To calculate accrued prices, use the proportion method. SAP Financial Period End Closing is based mostly on a share overhead,which is related to a price factor or a price ingredient group. In contrast to accrual calculation with a recurring entry in FI, this methodology has the benefit that the accrued costs are calculated utilizing the actual costs. The percentage technique, for instance, is useful for accrual calculations for labor prices relevant to salaries, equivalent to premiums.n When accrual is calculated, the system debits the cost centers with the accrual cost amounts. At the same time, a consumer-defined accrual object (value center, or inner order) is credited. The actual prices that arose are posted to the outcomes evaluation object, so that all the balances that exist between expenses in FI and accrued costs in CO are calculated, analyzed, and settled to profitability analysis.You create a main accrual cost component (cost component class = three) to course of the accrual Calculation.

Entering Statical Key Figures

You can enter statistical key figures as a tracing issue for periodic allocations, or for creating key figures in reporting. The prices from the allocation value center "Phone" will be allocated using the statistical key determine of "Phone models" for example. Should you enter "Workers" as a statistical key determine, then you'll find a way to present a report on the price facilities, on the level of HR prices for every employee.A decisive issue for statistical key figures, is the finest way in which you create them as grasp records.Mounted values (class 01) are updated from the corresponding posting interval onwards, in all of the following posting durations of the fiscal year. This takes place, assuming that fixed values don't change over a longer period of time.Totals values (class 02) are only entered for each present period. They change from interval to interval, and due to this fact need to be re-entered in every posting period.You could also enter statistical key figures particularly for an activity kind on a cost middle (statistical key figures which may be exercise-dependent).

Periodic Posting

Periodic re posting is used as a posting aid.Main postings (corresponding to, telephone prices) are collected on an allocation object (cost center,overhead price order, business course of, WBS factor, or value object) to restrict the variety of FI postings as a lot as possible. These prices are allocated during interval-end closing to the corresponding Controlling objects, utilizing a key outlined by the user.The receivers for an assessment generally is a price middle, WBS aspect, inner order, or price object.You'll give you the chance to restrict the variety of receiver classes in customizing.You can solely re post major costs. Throughout this process, the original value ingredient remains the same.Line items are posted for the sender in addition to for the receiver, enabling the allocation to be recorded exactly. The system does not save the information from the clearing cost middle in totals information throughout a periodic re posting. This permits it to save reminiscence when storing the data records.Periodic re postings might be reversed and repeated as usually as required.

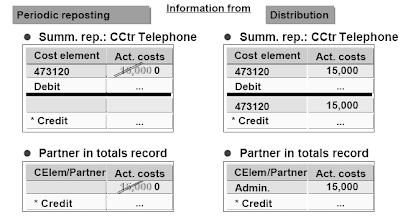

Differences between periodic re posting and distribution are as a consequence of data content and performance.For periodic re posting, no separate credit document is written on the sender for the price ingredient within the summary report. As an alternative, the totals report for the cost element is decreased on the debit side, which means that the original debit amount can not be checked there ("unclean credit"). Nevertheless,during distribution, the system writes a totals document for the credit ("clear credit score"). The data on the receiver is identical for periodic reposting and distribution ("clean debit").In contrast with periodic re posting, during distribution, the system also updates the partner within the totals file for the sender. Because of this the companion could be displayed within the data system on the totals document level.As fewer totals data are written during periodic re posting, efficiency is healthier than during distribution. See customizing for an instance with figures that illustrates this aspect. Below utilities,make settings for the SAP script textual content display, then call up the text by choosing Periodic re posting,Distribution, or Assessment from the menu.

Assignment

Evaluation was created to switch main and secondary prices from a sender value middle to receiving controlling objects. During assessment, value centers or business processes can be used as senders .The receivers for an evaluation could be a price middle, WBS aspect, inside order, value object, or a business process. You possibly can prohibit the variety of receiver classes in customizing.Major and secondary postings are allocated on the finish of the interval by the use of the user-outlined key.Throughout evaluation, the unique cost components are summarized into evaluation cost parts (secondary price element class = 42). As the system writes fewer totals data, the assessment has a better performance than periodic re posting and distribution.Line gadgets are posted for the sender in addition to for the receiver, enabling the allocation to be recorded exactly. The system doesn't show the original price parts within the receivers. Therefore,evaluation is useful if the fee drill down for the receiver shouldn't be vital, for example, as in the case of the allocation for the "cafeteria" value center.Much like distribution, the accomplice is up to date in the totals record throughout distribution.You can reverse assessments as often as required.You use the Cycle -Section technique to define sender-receiver relationships.

You may solely use periodic re posting and distribution for main cost elements. The prices are transferred to the receivers utilizing the unique price aspect, so they're transferred to the first price components of the receiver. Secondary price elements remain on the sender.The assessment allocates main in addition to secondary costs. The data on the unique primary value elements for the sender is misplaced because the costs are allotted utilizing an assessment cost aspect (class 42). You ought to utilize multiple evaluation price element for differentiation purposes.For performance reasons , periodic re posting of the distribution is really helpful, as the system does not write any sender/receiver relationships on the totals records level for this. Evaluation has the finest efficiency as prices from different main and secondary price elements could be totaled in one posting to the assessment cost element.

Reversing and Re posting Segments

Many organizations have to change allocations from previous periods. They want to change allocations belonging to prior periods. Audit corrections, data that is acquired after period-end closing,and easy errors, imply that corrections are needed even months after allocations have been finished.Section reversal and re booking includes taking segments from a previous period and posting a new allocation within the current interval (using corrected reference information from the previous interval).The segment reversal deletes the allocation postings for the selected section by re posting the outcomes with reversed +/- signs. The information for the present period-end closing transaction is not changed.Segment reversal and re booking deletes the allocation but retains the element data. If required,you possibly can right information from the earlier period for a specific phase or segments. You can change statistical key figures, change spherical +/- indicators, choose different receivers, and make any other corrections necessary. You should use the rebooking features solely in combination with the reversal operate: a separate transaction for rebookings doesn't exist.Though the interval that is to be reversed is generally closed, this doesn't need to be the case.Nevertheless, allocations belonging to the previous period must have used the cycle and the segments,and the present period must not be closed. You don't need to repeat period-finish closing for the earlier durations; reporting stays constant for all of the durations in question.Phase adjustment is feasible for assessment, distribution, and for periodic repostings. Be aware that individual segments are reversed and re booked, but not entire cycles. Iterative relationships between cycles should not included. This could trigger inconsistencies and errors if you do not reverse and rebook iterative segments at the identical time.

Manual Cost Allocation

Manual price allocation allows you to put up primary and secondary costs manually. Unlike the re posting of prices, which reduces the unique debit line on the related fee middle, under handbook cost allocation, separate credit line is written to the sender.You'll have the ability to avoid having to make time-consuming settings in Customizing by utilizing handbook price allocation for easy allocations . Guide value allocation additionally helps you to regulate incorrect secondary postings and import knowledge from exterior systems. Such changes don't involve a reversal, but a new allocation.You can use guide value allocation for all value component categories. An exception to this is class forty three (allocation of activities/processes) which can solely be used for activity allocation. Senders and receivers embody value facilities, internal orders, WBS components, enterprise processes, networks,activities, customer orders, cost objects, and real estate objects.Notice that you need to use guide price allocation for precise data only.For those who carry out interval-based mostly allocation following guide allocation, be certain that all the cost parts used within the manual posting are contained in the allocation scheme for automated allocation.Prices that are debited to a price center by handbook cost allocation cannot be additional debited utilizing periodic re posting. Periodic repostings are used only to right postings, and needs to be carried out before the allocations (handbook or automatic) take place.

Within the reconciliation ledger, CO data is totaled and valuated. The reconciliation ledger exhibits you the information in all CO appliations for a cost component, as properly as totals for firm codes, enterprise areas,object types, and object classes and so on.Though it is not a statutory requirement, it ought to be doable to reconcile data from Controlling and Financial Accounting. One purpose of the reconciliation ledger is to create reconciliation postings.Exterior postings to FI which can be relevant to cost are robotically transferred to the corresponding CO software element (this is achieved directly, in realtime). The CO totals are updated for the reconciliation ledger for these postings.

If amounts in CO are posted throughout firm code, functional space, or business area, then this info needs to be transferred back to FI. This information is just not automatically transferred to Financial Accounting. The CO totals within the reconciliation ledger are updated however.You can use the reconciliation ledger to create a posting for reconciling FI and CO postings.In addition to CO/FI reconciliation, the reconciliation ledger also has the following informative capabilities :

Periodic Lock

Use the interval lock to lock plan and precise business transactions for a mix of controlling area, fiscal yr, and version.You may choose individual business transactions for locking from a list of all the actual and plan business transactions.Additionally it is doable to lock particular person enterprise transactions for all of the durations of the fiscal yr, or all business transactions for individual periods.

Manual Cost Allocation

Manual price allocation allows you to put up primary and secondary costs manually. Unlike the re posting of prices, which reduces the unique debit line on the related fee middle, under handbook cost allocation, separate credit line is written to the sender.You'll have the ability to avoid having to make time-consuming settings in Customizing by utilizing handbook price allocation for easy allocations . Guide value allocation additionally helps you to regulate incorrect secondary postings and import knowledge from exterior systems. Such changes don't involve a reversal, but a new allocation.You can use guide value allocation for all value component categories. An exception to this is class forty three (allocation of activities/processes) which can solely be used for activity allocation. Senders and receivers embody value facilities, internal orders, WBS components, enterprise processes, networks,activities, customer orders, cost objects, and real estate objects.Notice that you need to use guide price allocation for precise data only.For those who carry out interval-based mostly allocation following guide allocation, be certain that all the cost parts used within the manual posting are contained in the allocation scheme for automated allocation.Prices that are debited to a price center by handbook cost allocation cannot be additional debited utilizing periodic re posting. Periodic repostings are used only to right postings, and needs to be carried out before the allocations (handbook or automatic) take place.

Within the reconciliation ledger, CO data is totaled and valuated. The reconciliation ledger exhibits you the information in all CO appliations for a cost component, as properly as totals for firm codes, enterprise areas,object types, and object classes and so on.Though it is not a statutory requirement, it ought to be doable to reconcile data from Controlling and Financial Accounting. One purpose of the reconciliation ledger is to create reconciliation postings.Exterior postings to FI which can be relevant to cost are robotically transferred to the corresponding CO software element (this is achieved directly, in realtime). The CO totals are updated for the reconciliation ledger for these postings.

If amounts in CO are posted throughout firm code, functional space, or business area, then this info needs to be transferred back to FI. This information is just not automatically transferred to Financial Accounting. The CO totals within the reconciliation ledger are updated however.You can use the reconciliation ledger to create a posting for reconciling FI and CO postings.In addition to CO/FI reconciliation, the reconciliation ledger also has the following informative capabilities :

- Cross-CO value analyses

- Navigation help and entry to Controlling for the revenue and loss statement.

Periodic Lock

Use the interval lock to lock plan and precise business transactions for a mix of controlling area, fiscal yr, and version.You may choose individual business transactions for locking from a list of all the actual and plan business transactions.Additionally it is doable to lock particular person enterprise transactions for all of the durations of the fiscal yr, or all business transactions for individual periods.

Related Posts

SAP ABAP BAPI 2

SAP ABAP BAPI 3

SAP ABAP BAPI 4

No comments :

Post a Comment