SAP Financial Post Control has customers log onto R/3, their consumer id has particular properties i.e. log on language, date formatting,decimal notation, that can observe the person throughout the system. Customers even have the choice to set a default printer for themselves.R/3 offers some fundamental defaults during document processing. R/3 all the time proposes the current date because the posting date and the entry date throughout document processing. Nonetheless, the entry date can't be changed.R/3 adheres to the “Document Principle”: all documents should balance earlier than they are often posted.As you course of via numerous accounting transactions, default document sorts and posting keys are outlined per transaction in customizing. A vendor invoice could have the document kind KR; the credit entry will most likely be posted using posting key 31. A buyer invoice can have the doc type DR; the debit entry might be posted utilizing the posting key 01.You too can have R/3 propose the worth date and the fiscal 12 months in numerous accounting transactions.On the firm code degree, specify the utmost trade price difference between the exchange fee entered within the doc header of a transaction and the speed in the change rate desk If the system finds a distinction which exceeds the share charge specified, a warning message is given. In this manner, incorrect entries could be recognized and corrected in time.

SAP Financial Post Control has parameter ID’s enable customers to set default values for fields whose value doesn't change very often e.g. company code, currency. During transaction processing, these values will default into the fields thus saving time, lowering keystrokes and bettering accuracy.Enhancing options permit customers to change their R/3 screens in the following areas:

To distinguish change rules for every field as follows:

Phrases of fee are circumstances established between enterprise partners to settle the payment of invoices. The circumstances outline the bill cost due date and the cash discount offered for early settlement of the invoice.Inside R/3, some common cost phrases have been predefined; new cost terms may be created as required.Fee terms allow the system to calculate a cash discount and invoice due date.With a goal to carry out this calculation, the system wants the next three data parts:

Payment Types

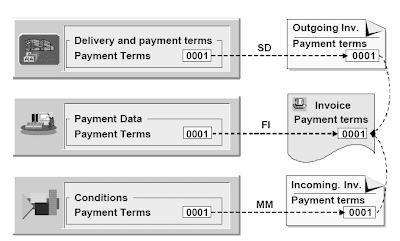

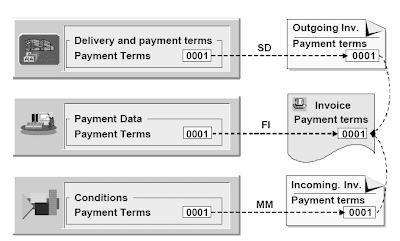

Cost phrases might be entered into the corporate code phase, sales area section, and purchasing segment of a buyer / vendor grasp document.Which cost phrases are defaulted when posting an invoice is decided by where the bill is created:

Bill associated credit memos:

Bill associated credit memos:

Credit memos could be linked to the unique bill by coming into the invoice number in the bill reference discipline throughout document entry. In this case, the cost terms are copied from the bill so that the bill and the credit memo are due on the identical date.Fee phrases in different credit memos aren't valid and are due at the document date. To activate the payment phrases on these non-bill related credit memos, enter a “V” in the bill reference subject during document entry.

Payment Terms Basic Data

General:The day limit is the calendar day up to which the fee time period could apply, permitting date dependent payment terms.The description of a cost term consists of three parts:

A system decided clarification which is a gross sales associated description for printing on invoices, and a user outlined explanation.The account type allows for mutual or exclusive use of a cost term within a sub-ledger.

Cost Control: An invoice is normally blocked by using a block key on the line item; nevertheless, a block key could also be defined in a cost term.A fee technique is often entered within the line merchandise; nevertheless, a cost methodology could also be defined in a cost term. A block key and fee technique outlined in a cost time period will default in the line item if the fee term is assigned within the enterprise companion master record.

Baseline Date:The baseline date is the beginning date the system makes use of to calculate the invoice due date.The following guidelines apply when defining the calculation of the baseline date:

. The default values from which the baseline date could be decided are as follows:‘No Default'; ‘Posting Date'; ‘Document Date' or ‘Entry Date’

. Specs for calculating the baseline date:The required mounted day used to override the calendar day of the baseline date.The number of month(s) to be added to the calendar month of the baseline month.To calculate the cash low cost, a share charge is entered into the cost term. The number of days that the proportion is legitimate for can be entered on the same line. Extra fastened days or months may be added on as well.The days and months specified in the payment term are used along side the baseline date to calculate the correct discount amount for the cost date.Up to three low cost periods may be entered.Day limits allow date dependent payment terms.Several versions of a payment term’s key will be defined with every version having a special day limit.The day limit is the posting day up to which the payment term version might apply.

Hold Back

An invoice can be paid over a number of months utilizing an installment plan, or a portion of the invoice quantity may be retained for fee at a later date.The entire invoice quantity is divided into acceptable quantities as per the plan and every separate quantity is then due on completely different dates.The system will perform the above perform mechanically through the use of a holdback/retainage payment term.A holdback/retainage term is outlined by setting the holdback/retainage flag and not assigning low cost days or percentages.The holdback/retainage payment time period is further outlined utilizing an installment quantity, installment proportion charge and an installment payment term. The proportion rates specified should whole 100%. The system will create a line merchandise for every installment specified.Every line merchandise amount will be equal to the installment proportion price of the full major quantity, and the sum of the line item quantities will equal the whole main amount.The line gadgets can have fee terms as outlined by the installment plan.

Depending on the nationwide laws of your nation, the cash discount base quantity will be the net value (sum of G/L account and fixed property line gadgets, taxes not included) or gross worth (including taxes). You have to decide per company code or per jurisdiction code how the system determines the money discount base amount.

The cash discount quantity is entered in the invoice both manually or mechanically by the system using the rates in the payment terms. It could be modified even after the invoice is posted.When an open item on a buyer or vendor account is cleared, the attainable cash low cost is posted routinely to an account for “money discount granted” or “money discount taken”.The accounts for “cash discount granted” or “cash discount taken” are defined in configuration.In the occasion you put up a vendor invoice with a doc type for the online process , the amount posted to the expense or balance sheet account is diminished by the money discount amount. The same quantity can also be posted to a money discount clearing account to clear the document.When utilizing the net process, the money discount amount is routinely posted when the bill is posted.

When you post a vendor bill with a document type for the web procedure , the amount posted to the expense or balance sheet account is lowered by the cash discount amount. The same quantity can also be posted to a money low cost clearing account to clear the document.When utilizing the web process, the money low cost amount is robotically posted when the invoice is posted.Whenever you clear the doc, the system carries out a clearing posting to the money low cost clearing account.If the bill is paid after the money discount deadline, the misplaced cash low cost is posted to a separate account.The money discount clearing account have to be managed on an open merchandise basis.

Cross Company Code Transaction

A cross-firm code transaction involves two or more firm codes in a single enterprise transaction. Examples for a cross-company code transaction are:

Center Purchasing

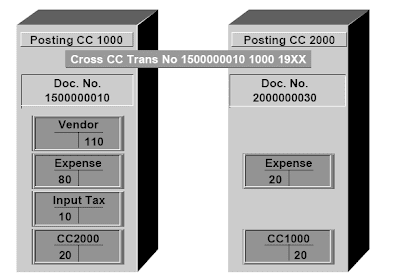

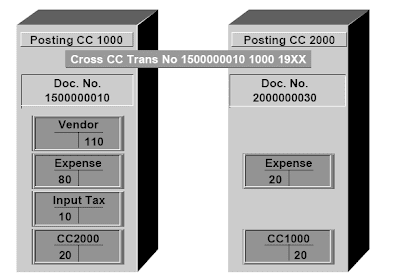

A vendor delivers tools to company code a thousand and different equipment to firm code 2000, but sends just one invoice for all the tools to company code 1000. You enter a half of the expense

and publish the bill to the vendor account in company code 1000. When coming into the invoice, you should submit the other part of the bills in firm code 2000. The clearing postings and the tax

posting are generated automatically.The tax isn't distributed between the corporate codes in line with their expenses. Due to this fact, this functionality might solely be used if the transaction itself will not be tax-relevant or if the company codes kind a taxable entity.The tax calculated is at all times posted to the corporate code of the first position. Due to this fact, to ensure that the tax is posted to the same company code as the invoice, the invoice position should always be entered first.Sure international locations tax laws (e.g. in Japan and Denmark) require that the tax amounts are posted in the firm codes wherein the expenses occurred. Therefore, the tax must be distributed from the primary company code to the opposite firm codes based on their expense amount. This can be completed through the use of the report RFBUST10.

Clearing Accounts

The clearing accounts have to be defined in each firm code before a cross-firm code transaction may be carried out. The clearing accounts could additionally be G/L accounts, customer, or vendor accounts.Within the configuration it's essential to assign clearing accounts to every potential combination of two company codes to allow cross-company code postings between these mixtures (, i.e. three firm codes need 3*2= 6 clearing accounts).To lower the variety of clearing accounts, you ought to use just one company code as the clearing firm code. On this case, you solely should assign clearing accounts to every combination of the clearing firm code to the opposite company codes, ( i.e. three firm codes need 2*2= 4 clearing accounts).Posting keys must be assigned to the clearing accounts to establish their account types.

Cross Company Code

When the cross-firm code document is posted, the system generates a cross-firm code document quantity to hyperlink all the new paperwork together.The doc quantity is a combination of the document variety of the first company code, the first firm code quantity and the then fiscal year. It's stored within the doc header of the entire documents created for a complete audit trail. Cross-company code documents may be reversed: the system can reverse every document that was created with the cross-company document, or the individual paperwork could be reversed separately.

Reversing Documents

It is attainable for a consumer to make an enter error. As a result, the document created will comprise incorrect information. As a manner to present an audit of the correction, the user must first reverse the doc in error, and then seize the doc correctly.The system offers a operate to reverse G/L, A/R and A/P paperwork both individually or in mass.A document may be reversed either by:

Standard Reversal Posting

The standard reversal posting causes the system to post the debit in error as a credit and the credit in error as a debit. The usual reversal posting causes an additional increase within the transaction figures.The damaging posting also posts the debit in error as a credit score and the credit in error as a debit. This time the posted amount just isn't added to the transaction figures but it's subtracted from the transaction figure of the opposite facet of the account. This sets the transaction figures again to as they have been before the incorrect posting took place.Usually the system uses the standard reversal posting to reverse documents. The next requirements have to be fulfilled to perform negative postings:

Related Posts

SAP CRM Technology Overview

MySAP CRM Marketing IntroductionCRM Marketing and lead management

SAP Financial Master Data for General Ledger

SAP Financial Document Control

SAP Financial Post Control has parameter ID’s enable customers to set default values for fields whose value doesn't change very often e.g. company code, currency. During transaction processing, these values will default into the fields thus saving time, lowering keystrokes and bettering accuracy.Enhancing options permit customers to change their R/3 screens in the following areas:

- Document entry: users can “disguise” fields that will not be relevant for his or her jobs like overseas foreign money or cross company code transactions.

- Document show: customers can set totally different show options when querying documents.

- Open items: users select line format displays and posting options for processing open items i.e. customers have the option to enter the amount of a partial fee or the steadiness of the model new open item.

- Doc header: only the reference number and textual content fields will be changed

- Line items: the system doesn't allow changes to the quantity, the posting key, the account or some other fields that might have an impact on the reconciliation of a posting.

- The sector that was changed

- The new and previous values

- The person who made the change

- The time and date of the change

To distinguish change rules for every field as follows:

- Account type: The account kind allows users to distinguish a rule between A/R, A/P and G/L.

- Transaction class: Transaction lessons are only used for particular GL transactions for payments of change and down payments.

- Company code: If the sphere is blank, the rule applies to every company code.

- The posting interval continues to be open

- The road item shouldn't be but cleared

- The road merchandise is either a debit on a buyer account or a credit score on a vendor account.

- The document shouldn't be an bill related credit score memo

- The doc shouldn't be a credit score memo from a down payment

Phrases of fee are circumstances established between enterprise partners to settle the payment of invoices. The circumstances outline the bill cost due date and the cash discount offered for early settlement of the invoice.Inside R/3, some common cost phrases have been predefined; new cost terms may be created as required.Fee terms allow the system to calculate a cash discount and invoice due date.With a goal to carry out this calculation, the system wants the next three data parts:

- Baseline date : The date from which the due date is derived.

- Money discount periods: The period during which the low cost is allowed to be taken.

- Cash discount share price: The rate used to calculate the discount value.

Payment Types

Cost phrases might be entered into the corporate code phase, sales area section, and purchasing segment of a buyer / vendor grasp document.Which cost phrases are defaulted when posting an invoice is decided by where the bill is created:

- If the invoice is created in FI, the payment terms from the company code phase are defaulted.

- If a customer bill is created in SD, the fee terms from the gross sales space phase are defaulted. When posting the SD-bill, fee terms are copied to the FI-invoice (which is created mechanically).

- If a vendor bill is created in MM, fee terms from the purchasing phase are defaulted.When posting the MM-bill, the payment phrases are copied to the FI-bill

Bill associated credit memos:

Bill associated credit memos:Credit memos could be linked to the unique bill by coming into the invoice number in the bill reference discipline throughout document entry. In this case, the cost terms are copied from the bill so that the bill and the credit memo are due on the identical date.Fee phrases in different credit memos aren't valid and are due at the document date. To activate the payment phrases on these non-bill related credit memos, enter a “V” in the bill reference subject during document entry.

Payment Terms Basic Data

General:The day limit is the calendar day up to which the fee time period could apply, permitting date dependent payment terms.The description of a cost term consists of three parts:

A system decided clarification which is a gross sales associated description for printing on invoices, and a user outlined explanation.The account type allows for mutual or exclusive use of a cost term within a sub-ledger.

Cost Control: An invoice is normally blocked by using a block key on the line item; nevertheless, a block key could also be defined in a cost term.A fee technique is often entered within the line merchandise; nevertheless, a cost methodology could also be defined in a cost term. A block key and fee technique outlined in a cost time period will default in the line item if the fee term is assigned within the enterprise companion master record.

Baseline Date:The baseline date is the beginning date the system makes use of to calculate the invoice due date.The following guidelines apply when defining the calculation of the baseline date:

. The default values from which the baseline date could be decided are as follows:‘No Default'; ‘Posting Date'; ‘Document Date' or ‘Entry Date’

. Specs for calculating the baseline date:The required mounted day used to override the calendar day of the baseline date.The number of month(s) to be added to the calendar month of the baseline month.To calculate the cash low cost, a share charge is entered into the cost term. The number of days that the proportion is legitimate for can be entered on the same line. Extra fastened days or months may be added on as well.The days and months specified in the payment term are used along side the baseline date to calculate the correct discount amount for the cost date.Up to three low cost periods may be entered.Day limits allow date dependent payment terms.Several versions of a payment term’s key will be defined with every version having a special day limit.The day limit is the posting day up to which the payment term version might apply.

Hold Back

An invoice can be paid over a number of months utilizing an installment plan, or a portion of the invoice quantity may be retained for fee at a later date.The entire invoice quantity is divided into acceptable quantities as per the plan and every separate quantity is then due on completely different dates.The system will perform the above perform mechanically through the use of a holdback/retainage payment term.A holdback/retainage term is outlined by setting the holdback/retainage flag and not assigning low cost days or percentages.The holdback/retainage payment time period is further outlined utilizing an installment quantity, installment proportion charge and an installment payment term. The proportion rates specified should whole 100%. The system will create a line merchandise for every installment specified.Every line merchandise amount will be equal to the installment proportion price of the full major quantity, and the sum of the line item quantities will equal the whole main amount.The line gadgets can have fee terms as outlined by the installment plan.

Depending on the nationwide laws of your nation, the cash discount base quantity will be the net value (sum of G/L account and fixed property line gadgets, taxes not included) or gross worth (including taxes). You have to decide per company code or per jurisdiction code how the system determines the money discount base amount.

The cash discount quantity is entered in the invoice both manually or mechanically by the system using the rates in the payment terms. It could be modified even after the invoice is posted.When an open item on a buyer or vendor account is cleared, the attainable cash low cost is posted routinely to an account for “money discount granted” or “money discount taken”.The accounts for “cash discount granted” or “cash discount taken” are defined in configuration.In the occasion you put up a vendor invoice with a doc type for the online process , the amount posted to the expense or balance sheet account is diminished by the money discount amount. The same quantity can also be posted to a money discount clearing account to clear the document.When utilizing the net process, the money discount amount is routinely posted when the bill is posted.

When you post a vendor bill with a document type for the web procedure , the amount posted to the expense or balance sheet account is lowered by the cash discount amount. The same quantity can also be posted to a money low cost clearing account to clear the document.When utilizing the web process, the money low cost amount is robotically posted when the invoice is posted.Whenever you clear the doc, the system carries out a clearing posting to the money low cost clearing account.If the bill is paid after the money discount deadline, the misplaced cash low cost is posted to a separate account.The money discount clearing account have to be managed on an open merchandise basis.

Cross Company Code Transaction

A cross-firm code transaction involves two or more firm codes in a single enterprise transaction. Examples for a cross-company code transaction are:

- One firm code makes purchases for different firm codes (Central Procurement)

- One firm code pays for different company codes (Central Fee)

- One company code sells goods to other firm codes

Center Purchasing

A vendor delivers tools to company code a thousand and different equipment to firm code 2000, but sends just one invoice for all the tools to company code 1000. You enter a half of the expense

and publish the bill to the vendor account in company code 1000. When coming into the invoice, you should submit the other part of the bills in firm code 2000. The clearing postings and the tax

posting are generated automatically.The tax isn't distributed between the corporate codes in line with their expenses. Due to this fact, this functionality might solely be used if the transaction itself will not be tax-relevant or if the company codes kind a taxable entity.The tax calculated is at all times posted to the corporate code of the first position. Due to this fact, to ensure that the tax is posted to the same company code as the invoice, the invoice position should always be entered first.Sure international locations tax laws (e.g. in Japan and Denmark) require that the tax amounts are posted in the firm codes wherein the expenses occurred. Therefore, the tax must be distributed from the primary company code to the opposite firm codes based on their expense amount. This can be completed through the use of the report RFBUST10.

Clearing Accounts

The clearing accounts have to be defined in each firm code before a cross-firm code transaction may be carried out. The clearing accounts could additionally be G/L accounts, customer, or vendor accounts.Within the configuration it's essential to assign clearing accounts to every potential combination of two company codes to allow cross-company code postings between these mixtures (, i.e. three firm codes need 3*2= 6 clearing accounts).To lower the variety of clearing accounts, you ought to use just one company code as the clearing firm code. On this case, you solely should assign clearing accounts to every combination of the clearing firm code to the opposite company codes, ( i.e. three firm codes need 2*2= 4 clearing accounts).Posting keys must be assigned to the clearing accounts to establish their account types.

Cross Company Code

When the cross-firm code document is posted, the system generates a cross-firm code document quantity to hyperlink all the new paperwork together.The doc quantity is a combination of the document variety of the first company code, the first firm code quantity and the then fiscal year. It's stored within the doc header of the entire documents created for a complete audit trail. Cross-company code documents may be reversed: the system can reverse every document that was created with the cross-company document, or the individual paperwork could be reversed separately.

Reversing Documents

It is attainable for a consumer to make an enter error. As a result, the document created will comprise incorrect information. As a manner to present an audit of the correction, the user must first reverse the doc in error, and then seize the doc correctly.The system offers a operate to reverse G/L, A/R and A/P paperwork both individually or in mass.A document may be reversed either by:

- getting into a regular reversal posting or

- coming into a detrimental posting .

Standard Reversal Posting

The standard reversal posting causes the system to post the debit in error as a credit and the credit in error as a debit. The usual reversal posting causes an additional increase within the transaction figures.The damaging posting also posts the debit in error as a credit score and the credit in error as a debit. This time the posted amount just isn't added to the transaction figures but it's subtracted from the transaction figure of the opposite facet of the account. This sets the transaction figures again to as they have been before the incorrect posting took place.Usually the system uses the standard reversal posting to reverse documents. The next requirements have to be fulfilled to perform negative postings:

- The corporate code should permit adverse postings.

- The reversal's cause code should be specified for damaging postings.

Related Posts

SAP CRM Technology Overview

MySAP CRM Marketing IntroductionCRM Marketing and lead management

SAP Financial Master Data for General Ledger

SAP Financial Document Control

No comments :

Post a Comment