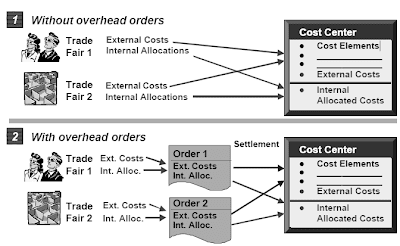

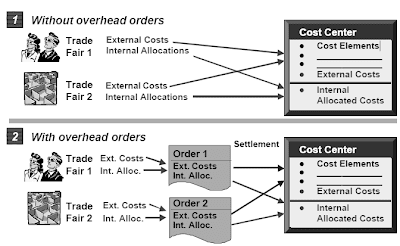

SAP Financial Internal Order has exterior costs and inside actions have the same value parts on the identical price middle, you can not simply decide which occasion created which costs. This means that you cannot make any additional analyses for comparability purposes.If, nevertheless, each occasion receives its personal overhead order, as in the second case, the costs are collected separately. The settlement perform allocates the order prices to the cost middle responsib le for supporting the commerce festivals, which provides you with the organizational view of the costs. This allows you to research and evaluate the results of the commerce gala's, even after the settlement has been made.An extra benefit is the wide range of planning and budgeting features supplied for orders.

Orders can be used as cost objects for everlasting or temporary jobs.Depending on the type of job described on the order, you may settle this order in different ways.If, for example, a job is for a single product, you could possibly discover a accountable cost middle to settle the prices to. The next step then would be to allocate the costs from the fee heart to CO-PA.If a job is basic, and issues the whole company, it might be difficult to search out the suitable price middle to debit. In this state of affairs it could be handy to settle directly to CO-PA.

Order Types

Internal orders in the R/3 System describe individual jobs inside a controlling area. Orders assist

action-oriented planning, monitoring, and allocation of costs.You can use internal orders to:

True Orders

You need to use overhead orders for detailed controlling for a selected object or activity. All prices associated to this object or exercise are assigned to the relevant order. Once you create an overhead order master file, you choose whether or not to create it as a true order or a statistical order.You use the true order to collect costs and distribute them later to different price centers or other objects.In the initial posting, the prices are updated to the true order. During periodic order settlement, you allocate the costs to the actual controlling objects. You can settle portions of the order prices to objects a large quantity of.While you create a truel order, you have to assign the order to a company code. If in case you have chosen enterprise space steadiness sheets in FI, you will need to also assign the order to a business area.

Statistical Orders

You use statistical orders to gauge costs that can not be itemized intimately in Value Aspect Accounting or Value Middle Accounting.You achieve this by assigning the costs to both the statistical order and the accountable price heart,which directly displays the prices on the order (statistical, for data purposes only) and the fee middle (actual costs).The cost heart to which you wish to post prices could be stored in the grasp data. This permits the system to search out the fee heart automatically. Normally you should specify the cost center and the order so that the posting doc is complete.You also have the choice on a statistical order whether to report an organization code and business space on the order grasp record. For these who make these assignments, you'll give you the chance to only put up transactions to controlling objects, similar to cost facilities, which belong to the identical firm code and enterprise area.For cross-firm code or cross-business area controlling, don't assign an organization code or business space to the statistical order.You can neither settle statistical orders nor apply overhead to them.

Internal Orders with Revenues

Internal orders with revenues can be used to show cost controlling parts of Sales and Distribution (SD) buyer orders, when you have no Gross sales and Distribution software active. You additionally can use orders with revenues to observe costs and revenues for a enterprise not affecting the core business of the company. On this case the automatic billing can't be used to post revenues to the order.With the identifier “Income postings allowed” in the order sort you control whether revenues can be posted to an order.At the end of the interval orders with revenues will be settled in the following manner:

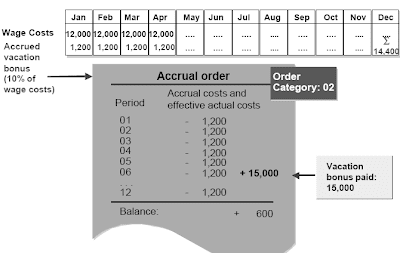

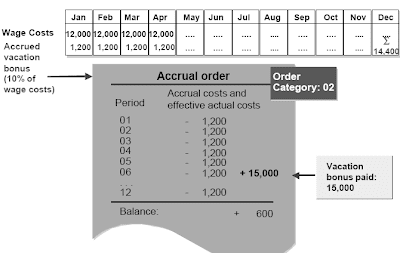

Inner orders can be used for gathering monthly credit that outcome from the accrual calculation.

Related Posts

Related Posts

LESSON 8 DISPATCHING IDOC

LESSON 9 ALE IDOC CHANGE POINTERS

LESSON 10 SENDING IDOC VIA STANDARD R3 SYSTEM

LESSON 11 IDOC OUTBOUND TEIGGER PART TWO

LESSON 12 IDOC OUTBOUND TRIGGER PART ONE

LESSON 13 ABAP IDOC INBOUND BASIC TOOLS

Orders can be used as cost objects for everlasting or temporary jobs.Depending on the type of job described on the order, you may settle this order in different ways.If, for example, a job is for a single product, you could possibly discover a accountable cost middle to settle the prices to. The next step then would be to allocate the costs from the fee heart to CO-PA.If a job is basic, and issues the whole company, it might be difficult to search out the suitable price middle to debit. In this state of affairs it could be handy to settle directly to CO-PA.

Order Types

Internal orders in the R/3 System describe individual jobs inside a controlling area. Orders assist

action-oriented planning, monitoring, and allocation of costs.You can use internal orders to:

- Monitor inner jobs settled to value centers (overhead orders)

- Monitor internal jobs settled to mounted assets (funding orders)

- Offsetting postings of accrued costs calculated in CO (accrual orders)

- Display the associated fee controlling components of Gross sales and Distribution customer orders and revenues that do not affect the core enterprise of the corporate (orders with revenues)

- You can analyze prices in a unique way than in Value Heart Accounting for price management.

- You possibly can evaluate in-home production and exterior procurement prices for resolution-making.

True Orders

You need to use overhead orders for detailed controlling for a selected object or activity. All prices associated to this object or exercise are assigned to the relevant order. Once you create an overhead order master file, you choose whether or not to create it as a true order or a statistical order.You use the true order to collect costs and distribute them later to different price centers or other objects.In the initial posting, the prices are updated to the true order. During periodic order settlement, you allocate the costs to the actual controlling objects. You can settle portions of the order prices to objects a large quantity of.While you create a truel order, you have to assign the order to a company code. If in case you have chosen enterprise space steadiness sheets in FI, you will need to also assign the order to a business area.

Statistical Orders

You use statistical orders to gauge costs that can not be itemized intimately in Value Aspect Accounting or Value Middle Accounting.You achieve this by assigning the costs to both the statistical order and the accountable price heart,which directly displays the prices on the order (statistical, for data purposes only) and the fee middle (actual costs).The cost heart to which you wish to post prices could be stored in the grasp data. This permits the system to search out the fee heart automatically. Normally you should specify the cost center and the order so that the posting doc is complete.You also have the choice on a statistical order whether to report an organization code and business space on the order grasp record. For these who make these assignments, you'll give you the chance to only put up transactions to controlling objects, similar to cost facilities, which belong to the identical firm code and enterprise area.For cross-firm code or cross-business area controlling, don't assign an organization code or business space to the statistical order.You can neither settle statistical orders nor apply overhead to them.

Internal Orders with Revenues

Internal orders with revenues can be used to show cost controlling parts of Sales and Distribution (SD) buyer orders, when you have no Gross sales and Distribution software active. You additionally can use orders with revenues to observe costs and revenues for a enterprise not affecting the core business of the company. On this case the automatic billing can't be used to post revenues to the order.With the identifier “Income postings allowed” in the order sort you control whether revenues can be posted to an order.At the end of the interval orders with revenues will be settled in the following manner:

- Prices

- are allowed to settle to any receiver.

- Revenues

- can solely be settled to the next objects:

- G/L accounts

- Profitability

- segments

- Gross sales

- orders

- Billing

- parts

- Other

- orders with revenues

Inner orders can be used for gathering monthly credit that outcome from the accrual calculation.

Related Posts

Related PostsLESSON 8 DISPATCHING IDOC

LESSON 9 ALE IDOC CHANGE POINTERS

LESSON 10 SENDING IDOC VIA STANDARD R3 SYSTEM

LESSON 11 IDOC OUTBOUND TEIGGER PART TWO

LESSON 12 IDOC OUTBOUND TRIGGER PART ONE

LESSON 13 ABAP IDOC INBOUND BASIC TOOLS

No comments :

Post a Comment