SAP Financial Open Item Clearing has open objects are incomplete transactions, reminiscent of a vendor invoice which has not been paid.In order for an open item transaction to be considered full, the transaction must have been cleared. A transaction is considered cleared when an offset value is posted to an merchandise or group of gadgets, in order that the ensuing steadiness of the objects is zero.Paperwork with open gadgets can't be archived and stay in the system till all open objects are cleared.

An example of posting with clearing :

Utilizing the “posting with clearing” function, enter the doc line items after which select the open items that are to be cleared.If the total quantity of selected open objects equals the amount of entered line objects, the system clears the open items by creating one or more offsetting entries.If the full amount of chosen open items doesn't equal the amount of entered line items, the system permits you to put up the differences.“Posting with clearing” can be finished for several accounts, account varieties and for any Forex simultaneously.The “posting with clearing” transaction could additionally be performed manually or automatically by using the automated cost program.

Account Clearing

Using the “account clearing” perform, choose and match these existing open items from an account that stability to zero. The system marks them as cleared and creates a clearing document. The clearing doc quantity and the clearing date is entered within the cleared open items. The clearing date will be the current date or a date that the person determines.The ”account clearing” function will work for any open item managed account in G/L, A/R and A/P. It's generally used with financial institution sub-accounts and clearing accounts. With this transaction you'll have the ability to solely clear objects from one account.Since more often than not postings should not have to be made throughout account clearing, the clearing document often contains no line items. Nonetheless, if line items from totally different business areas are a part of the clearing process, the system could require clearing entries to steadiness the business areas.The account clearing transaction could also be carried out manually or mechanically by utilizing the automated clearing program.

Automatic Clearing Program

The user can clear open items for A/R, A/P and G/L accounts with the automatic clearing program.The program groups gadgets collectively from an account which have the same:

Manual Payment Process

Manual Payment Process

A “handbook fee” is a transaction that clears an open merchandise, usually an invoice, by manually allocating an offsetting quantity to the open item.An “incoming fee”, typically utilized in Accounts Receivable, clears an open debit amount.An “outgoing fee”, usually utilized in Accounts Payable , clears an open credit score amount.A manual cost is processed in three steps:

The information entered within the document header is similar to the info entered when posting invoices. There are 3 sections to the doc header: the payment header, the financial institution information and open item selection.Enter the following info in the cost header section of the doc header:

Document Header Bank Data

Enter the next financial institution knowledge into the subsequent section of the doc header:

Enter the next “open item selection” information in the next section of the doc header:

. Account and account kind On this part, “account” refers to the business associate’s account quantity and their account type. K refers to distributors and D refers to customers. The account and account type are required to decide the account wherein the open items reside. You might as well enter a work checklist in the account subject to course of the open items from a gaggle of accounts.

The subsequent display lists the entire unmatched, open objects . These might be payments, debit or credit score memos or invoices. Depending on your settings, the entire gadgets may be selected or deselected when you initially get to this screen.Step one in processing open objects is to activate the required line objects to allocate a payment.The amount entered is allotted to the appropriate line item in proportion to the item quantity and discount.The activation or deactivation of a line item could also be achieved in a quantity of methods:

Post the payment

The final step is to do a final verify of the document entered.By choosing the overview possibility, the road objects entered may be reviewed before posting.By selecting doc, simulate , all line objects, including any routinely generated, can additionally be reviewed.If the debits do not equal the credit or a mistake has occurred throughout entry, the error could be corrected by finishing up one of many following options as changing, deleting or coming into a line merchandise

. selecting additional open gadgets and editing selected open gadgets.

If the debits and credits stability, the completed doc could additionally be posted.If the doc is later determined to be in error and needs to be corrected, reset the cleared items first after which reverse the document. The unique posting must be re-entered correctly.If crucial, the system performs automatic postings when clearing open items . The configuration of most of these computerized postings is covered in other units.Financial institution fees could additionally be entered when entering the financial institution item and are routinely posted to an assigned G/L-account.To perform handbook cross-firm code payments, a clearing process (both ”incoming payments” or “outgoing payments”) has to be assigned to the combination of the clearing company code and the corporate code which needs to be cleared. After performing these task, gadgets from each company codes will most likely be displayed when selecting open items.The dealing with of over- and underpayments is roofed within the topic “Cost Differences”.

Customers can cancel clearing transactions for individual documents. When the person reset cleared objects,the clearing knowledge is faraway from the road items.The changes are logged and might be displayed in changed documents. In A/R, the fee historical past and the credit limit can be corrected, if applicable.

Payment Difference

A payment distinction usually occurs in the course of the clearing of an open item. The difference is then in comparison with tolerance limits of the employee and the client/vendor and is handled accordingly inside tolerances posted automatically as both money low cost adjustment or unauthorized deduction and outdoors tolerances have to be processed manually.If the payment difference is immaterial, it could be processed robotically by permitting the system to adjust the money low cost or to charge it off to a particular account. The bounds to which a cost distinction is considered to be immaterial are outlined in tolerance groups.If the cost distinction is simply too excessive to be immaterial, the cost must be processed manually.The cost could additionally be posted as;

Reason Codes

Purpose Codes are used to explain the reason for fee differences. To assign more than one motive code to a cost difference, click on on “distribute difference”.Purpose codes will be assigned to:

When clearing open objects in a international forex, realized differences may occur resulting from fluctuations in change rates.This fluctuation causes trade price differences that the system routinely posts as realized good points or losses.The system mechanically posts to the Revenue/Expense accounts defined for trade fee variations in configuration, thus eliminating the potential of incorrect entries.The realized distinction is saved in the cleared line item.Exchange rate variations are also posted when open objects are valuated for the balance sheet. These alternate fee variations from valuation are posted to a different change fee difference account and to a stability sheet adjustment account. When clearing an open item that has already been valuated,the system reverses the stability sheet correction account and posts the remaining exchange charge difference to the account for realized change charge differences.

Related Posts

System Functions and user Profiles in SAP Financials

SAP Financial Check Deposit Customizing

SAP Financial Customer Vendor Accounts

EnjoySAP Financial Invoice

EntrySAP Financial Automatic Payments

An example of posting with clearing :

- An bill posted to a customer's account.This invoice is thought to be an open merchandise as a consequence of at this point it is unpaid.

- The customer pays the invoice and the cost is allotted to it.

- The bill is cleared with the cost and the resulting balance is zero.

- An instance of account clearing:

- Manually clearing an open bill with a associated credit memo and cost on account.

- A clearing transaction at all times creates a clearing document.

Utilizing the “posting with clearing” function, enter the doc line items after which select the open items that are to be cleared.If the total quantity of selected open objects equals the amount of entered line objects, the system clears the open items by creating one or more offsetting entries.If the full amount of chosen open items doesn't equal the amount of entered line items, the system permits you to put up the differences.“Posting with clearing” can be finished for several accounts, account varieties and for any Forex simultaneously.The “posting with clearing” transaction could additionally be performed manually or automatically by using the automated cost program.

Account Clearing

Using the “account clearing” perform, choose and match these existing open items from an account that stability to zero. The system marks them as cleared and creates a clearing document. The clearing doc quantity and the clearing date is entered within the cleared open items. The clearing date will be the current date or a date that the person determines.The ”account clearing” function will work for any open item managed account in G/L, A/R and A/P. It's generally used with financial institution sub-accounts and clearing accounts. With this transaction you'll have the ability to solely clear objects from one account.Since more often than not postings should not have to be made throughout account clearing, the clearing document often contains no line items. Nonetheless, if line items from totally different business areas are a part of the clearing process, the system could require clearing entries to steadiness the business areas.The account clearing transaction could also be carried out manually or mechanically by utilizing the automated clearing program.

Automatic Clearing Program

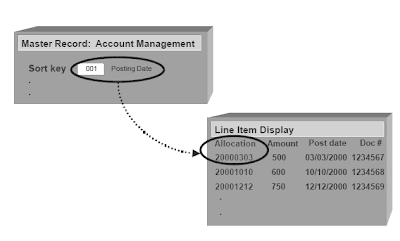

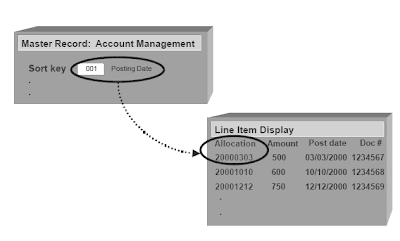

The user can clear open items for A/R, A/P and G/L accounts with the automatic clearing program.The program groups gadgets collectively from an account which have the same:

- reconciliation account quantity,

- Forex,

- special G/L indicator, and

- 5 freely outlined criteria from document header or merchandise i.e. allocation discipline, reference number,etc.

- famous gadgets

- statistical postings and certain particular G/L transactions (down payments and payments of trade)

- objects with withholding tax entries.

- reconciliation account number,

- foreign money,

- particular G/L indicator, and

- five freely outlined standards from doc header or merchandise i.e. allocation area, reference quantity, etc.

- famous gadgets

- statistical postings and certain particular G/L transactions (down funds and bills of trade)

- gadgets with withholding tax entries.

Manual Payment Process

Manual Payment ProcessA “handbook fee” is a transaction that clears an open merchandise, usually an invoice, by manually allocating an offsetting quantity to the open item.An “incoming fee”, typically utilized in Accounts Receivable, clears an open debit amount.An “outgoing fee”, usually utilized in Accounts Payable , clears an open credit score amount.A manual cost is processed in three steps:

- Doc header information is filled out.

- Open items are selected to be cleared.

- The transaction is saved.

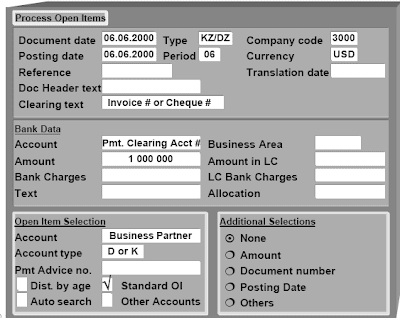

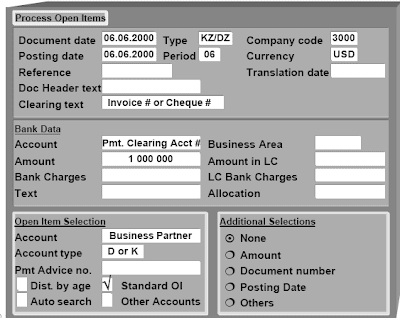

The information entered within the document header is similar to the info entered when posting invoices. There are 3 sections to the doc header: the payment header, the financial institution information and open item selection.Enter the following info in the cost header section of the doc header:

- The document date is entered. That is the date on the physical document.

- The doc kind is defaulted by the system (see “Posting Management - Default Values”). KZ is a vendor fee; DZ is a buyer payment.

- The company code is entered or defaulted by parameter default (see “Posting Control - Default Values”).

- The interval particulars are the posting date and the posting period. The present date is defaulted because the posting date and the posting interval is determined from the posting date.

- The currency particulars are the currency code , alternate price and the translation date . If no change rate or translation date is entered, the alternate fee from the change fee desk on the posting date is used.

- Any references wanted to identify the incoming cost may be entered within the reference doc number, document header text, and clearing text.

Document Header Bank Data

Enter the next financial institution knowledge into the subsequent section of the doc header:

- The account is a normal ledger account quantity used for incoming fee or outgoing payment clearing and have to be entered.

- The payment amount is the entire value of the payment being processed.

- The bank may cost bank charges for their services which are automatically posted to a particular expense account. In incoming payments, the system adds the bank prices to the cost quantity to kind the clearing amount. In outgoing funds, it subtracts the financial institution costs from the cost amount to kind the clearing amount. This fashion, the payer all the time has to pay the bank charges.

- The worth date is the date used to evaluate the cash administration position within the Cash Management module. It might be defaulted by the system (see “Posting Management - Default Values”).

- The text is any narrative required for this line item and is optionally entered. Start the road with ”*” to make it an exterior textual content which may be printed on correspondences. The consumer also can select an entry from a list of standard texts.

- The allocation quantity is both created by the system or may be entered manually.

Enter the next “open item selection” information in the next section of the doc header:

. Account and account kind On this part, “account” refers to the business associate’s account quantity and their account type. K refers to distributors and D refers to customers. The account and account type are required to decide the account wherein the open items reside. You might as well enter a work checklist in the account subject to course of the open items from a gaggle of accounts.

- Commonplace open items and/or Special G/L transactions Standard open items and/or special G/L transaction open items could also be selected for processing.

- Payment recommendation word quantity:The fee advice word variety of an entered cost recommendation could additionally be used to decide out the open objects required for processing.

- Different accounts:Other accounts from inside FI could also be selected for simultaneous processing of open items.

- Additional selection:Additional choices, defined in customizing, could additionally be used to pick the open gadgets required for processing. ”Distribute by age” or ”Automatic search” may be used to speed up the selection process.

The subsequent display lists the entire unmatched, open objects . These might be payments, debit or credit score memos or invoices. Depending on your settings, the entire gadgets may be selected or deselected when you initially get to this screen.Step one in processing open objects is to activate the required line objects to allocate a payment.The amount entered is allotted to the appropriate line item in proportion to the item quantity and discount.The activation or deactivation of a line item could also be achieved in a quantity of methods:

- Modifying options for open objects: Set flag to selected gadgets initially inactive.

- Mouse clicking: Double click on the mouse on the quantity of the required item.

- Pull-down Menus and function keys: Select items and use pull-down menus or perform keys to perform performance required.

Post the payment

The final step is to do a final verify of the document entered.By choosing the overview possibility, the road objects entered may be reviewed before posting.By selecting doc, simulate , all line objects, including any routinely generated, can additionally be reviewed.If the debits do not equal the credit or a mistake has occurred throughout entry, the error could be corrected by finishing up one of many following options as changing, deleting or coming into a line merchandise

. selecting additional open gadgets and editing selected open gadgets.

If the debits and credits stability, the completed doc could additionally be posted.If the doc is later determined to be in error and needs to be corrected, reset the cleared items first after which reverse the document. The unique posting must be re-entered correctly.If crucial, the system performs automatic postings when clearing open items . The configuration of most of these computerized postings is covered in other units.Financial institution fees could additionally be entered when entering the financial institution item and are routinely posted to an assigned G/L-account.To perform handbook cross-firm code payments, a clearing process (both ”incoming payments” or “outgoing payments”) has to be assigned to the combination of the clearing company code and the corporate code which needs to be cleared. After performing these task, gadgets from each company codes will most likely be displayed when selecting open items.The dealing with of over- and underpayments is roofed within the topic “Cost Differences”.

Customers can cancel clearing transactions for individual documents. When the person reset cleared objects,the clearing knowledge is faraway from the road items.The changes are logged and might be displayed in changed documents. In A/R, the fee historical past and the credit limit can be corrected, if applicable.

Payment Difference

A payment distinction usually occurs in the course of the clearing of an open item. The difference is then in comparison with tolerance limits of the employee and the client/vendor and is handled accordingly inside tolerances posted automatically as both money low cost adjustment or unauthorized deduction and outdoors tolerances have to be processed manually.If the payment difference is immaterial, it could be processed robotically by permitting the system to adjust the money low cost or to charge it off to a particular account. The bounds to which a cost distinction is considered to be immaterial are outlined in tolerance groups.If the cost distinction is simply too excessive to be immaterial, the cost must be processed manually.The cost could additionally be posted as;

- a partial payment,

- the fee difference could also be posted as a residual item,

- the fee difference could also be posted to an account assigned by a purpose code,

- or the cost distinction could additionally be charged off by getting into a new line item.

- Post the cost as a partial fee where all documents stay as open gadgets on the account.

- Post the payment difference as a residual merchandise the place solely the model new residual item is left on the account, clearing the unique doc and the payment. A new doc number is created referencing the original documents.

- Post the cost distinction as a difference posting to a different account utilizing reason codes with computerized account assignment.

- cost of the distinction (handbook account project)

- whether or not the payment term of the residual fee shall be equal to the cost term of the cleared merchandise or whether or not it's a mounted value

- whether the money low cost shall be granted just for the payment and not for the entire amount by using a dunning key whether the residual merchandise shall have a most dunning level or shall be printed separately.

Reason Codes

Purpose Codes are used to explain the reason for fee differences. To assign more than one motive code to a cost difference, click on on “distribute difference”.Purpose codes will be assigned to:

- distinction postings

- partial funds

- residual gadgets

- Control of the sort of cost discover which is sent to the customer.

- Management the account the place a residual merchandise is posted.

- Computerized posting of a residual item to a specified G/L account.

- Exclusion of residual gadgets from credit score limit checks because they're disputed.

When clearing open objects in a international forex, realized differences may occur resulting from fluctuations in change rates.This fluctuation causes trade price differences that the system routinely posts as realized good points or losses.The system mechanically posts to the Revenue/Expense accounts defined for trade fee variations in configuration, thus eliminating the potential of incorrect entries.The realized distinction is saved in the cleared line item.Exchange rate variations are also posted when open objects are valuated for the balance sheet. These alternate fee variations from valuation are posted to a different change fee difference account and to a stability sheet adjustment account. When clearing an open item that has already been valuated,the system reverses the stability sheet correction account and posts the remaining exchange charge difference to the account for realized change charge differences.

Related Posts

System Functions and user Profiles in SAP Financials

SAP Financial Check Deposit Customizing

SAP Financial Customer Vendor Accounts

EnjoySAP Financial Invoice

EntrySAP Financial Automatic Payments

No comments :

Post a Comment