Overhead costing is the means by which you allocate indirect prices to the suitable objects. This involves applying a percentage or quantity-primarily based fastened amount to a specified price base. To apply overhead, you use main price parts that were posted on to the order. Within the manufacturing industry, for example, these are normally the labor and materials costs.You'll give you the option to apply overhead to each planned and actual prices, or on the premise of dedication data.For testing and forecasting functions you can also simulate the costing. Data will not be up to date within the database. The costing outcomes are displayed as statistics and any errors are recorded in an error log. You can print out each the statistics and the error log.The principles for applying overhead are summarized within the overhead costing sheet.

The overhead costing sheet combines three central elements which define the overhead calculation.The calculation base specifies the cost factor base to which overhead is applied, such as the materials price elements. You probably can additional limit the bottom by figuring out the origin range. The origin subdivides the associated fee factor by material.The overhead key allows you to define the amount of overhead to be utilized as follows:

SAP Financial Period End Closing includes the following periodic actual postings:The overhead costing sheet combines three central elements which define the overhead calculation.The calculation base specifies the cost factor base to which overhead is applied, such as the materials price elements. You probably can additional limit the bottom by figuring out the origin range. The origin subdivides the associated fee factor by material.The overhead key allows you to define the amount of overhead to be utilized as follows:

- In the percentage method, you determine base value elements. A share is utilized to the costs posted to these value elements. The calculated cost is added as overhead.

- Within the quantity-based overhead method, you specify the amount of overhead cost to be applied (per amount unit posted) to the calculation base cost elements. On this case, items of measure should be recorded in Controlling (CO). You can enter the unit of measure in the price component grasp record. Alternatively, for these who publish materials with totally different units of measure to the identical price aspect, you have to set the fabric grasp indicator Materials origin. Materials with differing amount items must even be assigned to totally different origin groups if they are to be posted underneath the same cost element.

- The dependency means that you can differentiate overhead rates or amounts by plant, firm code, revenue center, accountable value center, order type, or different criteria.

- The overhead sort determines whether the overhead calculation is for precise, plan, or commitment data.

- Periodic re posting, assessment, distribution, oblique exercise allocation

- Overhead

- Process prices

- Precise worth revaluation

- Settlement

- Periodic re posting

Different period-end closing activities include Period locking and Updating the reconciliation ledger.

Debit

Main postings (corresponding to telephone costs) are collected on clearing cost center or order to minimize the number of postings in FI. These costs are allotted to the appropriate controlling objects (equivalent to an overhead price order), at interval-finish closing in keeping with a user-defined key.Line items are recorded for each the sender and receiver sides to doc the allocations exactly. Periodic allocations will be reversed and repeated as usually as desired.You'll have the option to credit an order by periodically re posting costs, using the cycle segment method.Periodic re postings could be made to a number of receivers utilizing allocation rules. This distinguishes the appropriate portion for every receiver to be posted.

Order Settlement

You usually use overhead value orders as an interim collector of prices, and as an support to planning,monitoring, and reporting processes. When the task is full, the costs are transferred to their last vacation spot (cost center, WBS factor, profitability section, and so forth). This course of is recognized as settlement.In settlement, some or all the prices posted to an order are allotted to a quantity of receivers. The offset postings, which credit the order, are generated automatically. You probably can settle orders individually or collectively.The costs collected on an order might be settled to a many alternative account assignment objects, as illustrated above. Settlement to an asset or general ledger account is an external settlement, as a outcome of FI is up to date by the settlement. Settlement to one of many remaining objects is an inside settlement in CO.You may settle statistically to a cost middle, statistical order, or statistical WBS element, in addition to the actual receivers.Order settlement will not be mandatory.

Define Order Settlement

Before you presumably can settle an order, you will want to specify the place you need to ship the costs. There are two procedures for outlining settlement: Primary settlement and prolonged settlement.Primary settlement permits you to settle one hundred% of the costs to no less than one price heart or to one G/L account, using one settlement price element. You enter the data in Interval End Closing on the order master record.Extended settlement lets you create Settlement Rules within the order grasp document which permits you to:

Settlement of Order Costs

You'll have the option to settle costs to your receivers utilizing the identical value parts that were initially posted to your order. This lets you determine intimately the varieties of costs which have been allotted to your receivers, corresponding to materials, provides, and personnel costs. Alternatively, you should utilize a settlement value factor to allocate costs. With this strategy, you'll have the option to easily determine what prices have been allotted to the receivers throughout the order settlement process.There are two classes of settlement price components:

To use the settlement structure, you could create price aspect groups that comprise the primary and secondary price components used for debit postings to your orders. In Customizing, you hyperlink the associated fee aspect group to the settlement structure with a settlement assignment. For each settlement task, you employ a receiver sort to specify whether or not the settlement uses the original posted value elements or a designated settlement price element.You can use settlement price elements:

Defining Settlement

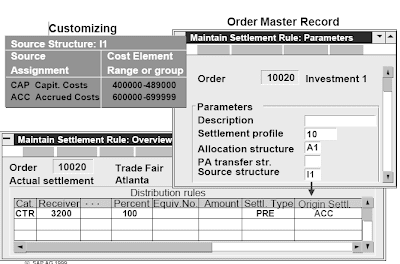

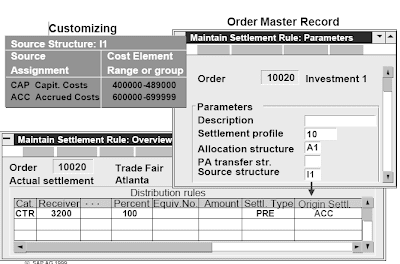

In the source structure , you combine the first and secondary price parts (used for debit postings to your order) into supply assignments. You employ the supply assignments to allocate different varieties of costs to completely different receivers. In our instance, all material costs are settled to a receiver order and all labor costs to a cost center.You don't want a supply construction if you want to settle all of your cost elements by the same rules. To use the source construction you outlined in Customizing, you enter the supply construction within the settlement parameters of the order master record. Once this selection is made, an extra column, Origin Settlement, seems in the Maintain Settlement Rule: Overview screen. This lets you enter a source assignment for every distribution rule and set up a unique receiver for each supply assignment.

As with value centers, periodic re postings may be used as a posting support with inside orders. You probably can apply overhead to an order. You assign an overhead costing sheet to the order to define the overhead calculation and posting information. The overhead costing sheet consists of the calculation base, the overhead quantity, and the credit posting data.Orders are settled using particular person or collective processing.To do this, you should enter a settlement rule in all orders.The R/3 System makes use of this settlement rule to determine the receivers of the order costs.

Order Settlement

You usually use overhead value orders as an interim collector of prices, and as an support to planning,monitoring, and reporting processes. When the task is full, the costs are transferred to their last vacation spot (cost center, WBS factor, profitability section, and so forth). This course of is recognized as settlement.In settlement, some or all the prices posted to an order are allotted to a quantity of receivers. The offset postings, which credit the order, are generated automatically. You probably can settle orders individually or collectively.The costs collected on an order might be settled to a many alternative account assignment objects, as illustrated above. Settlement to an asset or general ledger account is an external settlement, as a outcome of FI is up to date by the settlement. Settlement to one of many remaining objects is an inside settlement in CO.You may settle statistically to a cost middle, statistical order, or statistical WBS element, in addition to the actual receivers.Order settlement will not be mandatory.

Define Order Settlement

Before you presumably can settle an order, you will want to specify the place you need to ship the costs. There are two procedures for outlining settlement: Primary settlement and prolonged settlement.Primary settlement permits you to settle one hundred% of the costs to no less than one price heart or to one G/L account, using one settlement price element. You enter the data in Interval End Closing on the order master record.Extended settlement lets you create Settlement Rules within the order grasp document which permits you to:

- Settle prices to one or more receivers and permit a variety of receivers (WBS factor, gross sales order, profitability phase, and so forth)

- Specify how the prices are to be split (distribution guidelines)

- Specify the associated fee elements for use for settlement (settlement cost components or original value elements)

Settlement of Order Costs

You'll have the option to settle costs to your receivers utilizing the identical value parts that were initially posted to your order. This lets you determine intimately the varieties of costs which have been allotted to your receivers, corresponding to materials, provides, and personnel costs. Alternatively, you should utilize a settlement value factor to allocate costs. With this strategy, you'll have the option to easily determine what prices have been allotted to the receivers throughout the order settlement process.There are two classes of settlement price components:

- An inside settlement value element (value factor kind 21) is used whenever you settle to a controlling object similar to a price middle, order, WBS aspect, and so on.

- An external settlement price aspect (price factor sort 22) is used while you settle to an asset or a common ledger account.

- An FI doc containing all accounting-associated knowledge (external settlement solely)

- A CO document containing only value accounting-associated data

To use the settlement structure, you could create price aspect groups that comprise the primary and secondary price components used for debit postings to your orders. In Customizing, you hyperlink the associated fee aspect group to the settlement structure with a settlement assignment. For each settlement task, you employ a receiver sort to specify whether or not the settlement uses the original posted value elements or a designated settlement price element.You can use settlement price elements:

- To exclude costs allotted from orders to the receiver, and to describe their function, similar to Repairs or Upkeep

- To scale back knowledge volumes by combining a quantity of debit cost components into one settlement value ingredient

Defining Settlement

In the source structure , you combine the first and secondary price parts (used for debit postings to your order) into supply assignments. You employ the supply assignments to allocate different varieties of costs to completely different receivers. In our instance, all material costs are settled to a receiver order and all labor costs to a cost center.You don't want a supply construction if you want to settle all of your cost elements by the same rules. To use the source construction you outlined in Customizing, you enter the supply construction within the settlement parameters of the order master record. Once this selection is made, an extra column, Origin Settlement, seems in the Maintain Settlement Rule: Overview screen. This lets you enter a source assignment for every distribution rule and set up a unique receiver for each supply assignment.

As with value centers, periodic re postings may be used as a posting support with inside orders. You probably can apply overhead to an order. You assign an overhead costing sheet to the order to define the overhead calculation and posting information. The overhead costing sheet consists of the calculation base, the overhead quantity, and the credit posting data.Orders are settled using particular person or collective processing.To do this, you should enter a settlement rule in all orders.The R/3 System makes use of this settlement rule to determine the receivers of the order costs.

Related Posts

SAP WORK flow in sales and distribution 4

SAP WORK flowin sales and distribution 5

SAP WORK flowin sales and distribution 6

SAP WORK flow in sales and distribution 7

No comments :

Post a Comment