SAP Financial Event Based Posting and CO posting, the system creates a doc, to which a singular number is assigned.One of the CO undertaking staff reveals you ways he/she grouped the CO enterprise transactions and then assigned them to doc number ranges.To check the FI/CO interface, you submit some documents on a preliminary basis.You want to show the data on the fee centers utilizing totally different reports. Examine the reviews reviews contained in the usual system.You clarify the various reporting tools to the opposite members of the CO challenge, to indicate their flexibility.

Posting documents from HR and MM are often very extensive. Try to devise as easy methods as possible to correct faulty account assignments in CO. As you require data on future cost commitments in your value center, consider the use of commitments.You wish to enter all (consulting) activities, which you provide for a buyer, on a cost object. You can use this to create the billing documents.

Document Number Assignment

The varied activities that change an object (resembling, a value heart, or an order) appear within the R/3 system as enterprise transactions.It is advisable define number intervals for all business transactions that generate CO documents. It is doable to copy document quantity intervals from one controlling space to another.There are two steps to issuing number intervals for paperwork : You group multiple transaction together. If you would like to assign a special quantity interval to

each transaction, you'll have the ability to create a group for every transaction.You assign the group to an internal or external quantity interval. This allows you to use one group of number intervals for comparable transactions.You define number intervals for CO documents independently of fiscal year. The doc numbers might be assigned in ascending order.

SAP recommends that you simply create different quantity interval teams for precise and plan transactions.This ensures that reorganization programs that run individually for precise and planning knowledge also reset the number intervals separately.

Event Based Posting Integration

You possibly can enter primary prices either instantly in Financial Accounting (as for an invoice in Accounts Payable) or they are often generated from different purposes (as for a goods movement in Materials Management) and then transferred to FI. These business transactions (occasions) generate FI paperwork which are required for functions of external reporting within Accounting. These paperwork are stored in a central doc file for external accounting documents. FI paperwork contain not much less than two line objects and must stability to zero.Line objects are also written in Controlling for these business transactions if they are additionally posted to CO account project objects (such as cost centers). The CO posting is usually a one-sided entry, as solely the earnings assertion postings are posted to CO. The road objects file the enterprise transaction from a price controlling standpoint, and are managed in a CO line merchandise file. As properly as, the R/3 System summarizes all line items to kind totals records, which in turn are saved in a CO totals record file.

Posting to Cost Center

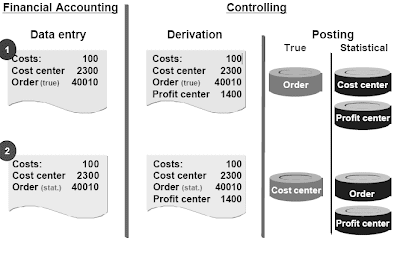

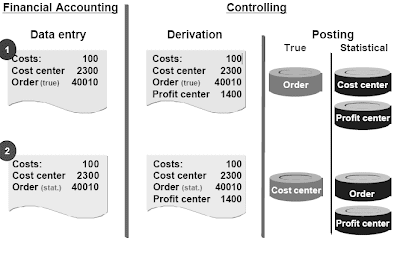

Value and revenue postings in CO can set off subsequent true and statistical postings:

Account Assignment Logic

Throughout posting, solely a true account task object might be transferred. The only exception to this rule is the account task to a cost center, and an extra, true account task object. In this case, the system at all times updates the cost heart statistically. If you specify a real order and a value middle within the posting row as described in the example above, then the true posting is made for the overhead value order. Statistical postings are entered for the price center and the profit center.Nonetheless, if the order is simply statistical, then it's posted to as such, and the cost middle receives true postings.You possibly can analzse statistical postings to price facilities in the Cost facilities: Actual/Plan/Variance report (scroll down within the report).You can only assign one object sort to every posting row. Which means you can not submit the identical transaction row to more than one value middle, or order, and so on.

Revenues can solely be posted as true postings to a profitability segment, gross sales order, sales mission, or to a true order that may have revenues. Income postings to the revenue heart are statistical, the same as for value postings.Revenues can also be recorded as statistical values on price centers .

Revenues can solely be posted as true postings to a profitability segment, gross sales order, sales mission, or to a true order that may have revenues. Income postings to the revenue heart are statistical, the same as for value postings.Revenues can also be recorded as statistical values on price centers .

Default Account Assignment

You'll be able to define automated account assignments or default account assignments for postings to major cost elements. The R/3 System then mechanically includes the specified (extra) account task for the primary postings you make. You define computerized and default account assignments for cost components that you always post to a specific cost center. It's additionally potential to outline the assignment of an overhead order or revenue center to a cost element. Whether or not computerized or default,the account assignments are default values that can be overwritten within the application.Computerized of default account assignments are required for primary cost components utilized in automatically-generated postings such as costs differences, alternate fee differences, and discounts.You enter the default account task in the cost component master record. Here, you enter the account assignment at controlling space degree and at account level.You enter computerized account assignments in Customizing within the activity "Computerized Account Project". You probably can enter the account assignments at totally different ranges:

Automatic Commitment

Commitments are payment obligations that aren't entered into the accounts, but at a future date lead to actual costs. They're incurred within the buying operate, in the "Supplies Managment"

component:

Re posting Costs and Revenues

You'll have the ability to manually re post primary prices and revenues using occasion-primarily based re postings. You utilize this perform mainly to adjust (right) posting errors.While you make an inner reposting, the first prices are reposted (beneath the original price ingredient) to a receiving order. If the original transaction is posted using an incorrect cost or income factor, the transaction must be corrected within the original utility element with a purpose to ensure reconciliation between external and inside accounting. Observe that no sender test is made, in other words the system doesn't verify whether or not the prices you re post actually exist on the sending cost center. Which means unfavourable prices might seem on the sending cost center. The business transaction is documented by means of line items on the sender side and receiver side.You should utilize the system to make event-primarily based repostings automatically. Following a collective posting in FI that was assigned to a clearing price heart, these automatic repostings are used to publish the values in Controlling to the actual originators of the costs. For instance, wage postings from the personnel department can be posted in their entirety to a clearing value heart, thus holding the number of postings in FI to a minimum. This collective posting is transferred to CO. So that the wage info can be used in CO, the costs should be assigned to the responsible value centers. The reposting credits the clearing price center and debits the originator of the costs by the appropriate amount.

The operate for re posting line items allows you to repost particular line gadgets from CO documents.This function is designed to enable you to correct major postings that you simply assigned to the incorrect accounts. To do that, the CO document should include a reference to the original FI document.Reposing line gadgets is the equivalent of a reversal on the sender object.You can too enter multiple receiver object.Re posting line gadgets creates CO documents which, in contrast to occasion-primarily based repostings of costs, always include a reference to the FI document. Consequently, you'll find a way to trace a line item reposting back to the unique Financial Accounting document.If you occur to repost a line item in CO, the unique account assignment object stays noted in the FI document. To right the account assignment object in the FI doc, you have to to reverse the FI document. When you've got got already carried out a line merchandise reposting in CO for this doc, you'll first have to reverse this reposting before you can reverse the doc in FI.

Direct Activity Allocation

Direct exercise allocation enables enterprise providers provided to be measured, entered, and allocated.You must create the corresponding (measurable) tracing factors within the R/3 system. These are referred to as exercise types in Value Center Accounting. To straight allocate activity, create an exercise sort (exercise sort category 1 = guide entry, guide allocation).If you need to enter a direct activity allocation, enter the related fee heart that provides the exercise (sender value center), the article that receives the exercise (receiver), the type (exercise type), and the quantity of the exercise provided. Notice that only one price center from the sender can be allocatd to an internal exercise allocation. The receiver will be any true Controlling object (similar to, a price heart, an order, a challenge, and so on).To directly allocate exercise, you should outline which value facilities are to supply which exercise sorts, by planning exercise output.During direct exercise allocation, the sender price center is credited, and the receiving price objects are debited. Debiting and crediting are executed a secondary cost factor (category "43"). Debiting and crediting are the activitiy provided, multiplied by the activity price.The cost element used for direct allocation of internal exercise is derived immediately from the grasp data for the activity type. The price factor can't be modified within the allocation transaction.Direct activity allocation is recorded by line items on the sender facet and receiver side.

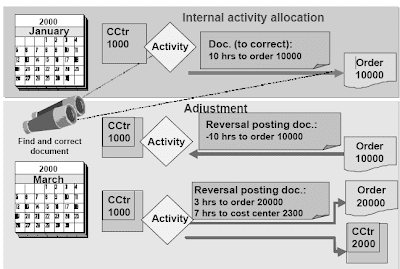

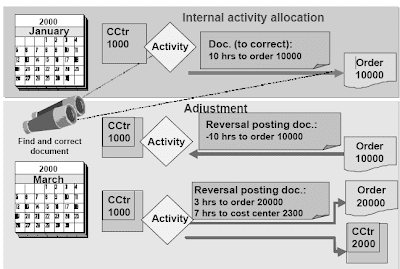

Re posting inside activity allocation is used to adjust posting fields.A search perform is on the market, which supplies you with the documents you're looking for.The entire quantity of the allotted activity must stay the identical, though you'll give you the chance to allocate the quantities to different receivers.You may make changes in durations , however not in the same period from which the document to be adjusted originates. Nevertheless, the fiscal yr must stay the same.You may repost the next documents for direct activity allocation:

Related Posts

EDI performance factors

SAP ABAP EDI out bound process scenarios examples

Outbound process with message control with example

Outbound process with out message control with scenario

With out message control edi with example

EDI with message control scenario with purchase order and part two

Posting documents from HR and MM are often very extensive. Try to devise as easy methods as possible to correct faulty account assignments in CO. As you require data on future cost commitments in your value center, consider the use of commitments.You wish to enter all (consulting) activities, which you provide for a buyer, on a cost object. You can use this to create the billing documents.

Document Number Assignment

The varied activities that change an object (resembling, a value heart, or an order) appear within the R/3 system as enterprise transactions.It is advisable define number intervals for all business transactions that generate CO documents. It is doable to copy document quantity intervals from one controlling space to another.There are two steps to issuing number intervals for paperwork : You group multiple transaction together. If you would like to assign a special quantity interval to

each transaction, you'll have the ability to create a group for every transaction.You assign the group to an internal or external quantity interval. This allows you to use one group of number intervals for comparable transactions.You define number intervals for CO documents independently of fiscal year. The doc numbers might be assigned in ascending order.

SAP recommends that you simply create different quantity interval teams for precise and plan transactions.This ensures that reorganization programs that run individually for precise and planning knowledge also reset the number intervals separately.

Event Based Posting Integration

You possibly can enter primary prices either instantly in Financial Accounting (as for an invoice in Accounts Payable) or they are often generated from different purposes (as for a goods movement in Materials Management) and then transferred to FI. These business transactions (occasions) generate FI paperwork which are required for functions of external reporting within Accounting. These paperwork are stored in a central doc file for external accounting documents. FI paperwork contain not much less than two line objects and must stability to zero.Line objects are also written in Controlling for these business transactions if they are additionally posted to CO account project objects (such as cost centers). The CO posting is usually a one-sided entry, as solely the earnings assertion postings are posted to CO. The road objects file the enterprise transaction from a price controlling standpoint, and are managed in a CO line merchandise file. As properly as, the R/3 System summarizes all line items to kind totals records, which in turn are saved in a CO totals record file.

Posting to Cost Center

Value and revenue postings in CO can set off subsequent true and statistical postings:

- True postings might be processed, and could be allotted or settled with different controlling objects. Only true postings (and only one) may be made to CO. This is the place the knowledge is, that is used transferred to FI for reconciliation purposes.

- Statistical postings are only used for data purposes. You might make as many statistical postings as you wish.

Account Assignment Logic

Throughout posting, solely a true account task object might be transferred. The only exception to this rule is the account task to a cost center, and an extra, true account task object. In this case, the system at all times updates the cost heart statistically. If you specify a real order and a value middle within the posting row as described in the example above, then the true posting is made for the overhead value order. Statistical postings are entered for the price center and the profit center.Nonetheless, if the order is simply statistical, then it's posted to as such, and the cost middle receives true postings.You possibly can analzse statistical postings to price facilities in the Cost facilities: Actual/Plan/Variance report (scroll down within the report).You can only assign one object sort to every posting row. Which means you can not submit the identical transaction row to more than one value middle, or order, and so on.

Revenues can solely be posted as true postings to a profitability segment, gross sales order, sales mission, or to a true order that may have revenues. Income postings to the revenue heart are statistical, the same as for value postings.Revenues can also be recorded as statistical values on price centers .

Revenues can solely be posted as true postings to a profitability segment, gross sales order, sales mission, or to a true order that may have revenues. Income postings to the revenue heart are statistical, the same as for value postings.Revenues can also be recorded as statistical values on price centers .Default Account Assignment

You'll be able to define automated account assignments or default account assignments for postings to major cost elements. The R/3 System then mechanically includes the specified (extra) account task for the primary postings you make. You define computerized and default account assignments for cost components that you always post to a specific cost center. It's additionally potential to outline the assignment of an overhead order or revenue center to a cost element. Whether or not computerized or default,the account assignments are default values that can be overwritten within the application.Computerized of default account assignments are required for primary cost components utilized in automatically-generated postings such as costs differences, alternate fee differences, and discounts.You enter the default account task in the cost component master record. Here, you enter the account assignment at controlling space degree and at account level.You enter computerized account assignments in Customizing within the activity "Computerized Account Project". You probably can enter the account assignments at totally different ranges:

- Controlling area, account, and firm code

- Controlling space, account, company code, enterprise space and/or valuation space

- Revenue middle

Automatic Commitment

Commitments are payment obligations that aren't entered into the accounts, but at a future date lead to actual costs. They're incurred within the buying operate, in the "Supplies Managment"

component:

- The internal communication for a buying request is identified as a buy order requisition (from the ordering social gathering to the purchaser). A purchase requisition is a provisional obligation, that can be modified at any time. You don't want to assign a CO object to a purchase requisition row. In the event you do not achieve this, then the commitment is just not displayed in CO.

- A purchase order order is a contractual agreement specifying that items or providers from a vendor will be taken under certain, agreed conditions Due to this fact, a purchase order order is a binding obligation, as it's based mostly on a contractually fixed agreement. For a purchase order row that's assigned to a cost factor,it is advisable specify a CO object, so the commitment can be displayed in CO.

Re posting Costs and Revenues

You'll have the ability to manually re post primary prices and revenues using occasion-primarily based re postings. You utilize this perform mainly to adjust (right) posting errors.While you make an inner reposting, the first prices are reposted (beneath the original price ingredient) to a receiving order. If the original transaction is posted using an incorrect cost or income factor, the transaction must be corrected within the original utility element with a purpose to ensure reconciliation between external and inside accounting. Observe that no sender test is made, in other words the system doesn't verify whether or not the prices you re post actually exist on the sending cost center. Which means unfavourable prices might seem on the sending cost center. The business transaction is documented by means of line items on the sender side and receiver side.You should utilize the system to make event-primarily based repostings automatically. Following a collective posting in FI that was assigned to a clearing price heart, these automatic repostings are used to publish the values in Controlling to the actual originators of the costs. For instance, wage postings from the personnel department can be posted in their entirety to a clearing value heart, thus holding the number of postings in FI to a minimum. This collective posting is transferred to CO. So that the wage info can be used in CO, the costs should be assigned to the responsible value centers. The reposting credits the clearing price center and debits the originator of the costs by the appropriate amount.

The operate for re posting line items allows you to repost particular line gadgets from CO documents.This function is designed to enable you to correct major postings that you simply assigned to the incorrect accounts. To do that, the CO document should include a reference to the original FI document.Reposing line gadgets is the equivalent of a reversal on the sender object.You can too enter multiple receiver object.Re posting line gadgets creates CO documents which, in contrast to occasion-primarily based repostings of costs, always include a reference to the FI document. Consequently, you'll find a way to trace a line item reposting back to the unique Financial Accounting document.If you occur to repost a line item in CO, the unique account assignment object stays noted in the FI document. To right the account assignment object in the FI doc, you have to to reverse the FI document. When you've got got already carried out a line merchandise reposting in CO for this doc, you'll first have to reverse this reposting before you can reverse the doc in FI.

Direct Activity Allocation

Direct exercise allocation enables enterprise providers provided to be measured, entered, and allocated.You must create the corresponding (measurable) tracing factors within the R/3 system. These are referred to as exercise types in Value Center Accounting. To straight allocate activity, create an exercise sort (exercise sort category 1 = guide entry, guide allocation).If you need to enter a direct activity allocation, enter the related fee heart that provides the exercise (sender value center), the article that receives the exercise (receiver), the type (exercise type), and the quantity of the exercise provided. Notice that only one price center from the sender can be allocatd to an internal exercise allocation. The receiver will be any true Controlling object (similar to, a price heart, an order, a challenge, and so on).To directly allocate exercise, you should outline which value facilities are to supply which exercise sorts, by planning exercise output.During direct exercise allocation, the sender price center is credited, and the receiving price objects are debited. Debiting and crediting are executed a secondary cost factor (category "43"). Debiting and crediting are the activitiy provided, multiplied by the activity price.The cost element used for direct allocation of internal exercise is derived immediately from the grasp data for the activity type. The price factor can't be modified within the allocation transaction.Direct activity allocation is recorded by line items on the sender facet and receiver side.

Re posting inside activity allocation is used to adjust posting fields.A search perform is on the market, which supplies you with the documents you're looking for.The entire quantity of the allotted activity must stay the identical, though you'll give you the chance to allocate the quantities to different receivers.You may make changes in durations , however not in the same period from which the document to be adjusted originates. Nevertheless, the fiscal yr must stay the same.You may repost the next documents for direct activity allocation:

- Paperwork entered manually into cost accounting

- CO documents for confirmations (from Manufacturing Planning and Controlling)

- CO paperwork for time entry (time sheet)

Related Posts

EDI performance factors

SAP ABAP EDI out bound process scenarios examples

Outbound process with message control with example

Outbound process with out message control with scenario

With out message control edi with example

EDI with message control scenario with purchase order and part two

No comments :

Post a Comment