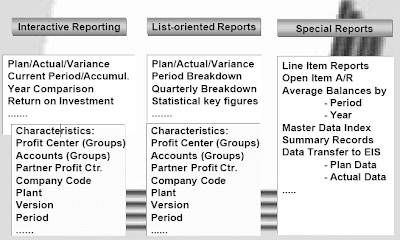

Standard Reports

The standard experiences and report teams are found within the libraries 8A2, 8A3 and 8A4. They'll roughly be divided into the following teams:The area profitability reports show the profits for the chosen revenue middle(s). These are usually not broken down into revenue and costs elements. Typical stories of this sort are the plan/precise comparisons, a period breakdown or profit heart return on Investment . These reviews are supposed to give the person a fast overview and function a springboard to the opposite report types.The group stories show the profits of a revenue heart group broken down according to the chosen revenue and value elements. These reports are meant to present the individuals in command of profit facilities with a more detailed analysis of their space of responsibility. These stories additionally let you use the

perform Variation.In addition, some of the stories additionally display chosen stability sheet items (fastened belongings, present belongings, payables) and the return on funding calculated from that, broken down according to the selected revenue and price elements.The revenue heart reviews comprise the individual profit centers broken down and summarized according to a profit heart group.One other kind of report is the plan/actual according to accounts experiences for Profit Heart Accounting. These stories contain the postings for every account broken down by revenue center.Alternative report currency experiences contain a number of the above reports which you'll execute in any currency.

Related Posts

Work flow for MM PART 6

Work flow for MM PART 7

Work flow for MM PART 8

Work flow for MM PART 9

Work flow for MM PART 10

Work flow for MM PART 11

Profitability Management

Profitability segments are the market channels or strategic business models which are to be analyzed in CO-PA. They might be mixtures of product, customer, and sales construction information, and/or might encompass company code, business area, and revenue heart information.Since reporting margins and different profitability figures along advertising strains (as outlined by these profitability segments) is the primary purpose of CO-PA, its design has been optimized for producing profit and loss statements below the fee-of-sales accounting format and philosophy.Profit facilities are areas of accountability within an organization for revenues and expenses, as nicely as sure assets and liabilities in some cases. All revenue centers are arranged into a regular hierarchy representing your complete organization.Since reporting efficiency information alongside responsibility-oriented organizational traces (as outlined by this profit middle hierarchy) is the first goal of EC-PCA, its design has been optimized for producing profit and loss statements below the period accounting format and philosophy. Nonetheless, price-of-gross sales accounting in EC-PCA can be now doable with the help of practical areas.

Profit Center Accounting

Revenue Center Accounting takes its knowledge primarily from the Controlling utility Components. Certain parameters of the controlling space have to be in place with the intention to use the functions within Controlling and Enterprise Controlling. You'll usually set up these parameters whenever you customize one of many other applications, resembling Cost Center Accounting or Inner Orders.In EC-PCA, we customise some further parameters which apply particularly to Revenue center Accounting. These settings can't be changed as quickly as information has been posted to EC-PCA within the controlling area.Step one is to enter the name of the standard hierarchy for revenue heart grasp data. The system creates the highest node or group of the standard hierarchy routinely if you save your settings. You'll find a way to then preserve it to create the decrease level nodes required to complete your hierarchy.The dummy revenue heart, which receives all of the postings that had been made to things not assigned to a selected profit heart, is displayed here for info purposes. Both the usual hierarchy and dummy revenue middle are lined in more element within the master information discussion.When you examine the elim. of internal enterprise change, the system won't update objects of the same kind that are assigned to the identical revenue center. For instance, in the event you repost costs from one value heart to another and both are assigned to the identical revenue middle, no posting will in all probability be made in EC-PCA for this transaction, if this change is “on”.

Revenue Center Accounting supports a division of the enterprise into areas of duty for profits. You'll have the ability to divide your enterprise in response to the next features:

- geographical division of revenue centers (locations, regions,and so forth)

- product-related division of profit centers (divisions, product traces, and so on)

- practical division of profit facilities (manufacturing, gross sales and distribution, analysis, and so forth)

You could define a hierarchical profit middle structure earlier than you create revenue centers. This structure known as the usual hierarchy. The standard hierarchy is a tree structure for grouping all revenue facilities which belong to a controlling area. You will want to assign every profit center to a gaggle (node) of the standard hierarchy whenever you create it. This ensures that each one the profit centers of the controlling area are contained in this structure.You may preserve the usual hierarchy in Customizing or from the application menu. Customizing also offers a perform to create profit center groups by copying value middle groups. If your value center structure is much like your profit heart construction, you ought to use this function to copy the price center standard hierarchy to create your revenue heart customary hierarchy. Along with the standard hierarchy, you can define various hierarchies to be used in the information system and other functions. Various hierarchies are addressed within the revenue middle group dialogue .

Profit Center Master Data

A profit heart is assigned to a controlling area. When making a revenue middle, you enter the name of the profit heart and the period of validity. Profit heart master information is time-primarily based; therefore, you can create totally different knowledge for different durations of time.You'll give you the option to copy the master data information from an present profit center.You preserve the necessary grasp data on the basic screen, such because the revenue middle name and description, the person in charge, and the department.The Revenue heart group subject defines the task to the usual hierarchy.By selecting the lock indicator, you'll have the opportunity to lock the revenue heart in opposition to any postings, for the required time interval. If an object is assigned to a locked revenue center and you try to submit to it, the system will show an error message and doesn't put up the data.You may enter more info for the profit center on additional screens, comparable to deal with and communication data and long text about your profit center.By default, a profit heart is assigned to all firm codes assigned to the controlling area. You can deselect certain company codes for a revenue middle by choosing Firm codes. This setting can additionally be used by features in Consolidation (EC-CS) in order to create consolidation units.If your revenue middle and price middle buildings are the same, you may copy price heart master records to create new revenue facilities after which modify them as required. To accomplish this, it's important to have created nodes on the revenue center commonplace hierarchy that are identical to the nodes on the associated fee heart normal hierarchy. You can't use this function to overwrite current profit centers.

Dummy Profit Center

In apply you might inadvertently forget to assign a specific object to a revenue center. If prices or gross sales are posted to this object, the corresponding knowledge is posted to the dummy profit center in Revenue Middle Accounting. This ensures that reconciliation between EC-PCA and Financial Accounting is nonetheless potential in such instances. You can even uncover lacking assignments by analyzing the postings to the dummy profit center.Revenue Center Accounting lets you allocate the info from the dummy profit center to common profit centers. Nevertheless, the dummy profit heart shouldn't be meant to be used as an “allocation revenue middle”.It is best to define separate allocation revenue facilities for this. A special transaction is offered in Customizing for creating the dummy revenue center. Creating the dummy revenue center has only a few differences from normal profit heart creation:

- You don't specify a validity period. It is mechanically legitimate for the maximum validity period.

- You cannot copy the dummy revenue heart from an current profit center.

- A swap figuring out it because the dummy revenue center is automatically set.

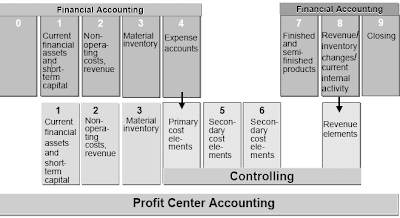

- These from Financial Accounting which are used in Controlling (income and first cost parts)

- Accounts which happen only in Controlling (revenue and secondary value components)

- Accounts from FI which are not used in Controlling (payables/receivables, material shares, work in course of, and so forth)

By assigning all the objects which incur prices or revenues in your system to revenue facilities, you determine how your organization is to be divided into profit centers. These assignments additionally make it attainable to show selected stability sheet items. All related account project objects are assigned to the respective profit facilities utilizing Customizing functions.These assignments mean that it is not necessary to put up information explicitly to profit centers every time.Instead, it's posted robotically in Revenue Center Accounting when it's posted to the unique object.Typically, revenue and items input are transferred to Profit Center Accounting primarily based on the project of sales order items, direct costs based mostly on the task of production orders and value objects, and overhead costs based mostly on the task of the account project objects in Overhead Administration (value centers, inner orders, and so on).

Assignment of Control Objects

You assign Overhead Value Controlling objects (value centers, internal orders, initiatives, enterprise processes) to revenue centers with a function to observe the move of overhead costs from Financial Accounting and their allocation by means of inner accounting from a revenue middle level of view.While you assign a controlling object to a profit middle, the system makes certain that the controlling area is the same for the item and the profit center.Cost centers and Exercise-Based mostly Costing (ABC) enterprise processes are assigned to a revenue middle within the grasp record Fundamental Data.The validity interval of the revenue center must utterly contain that of the price middle or enterprise process.Additionally, the assignment of a price middle or inside order to a profit middle implicitly additionally assigns all property assigned to this price heart or internal order to the profit middle as well.You hyperlink internal orders to a profit center in the order grasp information Assignments. Upkeep orders of the module Plant Upkeep are assigned to a profit heart the same method as inner orders.Cost objects are used in Product Value Accounting to collect and retailer prices which can't be assigned to objects on a decrease degree (orders, tasks or cost centers). Nevertheless, in sure circumstances, chances are you'll have to assign a price object to a revenue center. This assignment is identical as the profit center to cost heart assignment.

In distinction to other project objects, profitability segments wouldn't have master records. A profitability phase is a mixture of characteristics, equivalent to a buyer, product, plant, distribution channel, and so on. One among these characteristics is always the revenue center.

Assignment Through Substitution

Defaulting the revenue heart in a sales order item from the fabric master plant information assumes a product-oriented division of profit centers (primarily based on the fabric), a geographical division (primarily based on the plant), or a mixture of both.Should you wish to construction your organization from a gross sales-oriented relatively than a manufacturing-oriented view,it's additionally attainable to determine a profit center from the accessible fields within the sales order header or item with the assistance of substitution rules.The following is a partial listing of the fields from the sales order and associated info which might be used to derive the profit middle project:

- Gross sales group

- Gross sales office

- Gross sales district

- Distribution channel

- Business space

- Customer

- Customer group

- Storage location

Monitoring Assignment

The task monitor provides you with an summary of all of the assignments you've gotten made to

revenue facilities and helps you whenever you make or change assignments. For example, you'll have the option to call up a listing of cost centers which have not been assigned to a revenue middle or those value facilities that are assigned to a specific profit heart or profit middle group. Once you show the listing online, you'll have the opportunity to leap from there on to the transaction for changing the object. That way you can even make any missing assignments or correct any incorrect ones.The menu Material additionally accommodates the option Quick project, which helps you to assign numerous materials to a revenue middle quickly.The menu Orders permits you to analyze the next sorts of order: inside orders (CO), imputed cost orders (CO), CO manufacturing orders, PPS manufacturing orders, process orders, community headers and upkeep orders.The menu Price objects accommodates the final cost objects as nicely as the cost objects for course of manufacturing.Incorrect assignments lead to incorrect transaction data in Revenue Heart Accounting, which often can only be corrected with great difficulty. You must therefore test your assignments very carefully.

Balance Sheet Items

The following stability sheet gadgets may be transferred online in real time:

- material shares

- assets

- work in process

Standard Reports

The standard experiences and report teams are found within the libraries 8A2, 8A3 and 8A4. They'll roughly be divided into the following teams:The area profitability reports show the profits for the chosen revenue middle(s). These are usually not broken down into revenue and costs elements. Typical stories of this sort are the plan/precise comparisons, a period breakdown or profit heart return on Investment . These reviews are supposed to give the person a fast overview and function a springboard to the opposite report types.The group stories show the profits of a revenue heart group broken down according to the chosen revenue and value elements. These reports are meant to present the individuals in command of profit facilities with a more detailed analysis of their space of responsibility. These stories additionally let you use the

perform Variation.In addition, some of the stories additionally display chosen stability sheet items (fastened belongings, present belongings, payables) and the return on funding calculated from that, broken down according to the selected revenue and price elements.The revenue heart reviews comprise the individual profit centers broken down and summarized according to a profit heart group.One other kind of report is the plan/actual according to accounts experiences for Profit Heart Accounting. These stories contain the postings for every account broken down by revenue center.Alternative report currency experiences contain a number of the above reports which you'll execute in any currency.

Related Posts

Work flow for MM PART 6

Work flow for MM PART 7

Work flow for MM PART 8

Work flow for MM PART 9

Work flow for MM PART 10

Work flow for MM PART 11

No comments :

Post a Comment