Most businesses have too many financial institution accounts, held at too many different banks.This makes it troublesome to maintain an outline of the related account balances.As banks ship statements every day, exact, value-date accounting does not take place often. Businesses miss out on the complete advantages of investment instruments as a end result of worth date information is lacking.Payments are often constructed from one account only, no matter whether it incorporates ample funds.The duties of a cash management system are to analyze financial transactions in accomplished accounting durations and to determine and reproduce future moments in monetary budgeting as precisely as attainable.SAP R/3 Cash Administration provides the next tools, designed to make money flows clear as the money position, which illustrates short term actions within the financial institution accounts and the liquidity forecast, which illustrates medium-term moments in sub ledger accounts too.The cash position reveals how your financial institution accounts will move in the subsequent few days. Meanwhile, the liquidity forecast illustrates liquidity modifications within the sub ledger accounts. Functions are additionally supported which you ought to use to acquire related information on forecast fee flows. This data appears in the form of memo data in the money place, or as planned items within the liquidity forecast.

Financial budgeting and the lengthy-time period view of cash stream (target/precise comparability) at G/L account level should not supported by SAP R/3 Money Management, however are included as an alternative in SAP R/three Money Finances Management.

Check Deposits

You ought to utilize the verify deposit facility in SAP Money Administration to enter checks received.The handbook verify deposit is a fast entry device that subtantially reduces the guide work concerned in entering checks. You enter solely the checks acquired, not the posting records.The system then routinely makes the postings to the bank clearing account and buyer account, along with the cost clearing. You have two choices here:

Process:

Here, you stipulate the account assignment variant. That is the start variant and determines which fields are displayed if you end up really getting into checks. You'll be able to change the account task variant at any time throughout processing.The beginning variant specifies the account task variant for the individual postings. You ought to use customizing to create entry screens (variants) of your own.If you select inner financial institution determination, the system identifies the bank using the internal title instead of the financial institution number and external account number. You must use either, according to what's traditional in your company.The matchcode ID D and the contents of the shopper matchcode area on the following display screen make up the matchcode of the client account the system searches for (account determination for cost settlement).

The additional processing kind determines whether or not the postings in the batch enter session are made on-line or in the background.Transaction value date: The value date from the check entry is copied into the postings.Specify a type ID if you wish to use a kind that differs from the standard form for the test deposit list.

Enter the following data in the preliminary display screen:

Check Deposit List

Check Deposit List

The account project variants (start variants) determine which fields are displayed during entry.Different account assignment fields appear in the entry display screen, relying on the account assignment variant being used. Amongst other things, the variety of account assignment fields in a variant regulates whether or not 1, 2, or three traces are available for every memo record.You define the variants in customizing and may change them at any time throughout processing. In the occasion you use more account assignment fields than can be found in the current variant, this is proven in an extra field.For example, you probably can enter a quantity of document numbers and different bill quantities for a memo record. This is of use if a customer uses one examine to clear plenty of invoices. An account assignment discipline for which more than one worth has been enterd is highlighted in the display.

You'll find a way to print the verify deposit record immediately from the entry screen. You can also print a totals record coving numerous check deposits.The Print choice allows you to show the shape for printing.You can use the overview to achieve a perspective over all your examine deposits. It contains the following knowledge:

Generating Postings

You can generate the postings instantly or using batch enter sessions.The Put up option generates postings instantly or the batch enter sessions, together with postings for subledger accounts.You possibly can process the sessions individually or together, online or in the background (batch).The log displays the processing statistics and any incorrect transactions. Incorrect transactions, which weren't processed as a consequence of inadequate clearing information, should be post processed.

SAP CRM Solution Monitoring

CRM Backup Restoring System

SAP CRM Organizational Model

CRM Software Logistics and Support

MySAP CRM Marketing Introduction

CRM Marketing and lead management

Financial budgeting and the lengthy-time period view of cash stream (target/precise comparability) at G/L account level should not supported by SAP R/3 Money Management, however are included as an alternative in SAP R/three Money Finances Management.

Check Deposits

You ought to utilize the verify deposit facility in SAP Money Administration to enter checks received.The handbook verify deposit is a fast entry device that subtantially reduces the guide work concerned in entering checks. You enter solely the checks acquired, not the posting records.The system then routinely makes the postings to the bank clearing account and buyer account, along with the cost clearing. You have two choices here:

- Instant posting

- Create a batch input session, then run it.

Process:

- Enter checks. Bear in mind to incorporate clearing information. Create a batch input session.

- Run the subledger session. Postings to financial institution clearing accounts (incoming checks) and to subledger accounting (customer clearing).

- Print the examine deposit record and provides it to the bank, along with the checks.

- Import the bank assertion: financial institution postings (clearing the clearing accounts as crucial).

Here, you stipulate the account assignment variant. That is the start variant and determines which fields are displayed if you end up really getting into checks. You'll be able to change the account task variant at any time throughout processing.The beginning variant specifies the account task variant for the individual postings. You ought to use customizing to create entry screens (variants) of your own.If you select inner financial institution determination, the system identifies the bank using the internal title instead of the financial institution number and external account number. You must use either, according to what's traditional in your company.The matchcode ID D and the contents of the shopper matchcode area on the following display screen make up the matchcode of the client account the system searches for (account determination for cost settlement).

The additional processing kind determines whether or not the postings in the batch enter session are made on-line or in the background.Transaction value date: The value date from the check entry is copied into the postings.Specify a type ID if you wish to use a kind that differs from the standard form for the test deposit list.

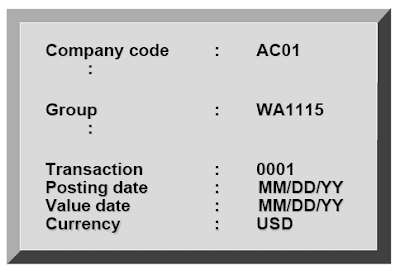

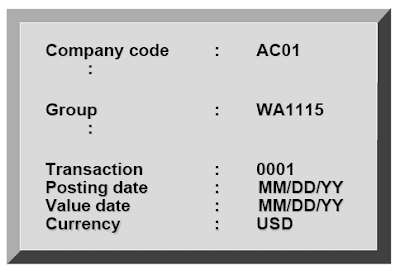

Enter the following data in the preliminary display screen:

- Group: This indicator is used to differentiate between examine deposit lists. For example, you'll have the opportunity to mix incoming checks into groups by home bank. You can choose any group you need for every list.

- Transaction: The transaction controls the posting.The principles are entered when the system is customized.

- Posting date: Of the documents for posting.

- Worth date: The anticipated value date within the financial institution statement (will be transferred to the paperwork for posting).

- Notice: A separate record must be created for every currency (or worth date) as a end result of various strategies in fixing worth dates.

Check Deposit List

Check Deposit ListThe account project variants (start variants) determine which fields are displayed during entry.Different account assignment fields appear in the entry display screen, relying on the account assignment variant being used. Amongst other things, the variety of account assignment fields in a variant regulates whether or not 1, 2, or three traces are available for every memo record.You define the variants in customizing and may change them at any time throughout processing. In the occasion you use more account assignment fields than can be found in the current variant, this is proven in an extra field.For example, you probably can enter a quantity of document numbers and different bill quantities for a memo record. This is of use if a customer uses one examine to clear plenty of invoices. An account assignment discipline for which more than one worth has been enterd is highlighted in the display.

You'll find a way to print the verify deposit record immediately from the entry screen. You can also print a totals record coving numerous check deposits.The Print choice allows you to show the shape for printing.You can use the overview to achieve a perspective over all your examine deposits. It contains the following knowledge:

- Date entered

- Entered by

- Group name

- Company code and currency

- Whole amount

- Processing status

Generating Postings

You can generate the postings instantly or using batch enter sessions.The Put up option generates postings instantly or the batch enter sessions, together with postings for subledger accounts.You possibly can process the sessions individually or together, online or in the background (batch).The log displays the processing statistics and any incorrect transactions. Incorrect transactions, which weren't processed as a consequence of inadequate clearing information, should be post processed.

- In case you are utilizing batch enter sessions, you will need to run these again online.

- If you're using fast postings, you need to postprocess the cost advices.

SAP CRM Solution Monitoring

CRM Backup Restoring System

SAP CRM Organizational Model

CRM Software Logistics and Support

MySAP CRM Marketing Introduction

CRM Marketing and lead management

No comments :

Post a Comment