The first step is to define posting rules (inner transactions). The posting rules represent posting transactions typical of the examine deposit. Assigning a posting rule to a transaction used within the application makes it doable to update the transaction for the verify deposit too. You'll have the opportunity to define the transaction title as you want. You want to specify the transaction title within the "Transaction" area within the check deposit element screen.Transaction value date: title of the rule for figuring out the worth date from the posting date (instance: posting date + 2 days) You define the rule with the bank terms.Account determination is effected using the posting rules. The system uses the interior transaction to decide the knowledge crucial for posting (posting keys, accounts, document kind).Financial institution assertion objects chosen for clearing but not yet cleared can now be posted to an account. This might be a bonus if the customer for the unique clearing has been recognized and the fee can be posted to the shopper ledger for later clearance. In addition, bank clearing accounts might be accessed within the system for the account posting.

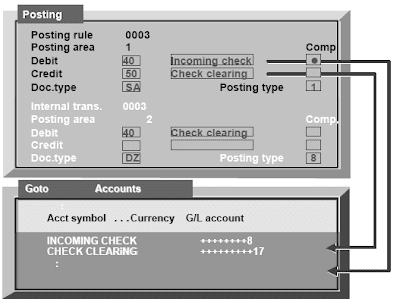

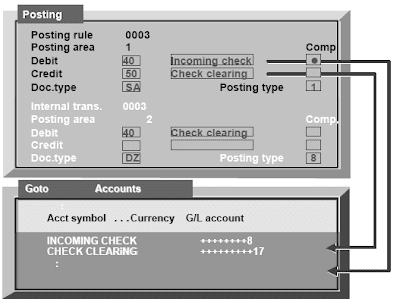

Relying on whether or not a posting transaction impacts common ledger accounting only or both G/L and sub ledger account, you enter posting rules for one or two posting areas. The system uses the posting area to determine whether or not it should submit the objects to the overall ledger or sub ledger .

The posting type controls the data update.It determines the posting rule (examples: G/L posting, subledger posting, with or with out clearing).The G/L accounts are discovered utilizing the account symbols (example: INCOMING CHECK). Partially masked entries seek advice from the clearing account that belongs to the G/L account. The system uses the entry in the "Currency" field to ship checks in overseas foreign money to the required international forex account.Choose the compression indicator to have the system publish the checks as a total reasonably than individually.

A posting key or account remains to be free in posting area (sub ledger accounting). The information required here for the clearing postings is taken from the examine data (drawer, document quantity, and so on).

Creating Screen Variants

You'll give you the option to create your own account assignment variants for the examine deposit, thereby tailoring the arrangement and/or selection of account task fields to your particular requirements. The normal we ship incorporates one variant which you can't change.If you do not need to work with the usual variant, you can change it off. In case you create any new variants of your individual, you could activate them.The fields required for checks entry are selected in the order you need them displayed on the screen.To do that, place the cursor on a possible subject, and double click on the sector or select it utilizing the menu option.

Bank statements Manual Entry

The account task process for the bank assertion is the same as that for the verify deposit.The manual financial institution statement is a fast entry tool that subtantially reduces the handbook work concerned in processing bank statements. You enter solely the bank statement items, not the posting records.The system then mechanically makes the postings to the bank account, bank clearing account, and customer account, together with the cost clearing. You have got two choices right here as rapid posting and create a batch input session, then run it.

Post processing differs, in line with which of these options you choose.The manual financial institution assertion is written, but not posted, after the checks are saved within the database. You could make changes relating to the statement whereas it has this status. Once the posting process has been initiated, no further adjustments are possible.

Entering Bank Statement

Right here, you stipulate the account task variant. This is the start variant and determines which

fields are displayed if you end up actually getting into financial institution statements. You may change the account task variant at any time throughout processing.The beginning variant specifies the account assignment variant for the person postings. You should utilize customizing to create entry screens (variants) of your own.If you choose internal bank determination, the system identifies the financial institution utilizing the inner title instead of the financial institution number and external account number. You must use either, in accordance to what is ordinary in your company.The matchcode IDs D and K and the contents of the shopper and vendor matchcode fields on the subsequent display screen make up the matchcode of the customer/vendor account the system searches for (account dedication for payment settlement). The additional processing type determines whether the postings within the batch input session are made online or within the background.

Transaction worth date: The worth date from the bank assertion is copied into the posting if you occur to choose this.

Processing Bank Statement

Home bank or checking account ID: For internal bank dedication, enter the home bank ID and the account ID. For exterior bank dedication, enter the financial institution nubmer and external account number.

You employ the transaction to regulate whic h type of bank posting you're processing, for instance, credit score memo, wire transfer or examine payment.Individual paperwork are selected in subledger accounting by using certain criteria (such as the document quantity) or by utilizing the matchcode (account determination) and extra info (document determination) akin to the quantity, allocation, posting date or document date. Which selection fieldl are queried depends upon the account task variant and the interpretation variant.You may select memo information regarding the bank assertion in the inital display via various characteristics. These are then defaulted in the element screens for coming into transactions. Selected memo records that do not agree with the bank account statements may be delated as a part of entry screen processing.

In case you accidentally entered incorrect beginning and finish balances, you may right them in the entry screen.Financial institution statements you enter can be displayed, changed, or deleted earlier than posting.

Post Bank Statement

You possibly can either publish bank statements separately or submit all the financial institution statements entered in the current work session together.The "Submit" possibility generates the batch input classes required for the bank account postings and sub ledger account postings, or posts them immediately.The examine by bank statement quantity ensures that postings can't be made twice.The system generates a posting log, exhibiting the batch session name if appropriate.

Display Overview

You can use the overview to realize a perspective over all your bank statements. The processing standing shows the stage bank assertion posting has reached. For the next day, choose New Statement.

Posting Rules

Step one is to outline posting rules (inner transactions). The posting rules represent posting transactions typical of the bank statement.Assigning a posting rule to a transaction used within the software makes it possible to replace the transaction for the bank assertion too. You may define the transaction title as you want. You will want to specify the transaction title in the "Transaction" discipline in the bank assertion element screen.Account willpower is effected using the posting rules. The system uses the internal transaction to decide the information vital for posting (posting keys, accounts, document kind).You must use account modifications to have postings sent to accounts aside from the usual account assignment.The interpretation algorithm determines which fields are evaluated for the clearing transaction or doc determination.

Posting Details

The interior transactions are used to search out the posting rules and crucial information (posting keys, accounts, and so on).The system makes use of the posting area to discover out whether it ought to submit the objects to the overall ledger or sub ledger.The posting kind controls the data update.The accounts are set with their account symbols. The account number is found utilizing these symbols.Advantage: No new desk entries are required for postings of the identical kind made to different banks. A posting key or account is still free in posting space 2 (subledger accounting). The data required here for the clearing postings is taken from the test data (drawer, document quantity, and so on).Financial institution statement gadgets chosen for clearing but not but cleared can now be posted to an account. This can be a bonus if the shopper for the unique clearing has been recognized and the payment can be posted to the customer ledger for later clearance. As well as, bank clearing accounts could be accessed throughout the system for the account posting. The same applies to clearing postings in the basic ledger.

The data source for EC-CS is the FI basic ledger, and the corporate code is the organizational unit. The FI firm code must be assigned to a chart of accounts and a company.In EC-CS, the consolidation items are generated from the business units (corporations and/or business areas).In accounting transactions between business items within the enterprise, the related trading accomplice unit must be stored in the document. That is mandatory for the following inter unit elimination.Retailer the related buying and selling partners in the master information for affiliated customers and vendors. n To transfer the information from the transaction sender system to the receiver system, you will make assignments tailored to the receiver system.These can be assignments which can be equally binding for all consolidation types, such because the assignment of an organization code to a company.If desired, enterprise area stability sheets will be activated for every company code in FI.You can subdivide an organization code into business areas to generate internal individual monetary statements utilizing freely selected areas of responsibility inside a company.

In enterprise space consolidation, a consolidation enterprise area should be assigned from the receiver system.If desired, you can create functional areas in FI in order that the revenue assertion might be grouped in preserving with the necessities of price of sales accounting.Companies are the worldwide organizational buildings in FI.You presumably can portray a quantity of of the client’s company codes, in addition to inside trading companions whose transaction financial accounting is carried out in different programs (SAP system or non-SAP programs).For the aim of integrated information transfer, it's a must to assign the company codes of the transaction system to the businesses of the group.

The data to be consolidated can both be stored in the transaction system or distributed over various systems. It makes no difference if the methods involved are SAP R/three Programs or non-SAP systems.The inner trading companions for which transaction monetary accounting just isn't carried out within the Consolidation system should even be represented by corporations in FI.In EC-CS, consolidation models are generated mechanically on the idea of the companies. Built-in data from firm codes which were assigned to a company can then be copied to the acceptable consolidation unit.In a similar approach, integration strategies can be used to copy data from other SAP Programs to consolidation units. In some other case, data entry is carried out using entry forms, versatile add, or MS Access.

Trading Partner

Identifying the group-internal posting procedures between affiliated enterprises is a crucial manner of preparing knowledge in particular person monetary statements.SAP shops the “Sender-Receiver” relationship at the document stage in Financial Accounting. The balances are dealt with in consolidation with the extra account task trading partner.The related trading companion quantity is saved in the customer/vendor grasp record.To permit entries within the “Trading accomplice” subject, this fie ld needs to be set to “Elective entry” within the applicable account group of the master information (“General data, control” subject status group).When postings are made to this account, the corporate number is copied to the road merchandise, and could be used in consolidation for elimination of IU payables and receivables, in addition to in income and expense elimination.The trading accomplice will also be saved within the G/L account. During posting, it is then copied to the road merchandise, enabling the elimination capabilities to be carried out in consolidation.Alternatively, the trading associate can be set manually in the document.For enterprise area consolidation, you also need a reference in FI to the trading associate enterprise area with which you have got a business relationship.

The enterprise space is usually derived from the MM/SD transactions.To allow the buying and selling accomplice enterprise areas to be entered for G/L account postings, in addition to for transactions in FI-AP/-AR, the “Trading associate enterprise space” subject in the discipline standing group of the FI reconciliation account must be set to optional entry.In many areas of the SAP System, grasp information is assigned to enterprise areas. Typically, this allows you to derive the enterprise areas and the trading companion business areas automatically.In most business transactions, the business space is derived when the information is posted.If the additional account assignment shouldn't be unique, nonetheless, the enterprise space is adjusted on the finish of the period.

Associate-particular data from the mix of firm/business area kinds the premise for integrated business area consolidation.The posting traces of the accounting enterprise transactions are supplied with a trading accomplice enterprise area task, enabling income and expense elimination to be carried out in the Consolidation system. In the MM component, the relationships between buy and sales orders are additionally tracked.

Defining Data Transfer

To define information switch, specify the group to which the companies of this SAP System report. Then define the fiscal yr variant utilized in Consolidation. Also specify the Consolidation system, the consolidation types which can be lively for integration, and the data switch methods to be used for each of those consolidation types. You'll need to make these settings in each consumer of every system.The system reads the consolidation chart of accounts and the corresponding transaction charts of accounts for every information stream. On the premise of this information, it determines the suitable item in the consolidation chart of accounts for each transaction account.The system checks the following before the settings will be saved:

If some firm codes put up to different enterprise areas, you'll have the opportunity to specify right here that a test must be run in the Accounting system to see if a enterprise area defined in the doc is valid for the company code in question. When the system runs this verify, it uses the permissible mixtures of firm code and business area that you just outlined in Customizing.The manner during which knowledge is transferred to consolidation depends upon the info switch method.

1. Condensed chart of accounts

2. Chart of accounts with key figures

Status Monitor

Consolidation is performed with the assistance of two monitors. They contain all of the procedures to be carried out.Information monitor: Prior to consolidation, the info to be consolidated must be prepared on the level of the consolidation units.The info monitor incorporates all preparatory procedures and their present status. Procedures in the knowledge monitor might be: Creation of monetary knowledge and extra financial knowledge (additionally, for the consolidation of relevant knowledge), validation of the monetary knowledge, handbook adjustment postings, forex translation, apportionment, validation of adjusted financial data.

Consolidation monitor: On the degree of the consolidation group, the prepared data of the consolidation models is lastly consolidated.Procedures in the consolidation monitor could presumably be: Consolidation of payables, sales, prices and bills, investment revenue, and capital. Additionally, the validation of consolidated values.If the system settings are correct and the financial knowledge was properly created, the system carries out the consolidation steps via the press of a button. The mechanically created postings are displayed in the log. Milestones are used to stop the automated consolidation replace at the procedures which would possibly be marked accordingly. The subsequent process is started separately.

Related Posts

SAP CRM Solution Monitoring

CRM Backup Restoring System

SAP CRM Organizational Model

CRM Software Logistics and Support

MySAP CRM Marketing Introduction

CRM Marketing and lead management

Relying on whether or not a posting transaction impacts common ledger accounting only or both G/L and sub ledger account, you enter posting rules for one or two posting areas. The system uses the posting area to determine whether or not it should submit the objects to the overall ledger or sub ledger .

The posting type controls the data update.It determines the posting rule (examples: G/L posting, subledger posting, with or with out clearing).The G/L accounts are discovered utilizing the account symbols (example: INCOMING CHECK). Partially masked entries seek advice from the clearing account that belongs to the G/L account. The system uses the entry in the "Currency" field to ship checks in overseas foreign money to the required international forex account.Choose the compression indicator to have the system publish the checks as a total reasonably than individually.

A posting key or account remains to be free in posting area (sub ledger accounting). The information required here for the clearing postings is taken from the examine data (drawer, document quantity, and so on).

Creating Screen Variants

You'll give you the option to create your own account assignment variants for the examine deposit, thereby tailoring the arrangement and/or selection of account task fields to your particular requirements. The normal we ship incorporates one variant which you can't change.If you do not need to work with the usual variant, you can change it off. In case you create any new variants of your individual, you could activate them.The fields required for checks entry are selected in the order you need them displayed on the screen.To do that, place the cursor on a possible subject, and double click on the sector or select it utilizing the menu option.

Bank statements Manual Entry

The account task process for the bank assertion is the same as that for the verify deposit.The manual financial institution statement is a fast entry tool that subtantially reduces the handbook work concerned in processing bank statements. You enter solely the bank statement items, not the posting records.The system then mechanically makes the postings to the bank account, bank clearing account, and customer account, together with the cost clearing. You have got two choices right here as rapid posting and create a batch input session, then run it.

Post processing differs, in line with which of these options you choose.The manual financial institution assertion is written, but not posted, after the checks are saved within the database. You could make changes relating to the statement whereas it has this status. Once the posting process has been initiated, no further adjustments are possible.

Entering Bank Statement

Right here, you stipulate the account task variant. This is the start variant and determines which

fields are displayed if you end up actually getting into financial institution statements. You may change the account task variant at any time throughout processing.The beginning variant specifies the account assignment variant for the person postings. You should utilize customizing to create entry screens (variants) of your own.If you choose internal bank determination, the system identifies the financial institution utilizing the inner title instead of the financial institution number and external account number. You must use either, in accordance to what is ordinary in your company.The matchcode IDs D and K and the contents of the shopper and vendor matchcode fields on the subsequent display screen make up the matchcode of the customer/vendor account the system searches for (account dedication for payment settlement). The additional processing type determines whether the postings within the batch input session are made online or within the background.

Transaction worth date: The worth date from the bank assertion is copied into the posting if you occur to choose this.

Processing Bank Statement

Home bank or checking account ID: For internal bank dedication, enter the home bank ID and the account ID. For exterior bank dedication, enter the financial institution nubmer and external account number.

- Assertion number and date

- Definition of cost advices As part of statement entry, payment advices which have come into Cash Management by means of memo records, can be copied to the financial institution assertion automatically. This clears them. Numerous choice critieria are available for this purpose. For example, you'll be able to select all cost advices entered in a particular planning period or as of a selected bank statement date.

- In Further processing, you may enter session names, in case you are working with batch enter sessions.You can also restrict processing to financial institution postings only.

You employ the transaction to regulate whic h type of bank posting you're processing, for instance, credit score memo, wire transfer or examine payment.Individual paperwork are selected in subledger accounting by using certain criteria (such as the document quantity) or by utilizing the matchcode (account determination) and extra info (document determination) akin to the quantity, allocation, posting date or document date. Which selection fieldl are queried depends upon the account task variant and the interpretation variant.You may select memo information regarding the bank assertion in the inital display via various characteristics. These are then defaulted in the element screens for coming into transactions. Selected memo records that do not agree with the bank account statements may be delated as a part of entry screen processing.

In case you accidentally entered incorrect beginning and finish balances, you may right them in the entry screen.Financial institution statements you enter can be displayed, changed, or deleted earlier than posting.

Post Bank Statement

You possibly can either publish bank statements separately or submit all the financial institution statements entered in the current work session together.The "Submit" possibility generates the batch input classes required for the bank account postings and sub ledger account postings, or posts them immediately.The examine by bank statement quantity ensures that postings can't be made twice.The system generates a posting log, exhibiting the batch session name if appropriate.

Display Overview

You can use the overview to realize a perspective over all your bank statements. The processing standing shows the stage bank assertion posting has reached. For the next day, choose New Statement.

Posting Rules

Step one is to outline posting rules (inner transactions). The posting rules represent posting transactions typical of the bank statement.Assigning a posting rule to a transaction used within the software makes it possible to replace the transaction for the bank assertion too. You may define the transaction title as you want. You will want to specify the transaction title in the "Transaction" discipline in the bank assertion element screen.Account willpower is effected using the posting rules. The system uses the internal transaction to decide the information vital for posting (posting keys, accounts, document kind).You must use account modifications to have postings sent to accounts aside from the usual account assignment.The interpretation algorithm determines which fields are evaluated for the clearing transaction or doc determination.

Posting Details

The interior transactions are used to search out the posting rules and crucial information (posting keys, accounts, and so on).The system makes use of the posting area to discover out whether it ought to submit the objects to the overall ledger or sub ledger.The posting kind controls the data update.The accounts are set with their account symbols. The account number is found utilizing these symbols.Advantage: No new desk entries are required for postings of the identical kind made to different banks. A posting key or account is still free in posting space 2 (subledger accounting). The data required here for the clearing postings is taken from the test data (drawer, document quantity, and so on).Financial institution statement gadgets chosen for clearing but not but cleared can now be posted to an account. This can be a bonus if the shopper for the unique clearing has been recognized and the payment can be posted to the customer ledger for later clearance. As well as, bank clearing accounts could be accessed throughout the system for the account posting. The same applies to clearing postings in the basic ledger.

- The account image determines the G/L account to which postings are made.

- The G/L account is determined utilizing the G/L account quantity assigned to an account ID (full masking).

- Partially masked entries reference the clearing account that belongs to the G/L account.

- The system uses the entry in the "Foreign money" field to send checks in overseas foreign money to the required international currency account.

- Entries in the account modification are freely definable. They are required by the user exit for company-specific posting transactions. Instance: Classification of account actions by particular person responsible, funds in or out, selection by delivery note.

The data source for EC-CS is the FI basic ledger, and the corporate code is the organizational unit. The FI firm code must be assigned to a chart of accounts and a company.In EC-CS, the consolidation items are generated from the business units (corporations and/or business areas).In accounting transactions between business items within the enterprise, the related trading accomplice unit must be stored in the document. That is mandatory for the following inter unit elimination.Retailer the related buying and selling partners in the master information for affiliated customers and vendors. n To transfer the information from the transaction sender system to the receiver system, you will make assignments tailored to the receiver system.These can be assignments which can be equally binding for all consolidation types, such because the assignment of an organization code to a company.If desired, enterprise area stability sheets will be activated for every company code in FI.You can subdivide an organization code into business areas to generate internal individual monetary statements utilizing freely selected areas of responsibility inside a company.

In enterprise space consolidation, a consolidation enterprise area should be assigned from the receiver system.If desired, you can create functional areas in FI in order that the revenue assertion might be grouped in preserving with the necessities of price of sales accounting.Companies are the worldwide organizational buildings in FI.You presumably can portray a quantity of of the client’s company codes, in addition to inside trading companions whose transaction financial accounting is carried out in different programs (SAP system or non-SAP programs).For the aim of integrated information transfer, it's a must to assign the company codes of the transaction system to the businesses of the group.

The data to be consolidated can both be stored in the transaction system or distributed over various systems. It makes no difference if the methods involved are SAP R/three Programs or non-SAP systems.The inner trading companions for which transaction monetary accounting just isn't carried out within the Consolidation system should even be represented by corporations in FI.In EC-CS, consolidation models are generated mechanically on the idea of the companies. Built-in data from firm codes which were assigned to a company can then be copied to the acceptable consolidation unit.In a similar approach, integration strategies can be used to copy data from other SAP Programs to consolidation units. In some other case, data entry is carried out using entry forms, versatile add, or MS Access.

Trading Partner

Identifying the group-internal posting procedures between affiliated enterprises is a crucial manner of preparing knowledge in particular person monetary statements.SAP shops the “Sender-Receiver” relationship at the document stage in Financial Accounting. The balances are dealt with in consolidation with the extra account task trading partner.The related trading companion quantity is saved in the customer/vendor grasp record.To permit entries within the “Trading accomplice” subject, this fie ld needs to be set to “Elective entry” within the applicable account group of the master information (“General data, control” subject status group).When postings are made to this account, the corporate number is copied to the road merchandise, and could be used in consolidation for elimination of IU payables and receivables, in addition to in income and expense elimination.The trading accomplice will also be saved within the G/L account. During posting, it is then copied to the road merchandise, enabling the elimination capabilities to be carried out in consolidation.Alternatively, the trading associate can be set manually in the document.For enterprise area consolidation, you also need a reference in FI to the trading associate enterprise area with which you have got a business relationship.

The enterprise space is usually derived from the MM/SD transactions.To allow the buying and selling accomplice enterprise areas to be entered for G/L account postings, in addition to for transactions in FI-AP/-AR, the “Trading associate enterprise space” subject in the discipline standing group of the FI reconciliation account must be set to optional entry.In many areas of the SAP System, grasp information is assigned to enterprise areas. Typically, this allows you to derive the enterprise areas and the trading companion business areas automatically.In most business transactions, the business space is derived when the information is posted.If the additional account assignment shouldn't be unique, nonetheless, the enterprise space is adjusted on the finish of the period.

Associate-particular data from the mix of firm/business area kinds the premise for integrated business area consolidation.The posting traces of the accounting enterprise transactions are supplied with a trading accomplice enterprise area task, enabling income and expense elimination to be carried out in the Consolidation system. In the MM component, the relationships between buy and sales orders are additionally tracked.

Defining Data Transfer

To define information switch, specify the group to which the companies of this SAP System report. Then define the fiscal yr variant utilized in Consolidation. Also specify the Consolidation system, the consolidation types which can be lively for integration, and the data switch methods to be used for each of those consolidation types. You'll need to make these settings in each consumer of every system.The system reads the consolidation chart of accounts and the corresponding transaction charts of accounts for every information stream. On the premise of this information, it determines the suitable item in the consolidation chart of accounts for each transaction account.The system checks the following before the settings will be saved:

- Whether lively information streams exist (at the very least one information stream must be outlined and flagged as energetic for each knowledge stream)

- The project of group accounts to G/L accounts (doesn't apply to periodic extract technique)

- Whether or not a default subitem and sender area have been outlined within the master file of the subitem classes used.

If some firm codes put up to different enterprise areas, you'll have the opportunity to specify right here that a test must be run in the Accounting system to see if a enterprise area defined in the doc is valid for the company code in question. When the system runs this verify, it uses the permissible mixtures of firm code and business area that you just outlined in Customizing.The manner during which knowledge is transferred to consolidation depends upon the info switch method.

- Direct update/rollup: Value items with the identical names as the accounts of the group chart of accounts should be within the consolidation chart of accounts for EC-CS. You create the group account of the sender system in the grasp information of the working chart of accounts.

- Periodic extract:The operating accounts are assigned to a gaggle monetary assertion version in the sender system.The items of the consolidation chart of accounts in the receiver system correspond to the road items of this financial assertion version. Within the FI sender system, you extract the monetary information with the financial assertion program.

1. Condensed chart of accounts

2. Chart of accounts with key figures

Status Monitor

Consolidation is performed with the assistance of two monitors. They contain all of the procedures to be carried out.Information monitor: Prior to consolidation, the info to be consolidated must be prepared on the level of the consolidation units.The info monitor incorporates all preparatory procedures and their present status. Procedures in the knowledge monitor might be: Creation of monetary knowledge and extra financial knowledge (additionally, for the consolidation of relevant knowledge), validation of the monetary knowledge, handbook adjustment postings, forex translation, apportionment, validation of adjusted financial data.

Consolidation monitor: On the degree of the consolidation group, the prepared data of the consolidation models is lastly consolidated.Procedures in the consolidation monitor could presumably be: Consolidation of payables, sales, prices and bills, investment revenue, and capital. Additionally, the validation of consolidated values.If the system settings are correct and the financial knowledge was properly created, the system carries out the consolidation steps via the press of a button. The mechanically created postings are displayed in the log. Milestones are used to stop the automated consolidation replace at the procedures which would possibly be marked accordingly. The subsequent process is started separately.

Related Posts

SAP CRM Solution Monitoring

CRM Backup Restoring System

SAP CRM Organizational Model

CRM Software Logistics and Support

MySAP CRM Marketing Introduction

CRM Marketing and lead management

No comments :

Post a Comment