SAP Financial Special General Ledger Accounts has special G/L transactions are transactions in accounts receivable and accounts payable which are displayed individually in the basic ledger and the subsidiary ledger. This can be crucial for reporting or inner reasons. For instance, down payments must not be balanced with receivables and parables for items and services.Transactions involving subsidiary ledgers are tied to the final ledger by the reconciliation account outlined within the sub-ledger grasp record. Particular general ledger indicators use the subsidiary ledger grasp data however are related to the overall ledger by method of various reconciliation accounts.The configuration of the particular normal ledger indicator determines if the posting can be an actual G/L posting, a noted item in the general ledger, or a statistical entry.

There are many makes use of for particular G/L transactions. These transactions will be grouped into 3 primary categories:

With automatic statistical postings , you all the time post to the same offsetting account. To simplify the posting procedure, you may define the number of the account required for the offsetting entry within the system. The system then posts the offsetting entry automatically. When you clear open items in an open merchandise account, the system mechanically clears the related open gadgets within the offsetting account.These transactions are referred to as statistical postings since they're typically not displayed on the steadiness sheet or solely in the appendix. For instance, guarantees made are displayed in the appendix,while guarantees received are usually not displayed. Nevertheless, for inside functions it is a good idea to have an outline of the ensures that have been received.

Noted gadgets are informative particular G/L transactions that are not supposed to be displayed or included in the basic ledger but are only to remind customers of excellent funds due or to be made.There is solely one line item produced when a famous item is entered. There is no offsetting entry made.The fee program and the dunning program can entry famous objects for additional processing.Famous items are managed as a line item within the open item account and the particular G/L account.Due to this fact you should all the time activate the line merchandise show for these accounts.

Examples of Noted Items: Down payment request, invoice of trade request

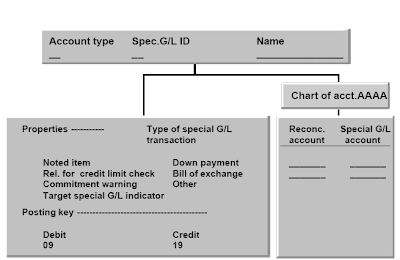

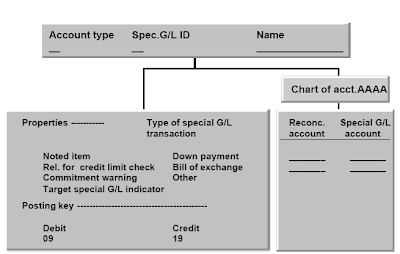

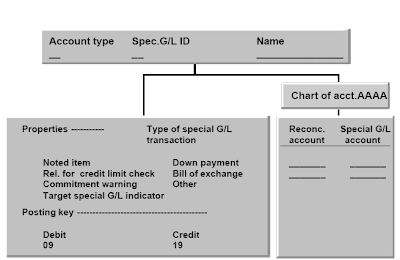

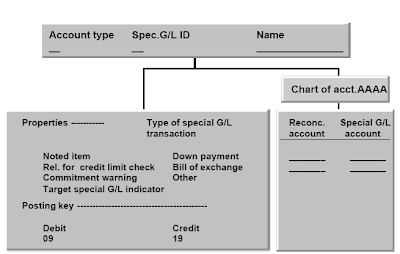

The property display screen defines the characteristics for every particular G/L indicator/account type Famous Gadgets: You'll be able to specify that a particular G/L transaction is not going to update account balances.Relevance for credit score restrict check: Particular G/L transactions may be included in customer credit limit checks. Noted items are generally not considered. All different transactions could be marked in accordance with person specifications.

The special G/L accounts are outlined as reconciliation accounts for account types D or K.In contrast to 'standard reconciliation accounts' (A/P A/R), particular G/L accounts generally have line merchandise show capability.You may change the display screen layout for coming into postings via the field standing group.

Down Payment Processing

Related Posts

CRM Sales Cycle Management

CRM Sales opportunity management

There are many makes use of for particular G/L transactions. These transactions will be grouped into 3 primary categories:

- Down Fee Associated: R/three provides special pre-configured packages and screens which handle the request, receipt and utility of down payments. They can be utilized within the A/P or A/R utility components and are are contained on the standard R/3 menus. Down payment processing has additionally been integrated into the R/3 dunning and fee processing programs.

- Invoice of Change Associated: Invoice of exchange processing is used to deal with country-particular requirements. R/3 comprises special pre-configured programs and screens which use special G/L transaction functions to fulfill these requirements. Bill of alternate choices are contained on the normal R/three A/R and A/P menus and are integrated into different FI functions.

- Other Transactions: Different miscellaneous kinds of enterprise transactions use the special G/L transaction functions. To entry a majority of these transactions, there is an possibility beneath doc processing in A/P and A/R entitled "Different". It is also attainable to direct individual financial document line objects to an alternate reconciliation account through the use of the particular G/L indicator. This will management the sort of processing that can happen when the enterprise transaction is entered.

With automatic statistical postings , you all the time post to the same offsetting account. To simplify the posting procedure, you may define the number of the account required for the offsetting entry within the system. The system then posts the offsetting entry automatically. When you clear open items in an open merchandise account, the system mechanically clears the related open gadgets within the offsetting account.These transactions are referred to as statistical postings since they're typically not displayed on the steadiness sheet or solely in the appendix. For instance, guarantees made are displayed in the appendix,while guarantees received are usually not displayed. Nevertheless, for inside functions it is a good idea to have an outline of the ensures that have been received.

Noted gadgets are informative particular G/L transactions that are not supposed to be displayed or included in the basic ledger but are only to remind customers of excellent funds due or to be made.There is solely one line item produced when a famous item is entered. There is no offsetting entry made.The fee program and the dunning program can entry famous objects for additional processing.Famous items are managed as a line item within the open item account and the particular G/L account.Due to this fact you should all the time activate the line merchandise show for these accounts.

Examples of Noted Items: Down payment request, invoice of trade request

- Particular G/L transactions configured as freely definable offsets create a real entry within the basic ledger. The alternative reconciliation account is automatically debited or credited relying on the entry. The user is required to enter the G/L account for the offsetting entry.

- Instance of Freely Definable Offsetting Entry - Down Payment Receipt: Upon receipt of a down cost request, a buyer sends 100,000. The R/three System registers the receipt of the fee in the accounts receivable ledger in addition to in the G/L reconciliation account (down payments acquired). The account that will probably be debited for the money obtained can be defined when the transaction is entered in the R/3 System.

- Particular G/L transactions are contained in the usual system. Nonetheless you would possibly what to customize additional if you occur to require changes to the usual transactions such as:

- Totally different account numbers for the reconciliation accounts or the particular G/L accounts

- Different posting keys or special G/L indicators for the individual transactions

- Other specifications for the automatic postings. These embody the accounts to be posted, the posting keys and the foundations for account project with computerized postings.

- Particular G/L transactions use the particular G/L indicator which specifies the sort of transaction, in conjunction with the kind of account (buyer or vendor) to outline a selected configuration.

- Instance: Buyer down payments and vendor down funds are configured separately.

- You can get to an inventory of particular G/L transactions by manner of the use of transaction code FBKP. Then choose particular G/L from the toolbar.

The property display screen defines the characteristics for every particular G/L indicator/account type Famous Gadgets: You'll be able to specify that a particular G/L transaction is not going to update account balances.Relevance for credit score restrict check: Particular G/L transactions may be included in customer credit limit checks. Noted items are generally not considered. All different transactions could be marked in accordance with person specifications.

- Commitment warning: You'll have the opportunity to specify that whenever you submit to a vendor or customer account, a message is issued warning the user that a particular G/L transaction exists.

- Instance: If you put up a vendor invoice, it is useful to know that a down fee exists for that vendor.

- Goal special G/L indicator: For noted objects, you may set the particular G/L indicators which would possibly be permitted during document entry. The goal particular G/L indicator is utilized in the standard system for down fee requests.

- Particular G/L Transaction Kind: This defines whether or not the transaction is a down payment, invoice of trade, or one other type.

- Posting keys: These are the one posting keys that can be allowed in combination with this particular G/L indicator.

The special G/L accounts are outlined as reconciliation accounts for account types D or K.In contrast to 'standard reconciliation accounts' (A/P A/R), particular G/L accounts generally have line merchandise show capability.You may change the display screen layout for coming into postings via the field standing group.

Down Payment Processing

- Down Cost request A down payment request is a noted item. It doesn't change any account balances. You possibly can can dun and pay mechanically on the premise of down fee requests.

- Down Fee Acquired A down cost acquired is a payable in your accounts and must not therefore change the stability of the “Receivables” reconciliation account. You manage down payments received in the different G/L account “Down Payments Acquired” in the payables space of the steadiness sheet.

- Customer Invoiced When items are delivered or services performed, the shopper receives an invoice.

- Apply Down Payment to Invoice At this level the down payment shouldn't be longer a down cost- Make the offsetting posting for it. Then it can be posted as a fee on account.

- Clear the down payment from your accounts.The process for down funds payable is strictly the same as that for down payments receivable. The down fee is definitely made with the cost program.

Related Posts

CRM Sales Cycle Management

CRM Sales opportunity management

No comments :

Post a Comment